Market sentiment, otherwise referred to as trader sentiment, is a means of measuring the current level of trading bias that exists for a specific instrument or asset class. Understanding how other traders are positioned within a specific market allows for more informed trading decisions and can play an important role in any trading strategy.

What is Sentiment in Forex Trading

Market Sentiment in the financial world can be defined as an insight tool that reflects the overall investors' and traders' bias towards a specific instrument or sometimes the overall market conditions. There are many sentiment indicators out there, some of which aim to provide a percentage of how traders feel about a certain market while others aim to provide a percentage for longs vs shorts through the available open positions/orders for a specific market. In some cases, certain instrument prices may be considered a gauge for market sentiment such as the well-known VIX index or certain commodity prices.

For many reasons and depending on which indicator, sentiment cannot provide an exact value, however the history of percentages changes helps identifying specific and critical levels, and in some cases major turning points. Let’s not forget that trader sentiment plays a role in driving prices, the more investors with positive expectations on a specific instrument the higher we can expect the price to be, a positive sentiment for a company may push its share price above its actual valuation.

What sentiment indicators and tools you could use when trading?

Sentiment indicators in the stock market

Our goal here is to focus on sentiment indicators that can be used in forex trading, however forex traders also check sentiment indicators available at other markets, to name a few, the VIX index, High Low index, the Bullish Percent Ratio, and the American Association of Individual Investors Sentiment Survey. These are just a few of many available resources that traders have from other markets, the collective reading of these indicators sheds some light on investors' appetite for risky assets.

Sentiment Indicators for forex trading

Commitment of Trader’s report (COT)

The Commitment of Traders Report (COT) is a weekly report released by the CFTC showing the breakdown of positions for certain market participants, the report is released to the public every Friday covering the data up to Tuesday of the same week. Although there is a lag, the report reflects sentiment for market participants.

The report includes multiple categories, we will focus here on the commercial traders or hedgers who are expected to be the most informed about the instrument. Examples for commercial traders are many, any manufacturer/producer who is looking to hedge against a price decline. An example on the other side of the market would be an overseas importer concerned about changes in currency prices and looking to lock in a currency price and hedge against currency fluctuation risks.

This means that most of the time, commercials are expected to be against the market, if prices are rising, commercials are selling, and the opposite is also true. In some cases, the relationship may be broken and that’s when some traders may look for divergences.

