Gross Domestic Product, or GDP, remains one of the most-followed indicators of economic growth globally. In this article, we discuss GDP, how it is calculated, and why you should care.

What is GDP and how is it calculated?

GDP, or Gross Domestic Product, measures the total value of all goods and services produced within a given economy over a specific period and is one of the most commonly used measures of current economic prosperity and future growth potential.

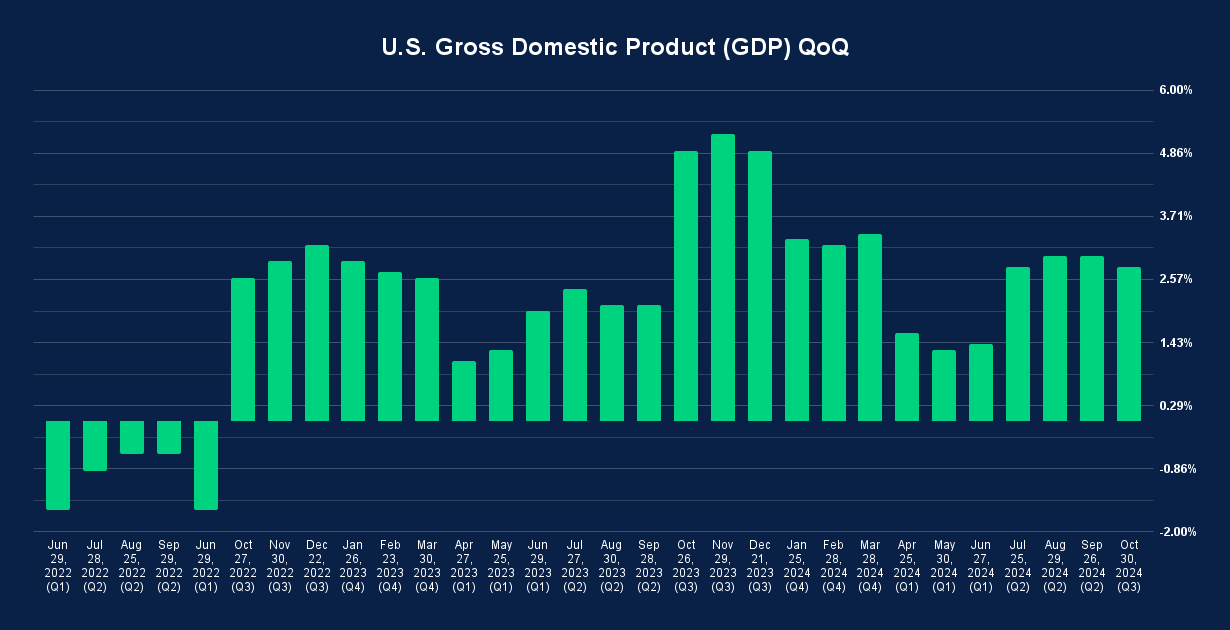

A graph showing the historical GDP of the USA. 06/29/2022 - 10/30/2024, Bureau of Economic Analysis (BEA). Past performance is not indicative of future results.

Gross Domestic Product can be calculated by three different methods, but theoretically, all should share the same result:

- Expenditure approach

The most recognized method for calculating GDP is the expenditure approach, summarized by the following formula: C+G+I+(X-M).

C = Consumer spending

G = Government spending

I = Business investment

(X-M) = Net exports - Value-added approach

The value-added approach calculates GDP by comparing how value is added via the means of production. For example, if a company buys raw materials to create a product, the final sale price is then compared to the cost of production, otherwise known as the ‘value-added.’ This is calculated across all producers in the economy. - Income approach

The income approach measures GDP by exclusively focusing on the income earned by producing goods and services. It sums up:

- Employee wages

- Business profits

- Interest earned on capital

- Rental income from owned property

- Taxes earned by the government

In the United States, the Bureau of Economic Analysis (BEA) reports on GDP numbers on behalf of the US Government, using a mixture of the three methods.

Why is GDP important?

Gross Domestic Product remains one of the most important economic indicators, providing valuable insight into an economy's health and performance.

- Measure of economic health and stability:

A growth in GDP numbers suggests an economy is growing, which usually equates to an increase in employment, rising incomes, and an overall increase in production. Conversely, a decrease in GDP could signal an economic downturn or even a period of recession. - Investment decisions:

The GDP of any given economy can be used as an objective measure to compare a country's economic performance. Strong GDP performance often boosts market confidence and, therefore, stock prices, which may help aid in investment decisions. - Policy guidance:

GDP growth numbers are used to judge the efficacy of any kind of governmental policy, including changes in the Federal Reserve's monetary policy.

Real vs. Nominal GDP

At its core, GDP is intended to measure economic productivity. As such, there are two types of GDP: Real and Nominal.

