Japan’s deflation problem combined with their low interest rate policy over the past years have made the yen a prime target funding currency that draws the attention of the traders. This article explains the instruments that Japanese authorities have historically used to intervene in the forex market to keep the yen away from volatility.

Japan’s Forex Fundamentals

You don’t need a PhD in economics to appreciate how important Japan’s economy has been to global markets over the past few decades.

Before you start trading forex, you need to understand how some of the big macro traders analyze the market.

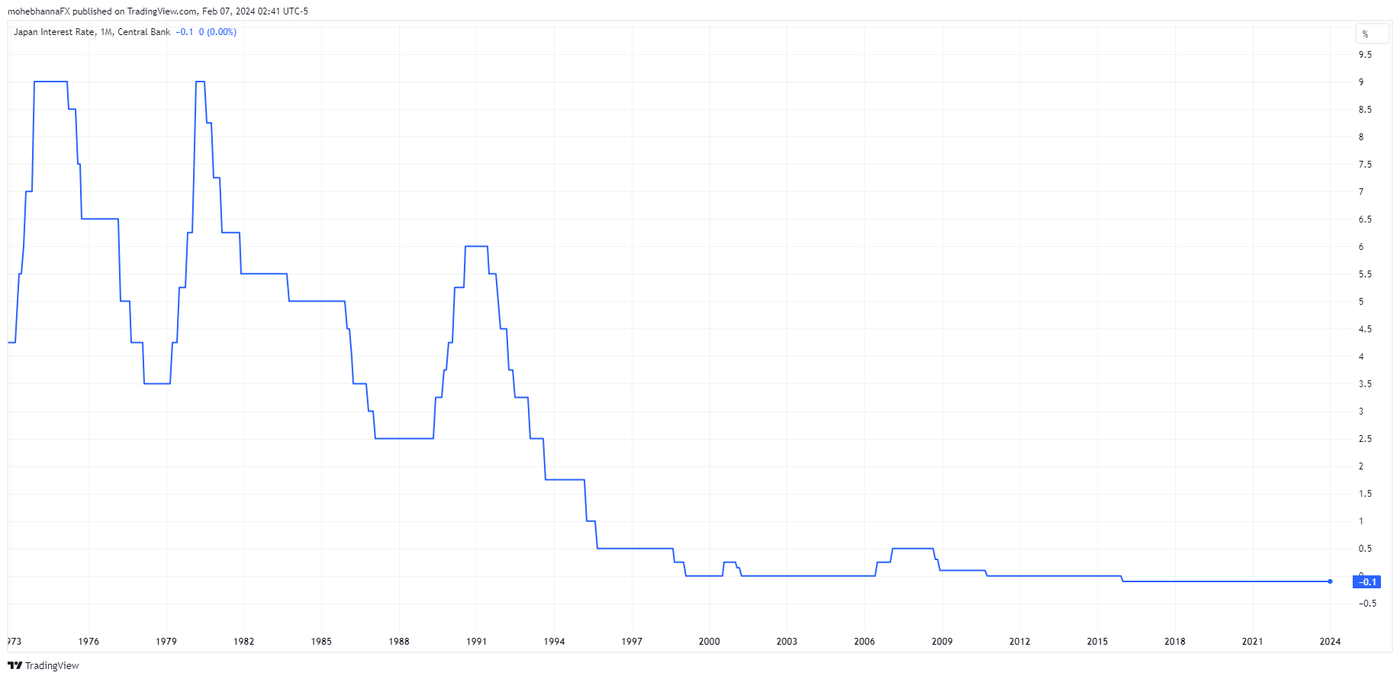

The interest rate and ongoing inflation expectations in a speculative environment have made the yen an attractive trade as many traders become fixated on Japan’s deflation problem. Japan had two bubbles burst in the late 1980s: a stock market crash and a housing market crisis.

This led to deflation, where prices for goods and services declined and consumer confidence was weakened, prompting many to wait to spend. Japan’s economy saw a contraction that was preceded by a low interest rate policy. When the economy stabilized and policy reversed, a credit contraction occurred, which triggered deflation.

The end result was that Japan was stuck with low interest rates, and that made it a prime target as a funding currency, which is money borrowed in one currency to purchase another currency.