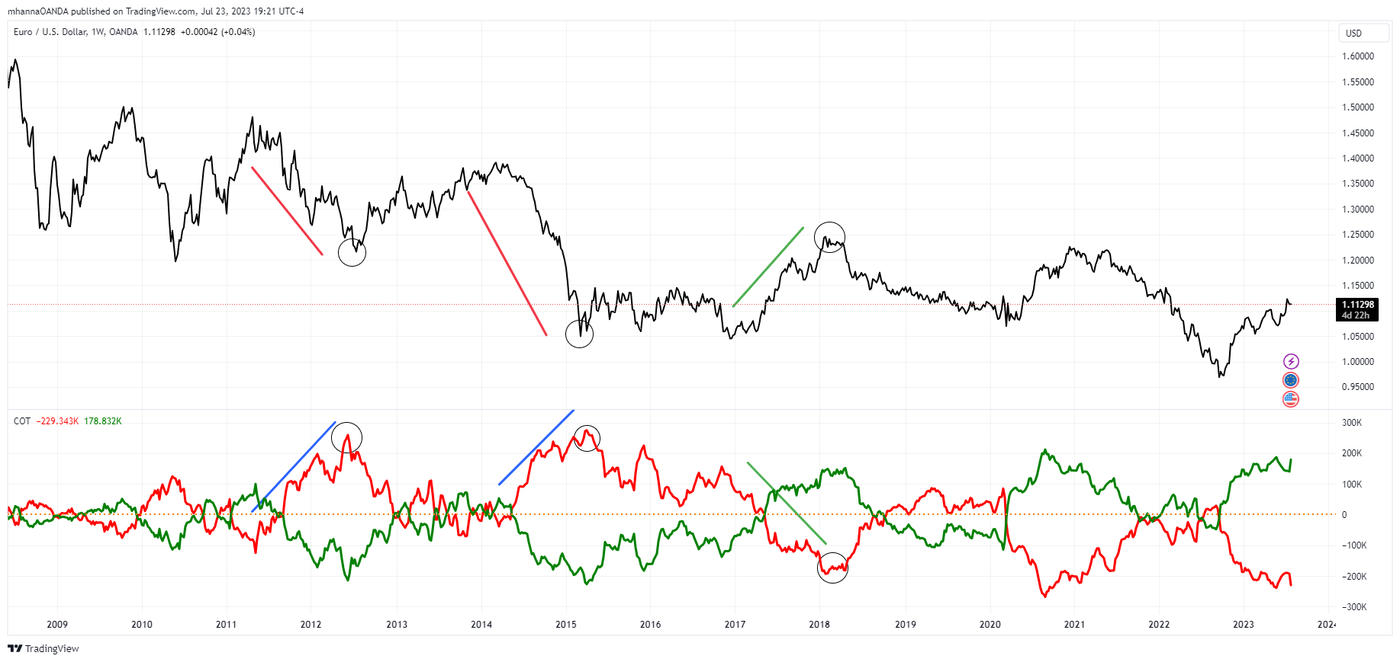

The weekly chart below for EUR/USD by TradingView, one of the platforms available for OANDA traders, with EURO Futures COT data applied as an oscillator below the price action, the red line represents commercials positioning, the indicator behavior clearly shows how commercials positioning is always against the market, also the extreme positioning levels aligns with major trend turning points.

Open Interest

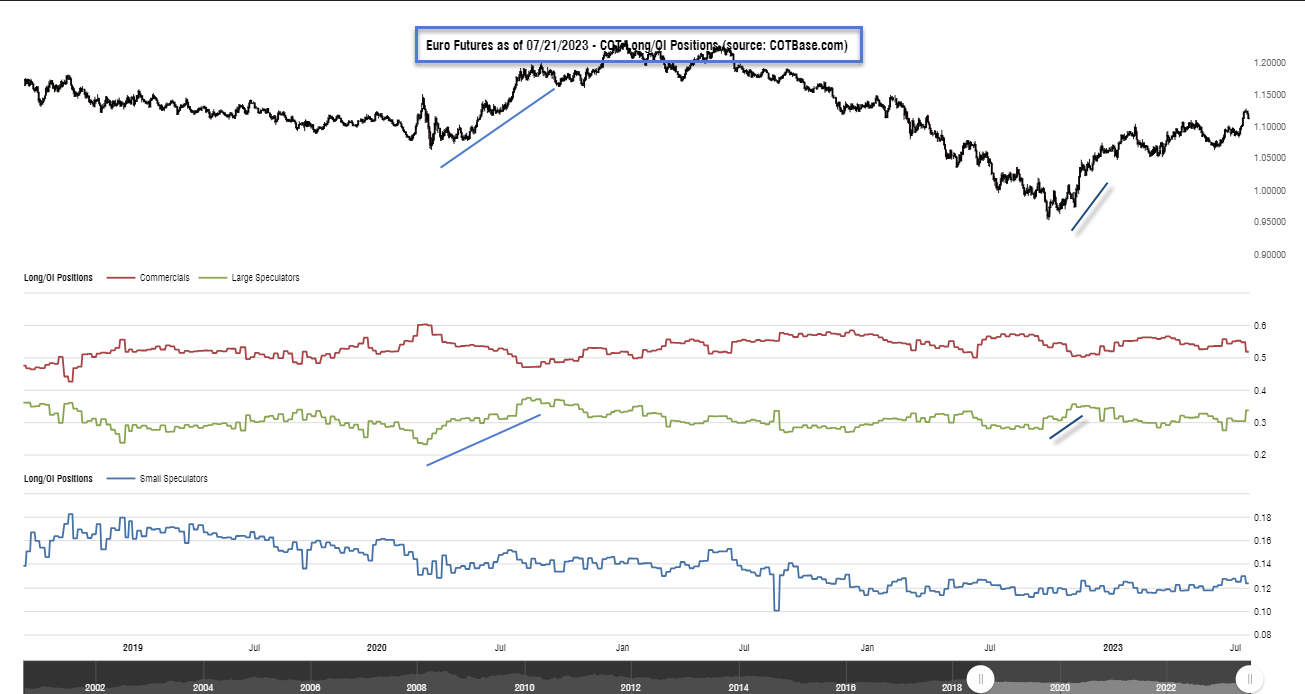

A different data set is also available on the COT which is Open Interest. The futures market works differently than the stock market. In stocks, the number of available shares is fixed but in futures, new contracts are created when a buyer and seller agree on entering a new position. Traders look for an increase in open interest as a support for a price trend whether it is up or down. This time, we will compare large speculators' long open interest to price action. Large speculators are known to be trend followers which is the opposite of commercials we discussed earlier and are represented by the green line on the COT report.

