Enhance your trading EUR/USD trading ability with five tips for your trading, covering monetary policy, fundamental events, key correlations, and more.

Five Tips for Trading EUR/USD

Intro

Typically offering higher leverage and lower margin requirements than other asset classes, forex trading has seen an explosive gain in popularity over the past ten years.

As not only the world’s largest but also the most liquid*, the forex market attracts traders worldwide who hope to profit from fluctuations in currency prices.

An image showing EUR/USD’s share of total forex market trading volume. Past performance is not indicative of future results. Bank for International Settlements (BIS)¹

EUR/USD: The world’s most traded currency pair

However, in this growing market, it would appear that some currency pairs receive much more market attention than others. Enter: EUR/USD

Accounting for almost a quarter of total global forex market trading volume at upwards of $1.25 trillion*, EUR/USD is the world’s most traded currency pair globally, offering plenty of trading opportunities for those looking to speculate on price.

This article discusses five tips to help you trade euro dollar at your best.

1. Track ECB and Fed monetary policy

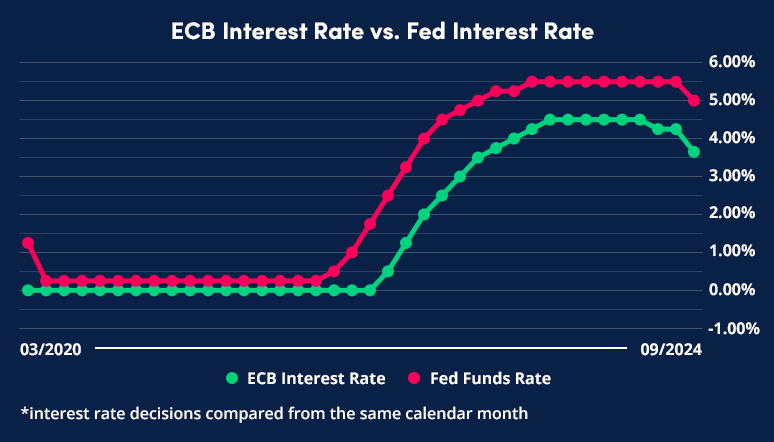

The interest rate differential between the euro and the dollar is one of the most significant market forces to consider when trading EUR/USD.

In a vacuum, the dynamic can be simplified as follows:

If the European Central Bank is to offer a higher level of base interest on each euro than the Federal Reserve offers on each dollar, EUR/USD is expected to rally.

If the Federal Reserve is to offer a higher level of base interest on each dollar than the European Central Bank offers on each euro, EUR/USD is expected to fall.

Traders should be advised to consider not only how the current base interest rates differ but also each central bank's likely next move.

The results of key economic data releases, such as the Consumer Price Index (CPI), Gross Domestic Product (GDP), and Non-farm Payrolls (NFP), can help predict future rate decisions better.

2. Understand market risk appetite

Within the FX markets, there is a common perception that some currencies are ‘riskier’ than others.

In the example of EUR/USD, the euro is typically said to be a ‘risk-on’ currency, while the US dollar is considered a ‘risk-off’ currency.

With all other factors unchanged, the ‘risk-on’ vs ‘risk-off’ dynamic can be explained as follows:

In times of high-risk appetite and when the market is more optimistic, EUR/USD is expected to rally.

In times of low-risk appetite and when the market is more pessimistic, EUR/USD is expected to fall.

When placing a trade on euro/dollar or managing an open position, traders should first attempt to understand the current sentiment toward market risk.

Many methods are available to achieve this, including following the VIX index or measuring inflows into ‘safe-haven’ and ‘risk-sensitive’ assets like gold and oil, respectively.

3. Analyze Eurozone and U.S. economic data

Economic data releases from both the United States and the Eurozone play an essential role in determining the likely success of any trade placed on EUR/USD.

To name a few, here are some events that are historically amongst the most impactful:

- US Non-farm Payrolls (NFP)

- US Consumer Price Index (CPI)

- US Gross Domestic Product (GDP)

- US Federal Reserve Interest Rate Decision

- EU German Ifo Business Climate Index

- EU Eurozone Harmonized Index of Consumer Prices (HICP)

- EU Eurozone Gross Domestic Product (GDP)

- EU European Central Bank Interest Rate Decision

When either looking to place a trade on EUR/USD or actively managing an existing position, traders should first understand how the outcome of a fundamental event could change the likelihood of a successful trade.

Using the following criteria, traders can build a better understanding of how the market will likely react in every eventuality and plan accordingly:

- How would the result of this event reflect on general economic health and future growth prospects?

- Would the result of this event change market opinion on the likelihood of future rate cuts/hikes?

4. Pick the right time to trade

The forex market is open twenty-four hours a day, five days a week.

But what is the best time to trade EUR/USD?

As shown in the chart above, EUR/USD trading volume is typically at its highest during the overlap of the London and New York trading sessions, roughly from around 08:00 to 12:00 EDT.

With liquidity often referred to as the ‘lifeblood’ of the financial markets, periods of high volume not only encourage markets to move more decisively but can also help the market to trend - which is often conducive to finding high-quality trading set-ups.