Japan’s Economy

The Japanese manufacturing sector is dynamic, as they produce vehicles, computers, and electrical machinery, but that only makes up less than one-fifth of GDP. A weak yen could make their exports more attractive, but that would still be an overall negative for the economy.

Japan’s economy has moved away from having a manufacturing focus to being service-driven. Key industries also include real estate, restaurant, advertising, hotel and leisure businesses, as well as data-processing industries

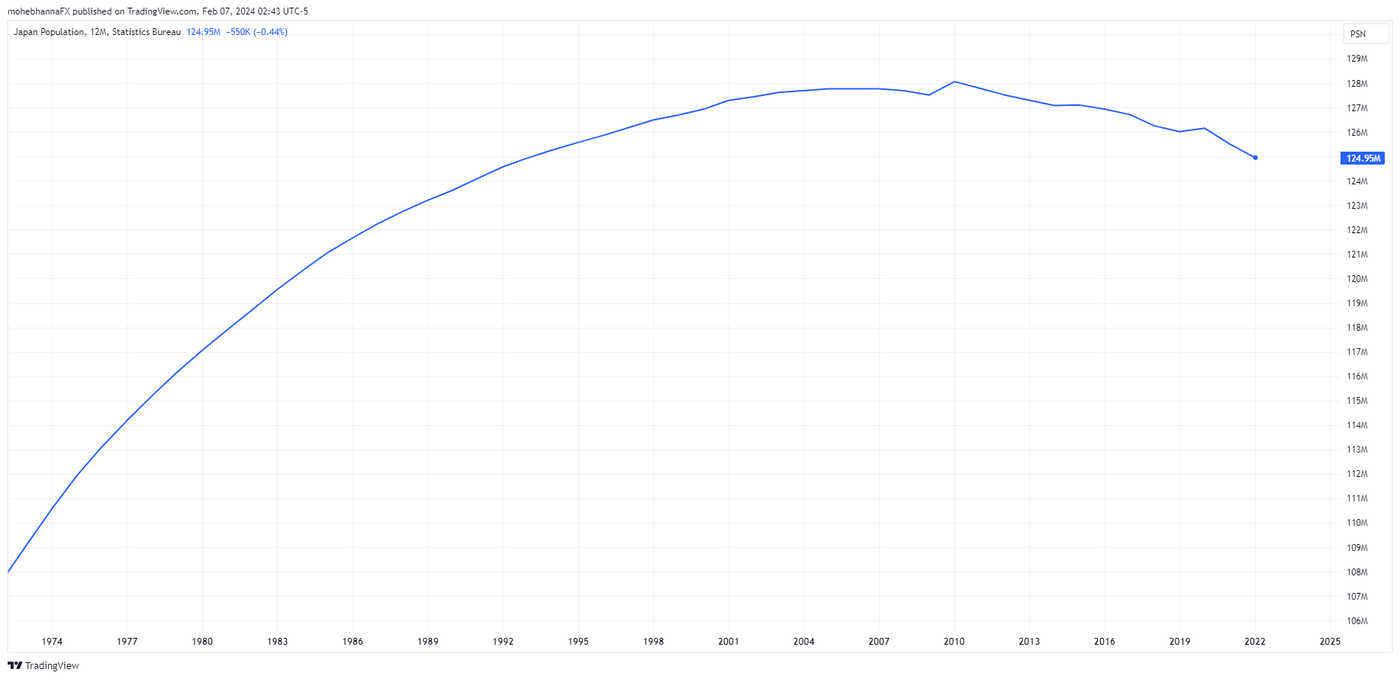

What is also complicating Japan’s circumstances is that the country has been battling a shrinking population for decades. The Internal Affairs and Communications Ministry reported in 2023 that the population of Japanese nationals declined by ~800,000 people to 122.4 million in 2022 from the previous year. With record low birth rates and one of the most rapidly declining populations in the world, this economy is not seeing robust enough consumer spending trends that will help support long-term aggregate demand for goods and services, leading to increased production and employment. With one-fifth of the population being millennials, they have lived most of their lives in an economic slump, and that has made them much more cautious about spending. Inflation expectations have been anchored for decades, and it will be difficult to imagine a major generational change anytime soon.