The chart below for EURO futures highlights rising long open interest with the uptrend.

The chart below for EURO futures highlights rising short open interest with downtrend.

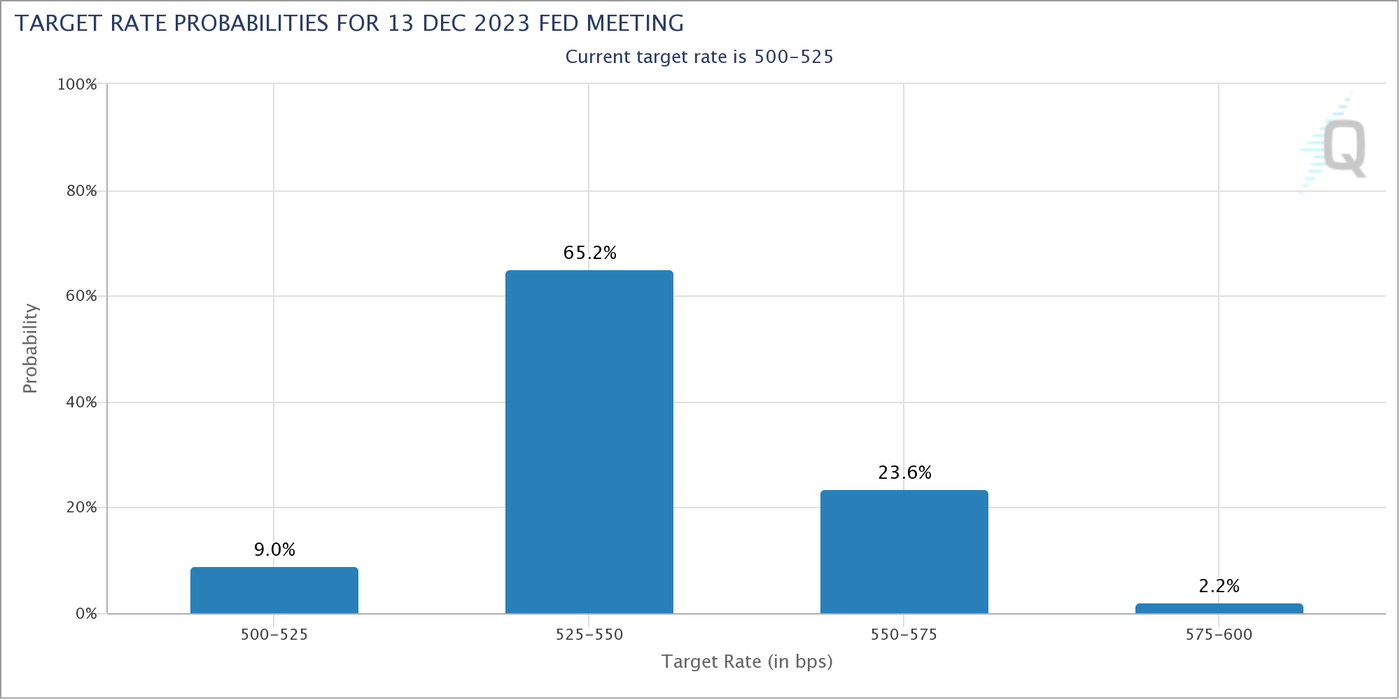

CME FEDWatch tool

Currency prices are largely influenced by interest rates set by central banks around the world. Currently we live in an era where interest rates are on the rise after being kept artificially low for years as global central banks worked to get the global economy back on track after the 2008 financial crisis. One of which, and the most influential, is the Federal Reserve, traders are always looking for clues on the next FED move in regard to interest rates as it heavily affects the exchange rates in the FX market. One of the available tools is CME’s FEDWatch tool which utilizes the data to demonstrate the probability of changes to interest for future FED meetings. The tool is common among traders and investors before scheduled FED meetings as it reflects market sentiment towards interest rate change which affect currency prices.