Read more: Understanding Forex Trading Sessions: When is the Best Time to Trade

An image to show the four primary trading sessions, Sydney, Tokyo, London, and New York, and how they overlap. Past performance is not indicative of future results.

Although there are multiple overlaps throughout the trading day, the euro dollar predictably sees the most attention during the stock market hours** of the eurozone and New York City, making the London and New York overlap often the best time to find a high-quality trading set-up.

5. Understand key EUR/USD correlations

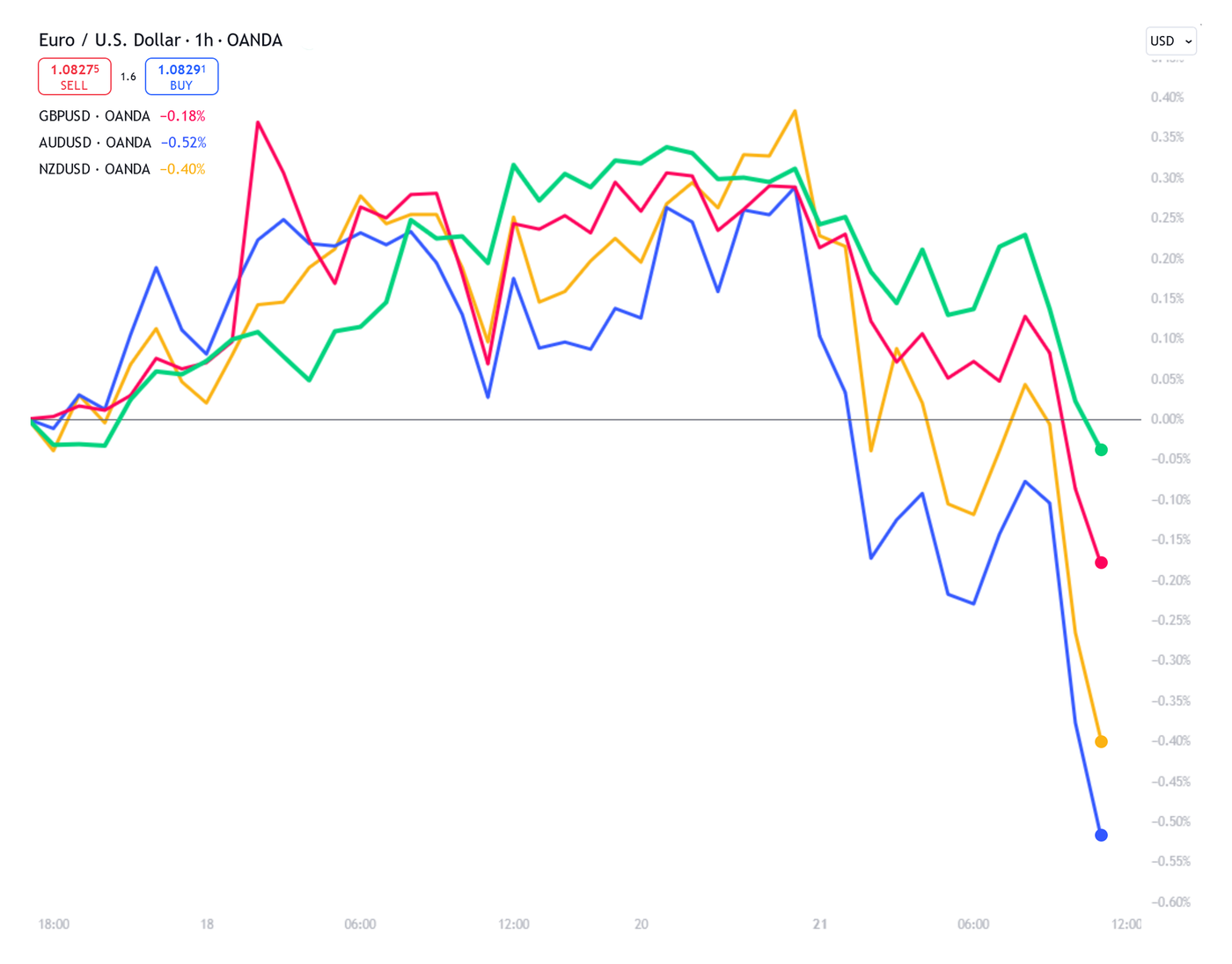

Historically, the price action of EUR/USD has positively correlated with other key currency pairs such as GBP/USD, NZD/USD, and AUD/USD.

When determining whether a long or short EUR/USD position would result in the best quality trading set-up, traders should first check the price action of the assets in which EUR/USD is positively correlated.

For example, if your trading system agrees that EUR/USD, NZD/USD, AUD/USD, and GBP/USD are all likely to go short, this could further validate a potential EUR/USD short position.

Practice on a demo account

Whether you’re new to forex trading or just looking to hone your analysis skills, apply for a demo account today with OANDA.

Without the risk of actual funds, demo trading allows you to practice your trading skills and test new strategies on a wide range of currency pairs - EUR/USD included.

Sign up today with a regulated, award-winning broker.

Footnotes

¹Bank for International Settlements (BIS) 2022 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets

²TradingView Broker Awards 2023, Broker of the Year

*OANDA clients do not have access to the interbank market

**OANDA clients in the United States do not have access to equity trading

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.