Real GDP:

Real GDP is typically seen as a more standardized measure of economic productivity, as it ignores the effects of inflation. The value of all final goods and services is calculated using the prices set by the base year. The intention is to measure the difference in economic output rather than extra revenue caused by increased prices.

Nominal GDP:

Unlike its counterpart, nominal GDP uses current market prices to calculate economic productivity. For example, if a company produced the same amount of a given product but sold it at an increased cost compared to the previous year, nominal GDP would rise despite the unchanged economic output.

GDP per Capita

Gross domestic product per capita, or simply GDP per capita, is a measure of economic productivity on a person-by-person basis and is commonly used to measure not only the economic output of a country but also the average person living there.

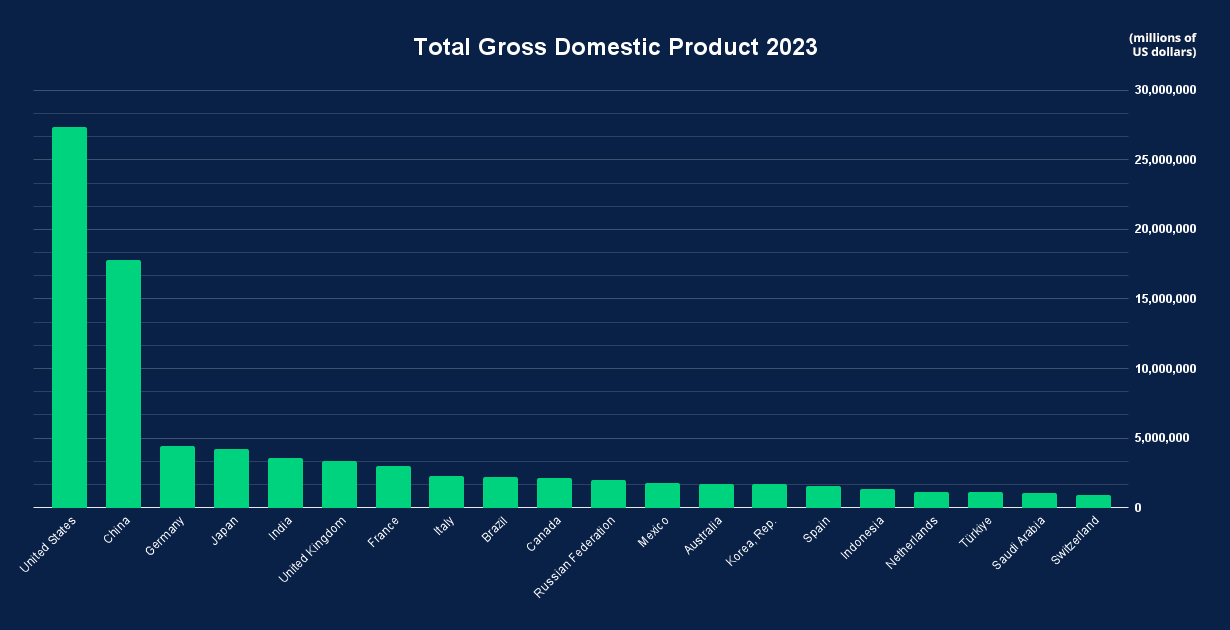

We can naturally expect countries with a higher population to produce more, so GDP per capita often allows for a more objective comparison from country to country.

Which country has the highest GDP?

As of 2023, the United States had the highest total GDP globally, at 27.36 trillion USD for the year. In second place was China, followed in third by Germany².

What are some criticisms of using GDP to measure economic output?

Using gross domestic product as the ‘be-all-end-all’ for measuring economic prosperity can, at least in some regards, be short-sighted. Here are a few limitations:

- GDP doesn’t account for well-being:

Gross domestic product only accounts for goods and services bought and sold and, therefore, does not gauge the general contentment of each person contributing to an economy. In addition, an increase in GDP may also cause undesirable secondary effects like pollution, negatively affecting well-being. - GDP doesn’t account for sustainable growth:

Some growth strategies are more short-term than others, like the unsustainable depletion of natural resources. GDP numbers cannot take this into account and treat all growth the same. - Harmful activities boost GDP:

The proceeds of crime, healthcare expenses for chronic illness, and the rebuilding of infrastructure after natural disasters can all contribute towards a higher GDP number. Questions are to be raised whether this shows ‘economic progress.’

Trade GDP releases with OANDA

Whether you’re looking to trade the market volatility around a GDP release or an entirely different market-moving event, open an account with OANDA today to take advantage of powerful analysis tools and tight spreads on your favorite forex pairs.

Footnotes

¹https://www.bea.gov/data/gdp/gross-domestic-product

²https://datacatalogfiles.worldbank.org/ddh-published/0038130/DR0046441/GDP.pdf?versionId=2024-07-01T12:42:23.8710032Z

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. It is not investment advice or a solution to buy or sell instruments.

Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.