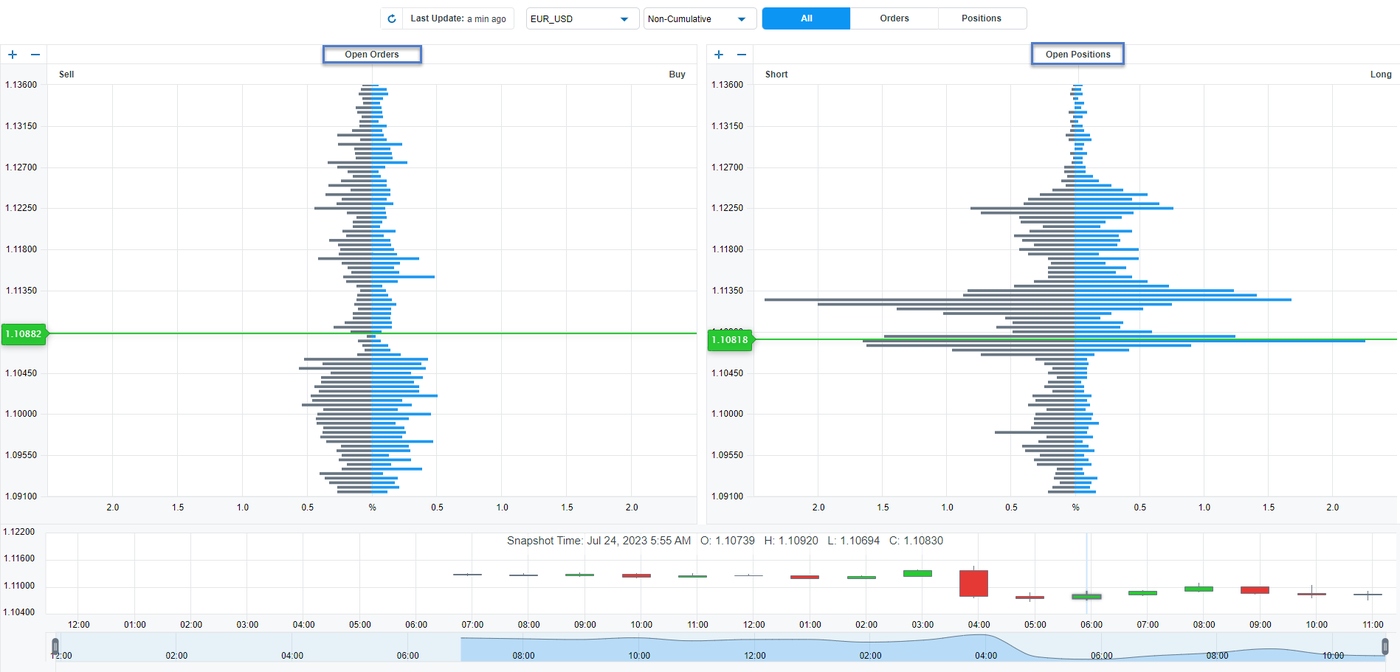

OANDA’s Order Book and position ratio indicator

Other tools used by Forex traders are the position ratio and the OANDA’s order book indicators. The broker’s proprietary data is a valuable resource which can be added to a trader’s arsenal. The indicators are calculated based on a different type of data set which is independent from market prices, the indicators simply tell us what some retail traders' existing open positions are and shed some light on their expected reactions as market prices move through the open order book.

OANDA’s order book indicators provide a percentage of traders looking to buy against those looking to sell at every price level for many currency pairs, therefore, reflecting a visual representation for traders’ sentiment at critical price levels.

Summary

Although it is logical to expect higher positive sentiment should translate into bullish price action, there is also “herd mentality” which we must always bear in mind, crowd can be misled sometimes by certain information or as a reaction to specific expectations which may or may not materialize, the crowd is also known to be wrong at extreme sentiment levels regardless bullish or bearish.

Depending on which sentiment indicator and which group of traders this sentiment represents, a trader may sometimes consider sentiment as a contrary indicator. Many traders have heard it before, “Buy the rumor, sell the news”.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.