Improve your USD/JPY strategy with five tips for your trading, covering monetary policy, fundamental news events, risk sentiment, and more.

How to Trade USD/JPY

Intro

Within the world of forex, there are a few currency pairs that can compare to USD/JPY.

Accounting for 12% of total market volume with a daily turnover of $439,000,000,000 (439 billion dollars), USD/JPY remains staunch as not only one of the most known currency pairs globally but statistically one of the most traded, ranking third only behind EUR/USD and GBP/USD.¹

An image showing total forex market turnover 2013 - 2022. Past performance is not indicative of future results. Source: Bank for International Settlements (BIS)¹

This article discusses five tips for trading dollar yen at your best, including technical and fundamental analysis techniques.

USD/JPY: A Trillion Dollar Giant

1. Analyze Japan and U.S economic data

When trading any currency pair, how the market reacts to an economic data release can be one of the most significant determining factors for a successful trade.

Proving no exception, here is a list of fundamental news events USD/JPY traders should be aware of:

- JP Tankan Large Manufacturing Index

- JP Tokyo Consumer Price Index (CPI)

- JP Gross Domestic Product (GDP)

- JP Bank of Japan Interest Rate Decision

- US Non-farm Payrolls (NFP)

- US Consumer Price Index (CPI)

- US Gross Domestic Product (GDP)

- US Federal Reserve Interest Rate Decision

When managing an open position or looking for a new trading opportunity, traders should consider how the outcome of any upcoming fundamental event could affect their trade, especially when trading shorter timeframes.

While the same conventional wisdom applies regarding proactively managing risk surrounding an event, this arguably goes double for USD/JPY traders, with some releases from the Japanese government happening outside of the New York and London trading sessions.

Read more: Understanding Forex Trading Sessions: When is the Best Time to Trade

When managing an open USD/JPY position, traders would be well-advised to review the schedule of upcoming Japanese events each day and adjust stop-losses and take-profits accordingly.

2. Track Bank of Japan and Federal Reserve monetary policy

For the best part of fifteen years, the Bank of Japan has been the ‘odd one out’ amongst its peers.

Having maintained ultra-low and even negative interest rates since the 2008 financial crash, the last time the yen offered a higher level of interest than the dollar was in 1993, with the greenback maintaining a higher interest rate since, often by some margin.

Read more: Understanding how Japan intervenes in the FX market

These conditions, at least in part, have all but guaranteed the yen’s gradual decline in value versus the dollar.

In the modern day, however, the winds of change are blowing.

Having raised rates twice in 2024, the market perception of the yen is shifting, courtesy of a complete u-turn in monetary policy stance by the Bank of Japan.

When simplified, and with all other variables remaining unchanged, the dollar/yen interest rate dynamic can be explained as follows:

If the Federal Reserve is to offer a higher level of base interest on each dollar than the Bank of Japan offers on each yen, USD/JPY can be expected to rally.

If the Bank of Japan is to offer a higher level of base interest on each yen than the Federal Reserve offers on each dollar, USD/JPY can be expected to fall.

Although the Federal Reserve’s interest rates are currently some ~4.00% higher than those of the Bank of Japan, narrowing this gap would make the dollar less attractive to buy-and-hold, likely supporting the yen’s value.

Traders would also be well-advised to consider how the markets predict the future trajectory of interest rates, both in upcoming decisions and in the longer term, as markets may have already ‘priced in’ the expected outcome.

Read more: The Global Trend of Central Banks Cutting Interest Rates

3. Pick the right time to trade

With FX trading increasingly popular around the globe, USD/JPY is uniquely positioned as a currency pair with two bouts of increased liquidity: the New York and Tokyo sessions.

While USD/JPY trading volume is relatively high throughout any twenty-four-hour period, it is typically at its highest during the New York and Tokyo sessions:

- The New York session, roughly 08:00 - 17:00 ET

- The Tokyo session, roughly 19:00 ET - 03:00 ET

A chart showing USD/JPY price action, with the New York and Tokyo trading sessions annotated. TradingView, 01/07/2025. Past performance is not indicative of future results.

With markets needing liquidity to decisively trend, traders would be well-advised to trade dollar/yen when trading volume is as its highest - with the added benefit of typically tighter spreads.

While the New York session covers normal working hours on the East Coast, some traders may benefit from focussing on trading pairs like USD/JPY in the Tokyo session if they cannot trade during normal working hours.

Read more: How to Choose a Forex Pair to Trade

4. Understand ‘safe-haven’ demand

Under different market conditions, demand for any individual currency constantly fluctuates, making the FX markets unique in how each currency pair trends.

The same key themes often determine how attractive a currency is to buy and hold, with risk appetite being among some of the most significant.

Although the Japanese yen and U.S. dollar can be considered typical ‘safe-haven’ currencies, which are expected to be bought in times of low economic confidence, the market has consistently shown that the Japanese yen continues to dominate at the premier ‘safe-haven’ currency choice over the dollar.