BOJ and the Minister of Finance

The Government of Japan has a tough task supporting the world’s third-largest economy and largest creditor. Over the past few decades, the Japanese Ministry of Finance has needed to tap their foreign reserves to sell dollars in hopes of supporting the yen. The way it works is that the finance minister issues the order to intervene, and the Bank of Japan (BOJ) delivers as the ministry’s agent. No press release is issued, so when the banks start processing the BOJ’s orders, yen volatility accelerates.

Intervention

With the Japanese yen steadily declining, the government could take extraordinary measures to try to sway the FX market. Japan has been criticized in the past for maintaining a weak yen to benefit their exporters, but when the yen falls below key levels, that oftentimes has triggered action.

Verbal intervention

Given their long history of intervening in currency markets, Japanese officials were closely listened to for hints about extraordinary actions. They often noted that they did not want to see one-sided or excessive moves in FX.

They typically have been avoiding expressing their potential actions directly and they have been using statements similar to the below, to push markets into actioning in line with their expectations instead:

- We will not tolerate speculative movements.

- We won’t rule out any options to combat excessive movements.

- We are ready to take decisive or bold action to counter excessive or speculative moves

- Consider us on standby, or we’re ready to take action at any time.

- We could conduct stealth intervention.

On March 8th, 2001, then-Japan’s finance minister Kiichi Miyazawa commented on Japan’s weak fiscal conditions and said that fiscal reforms were needed. The comments came after fiscal policy comments by other Japanese government officials, and the combined market reaction to these comments resulted in a highly volatile trading day.

On June 19th, 2001, Bank of Japan’s Gov. Masaru Hayami said, “Government intervention is possible if the currency's rapid decline continues.” The comment had a minor impact on the Yen’s exchange rate against the US Dollar, as the price moved from 123.25 to 123.02. However, the impact on the Yen’s exchange rate against the Euro was more noticeable, as it moved from 106.00 to 105.45.

The most recent example of a verbal intervention was on September 7th, 2022, when the BOJ was concerned about the yen’s weakness after it reached 143.00 against the US dollar. A top government official by that time, Hirokazu Matsuno, expressed his concerns and said, "The government would like to take the necessary steps if such movements continue."

Actual Intervention

BOJ’s actual intervention was highlighted in 2011; the global economy was under pressure as Japan was recovering from the effects of the March 11th, 2011 South East Asia earthquake, and Tsunami while Europe was still struggling with debt problems that resulted from Greece as well as other EU countries inability to meet their financial obligations, on April 7th, 2011, the Japanese government said that it intervened in currency markets to counteract excessive speculator driven movements with Yen that threatened Japan’s economy. Another significant intervention occurred on October 31st, 2011, when the Bank of Japan sold the yen after it hit another record high against the US dollar; the intervention was to counter speculation that could have harmed Japan’s economy at the time.

The above daily chart highlights the events surrounding the interventions; the April 7th, 2011, intervention led to a stronger yen against the US dollar, while the October 31st, 2011, intervention led to yen weakness against the US dollar. Please remember that the above chart has the yen as the “quote currency” (USD/JPY); rising candles mean weaker yen, and declining candles mean stronger yen.

Coordinated intervention

When some FX moves became too excessive, Japan didn’ act alone. In the 1980s, the Group of Five industrial nations signed the Plaza Accord, prompting the sale of US dollars. A couple years later, six of the G7 nations signed the Louvre Accord in hopes of thwarting the dollar’s decline. The Asian Financial Crisis had both US and Japanese official support yen. In 2011, the G7 tried to halt the surging yen after a massive earthquake triggered speculation of widespread repatriation of foreign assets to pay for rebuilding.

What FX traders need to know

Financial markets have seen many interventions throughout the years, and some have worked, while others have produced opportunities to fade the move. Many traders try to focus on key levels where Japanese officials have intervened in the past.

Interventions can lead to excessive moves that might initially lead to illiquid conditions, so be prepared to see abrupt and rapid movements.

Analyze the Japanese yen with OANDA

Try your hand at trading with OANDA

Interested in trading the US dollar against the Japanese yen? Learn how to trade as a forex trader.

To try your hand at FX trading and experiment with the volatility of the Japanese yen as it trades around prior levels that triggered action from Japanese officials, apply for a demo forex account at oanda.com

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.