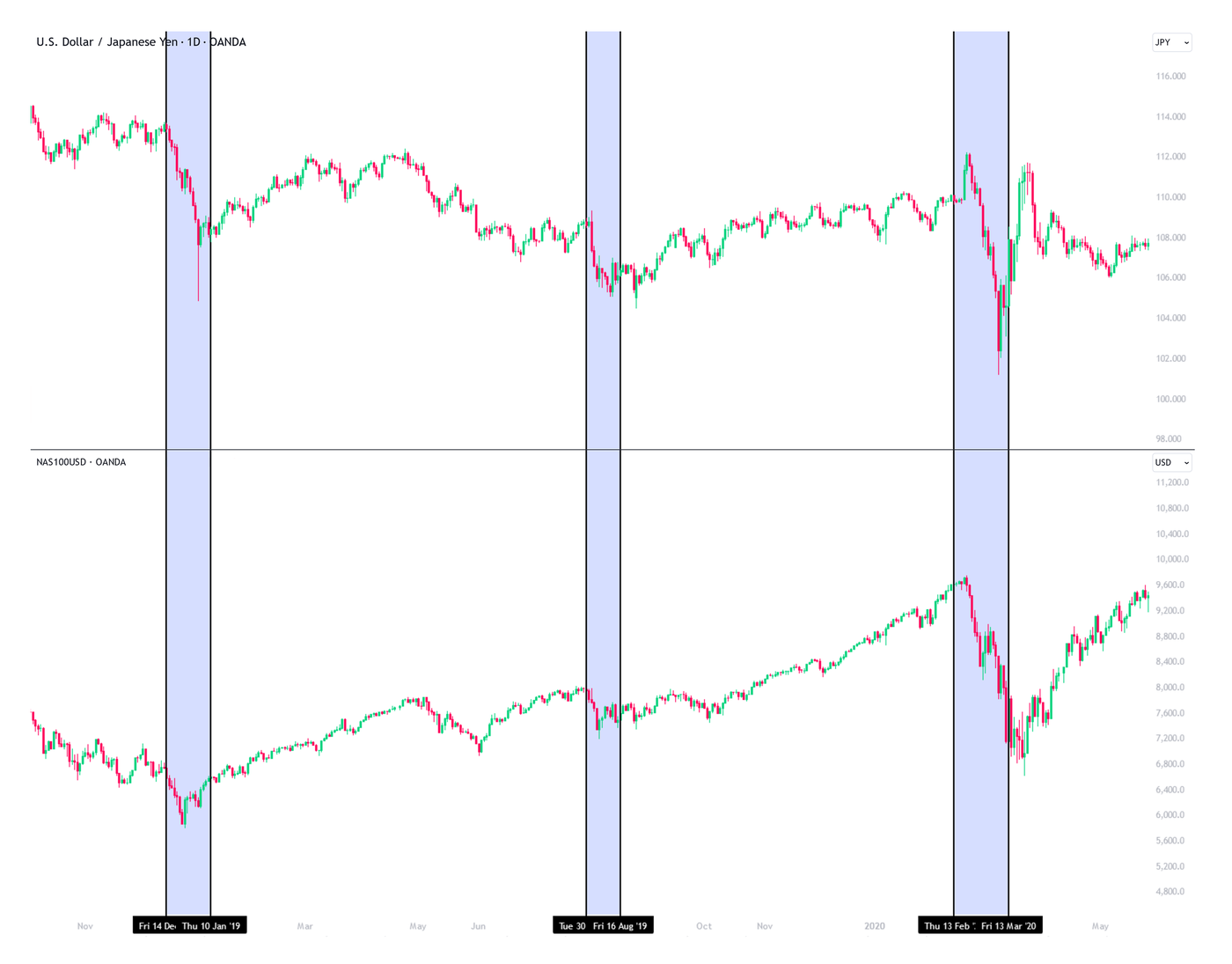

Although not perfectly correlated, as shown below, USD/JPY is typically sold during times of economic uncertainty:

When either looking to place a USD/JPY trade or managing an open position, traders should be attempt to first understand the current level of risk appetite in the market, and by extension, the demand for ‘safe-haven’ currencies.

Read more: How to Trade EUR/USD: Top 5 Tips to Boost Your Trading

5. Choose the right broker

Having an edge in your trading can sometimes be as simple as choosing the right broker.

Boasting competitive spreads, reliable customer support and an award winning² trading app, make the smarter choice with OANDA.

Over past 25 years, OANDA has built a stellar reputation for not only award-winning trading platforms* and innovative trading education but also transparent pricing, helping you understand how costs affect your trading.

Whichever currency pair you choose to trade, USD/JPY or otherwise, take advantage of tight spreads with OANDA.

Footnotes

¹ Bank for International Settlements (BIS) 2022 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets

² Awarded highest client satisfaction for mobile platform/app (Investment Trends 2021 US Leverage Trading Report, Margin Forex)

* OANDA clients do not have access to the interbank market

** OANDA clients in the United States do not have access to equity trading

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. It is not investment advice or a solution to buy or sell instruments.

Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.