With the eleventh month of 2024 already underway, here are the five currency pairs to add to your watchlist for November.

Five Currency Pairs to Watch This Month

With the 11th month of the year already upon us, one theme remains at the forefront of traders’ minds: the upcoming US Presidential Election.

With this keystone event less than a week away, here are five currency pairs to watch this month and some key dates to mark your calendar.

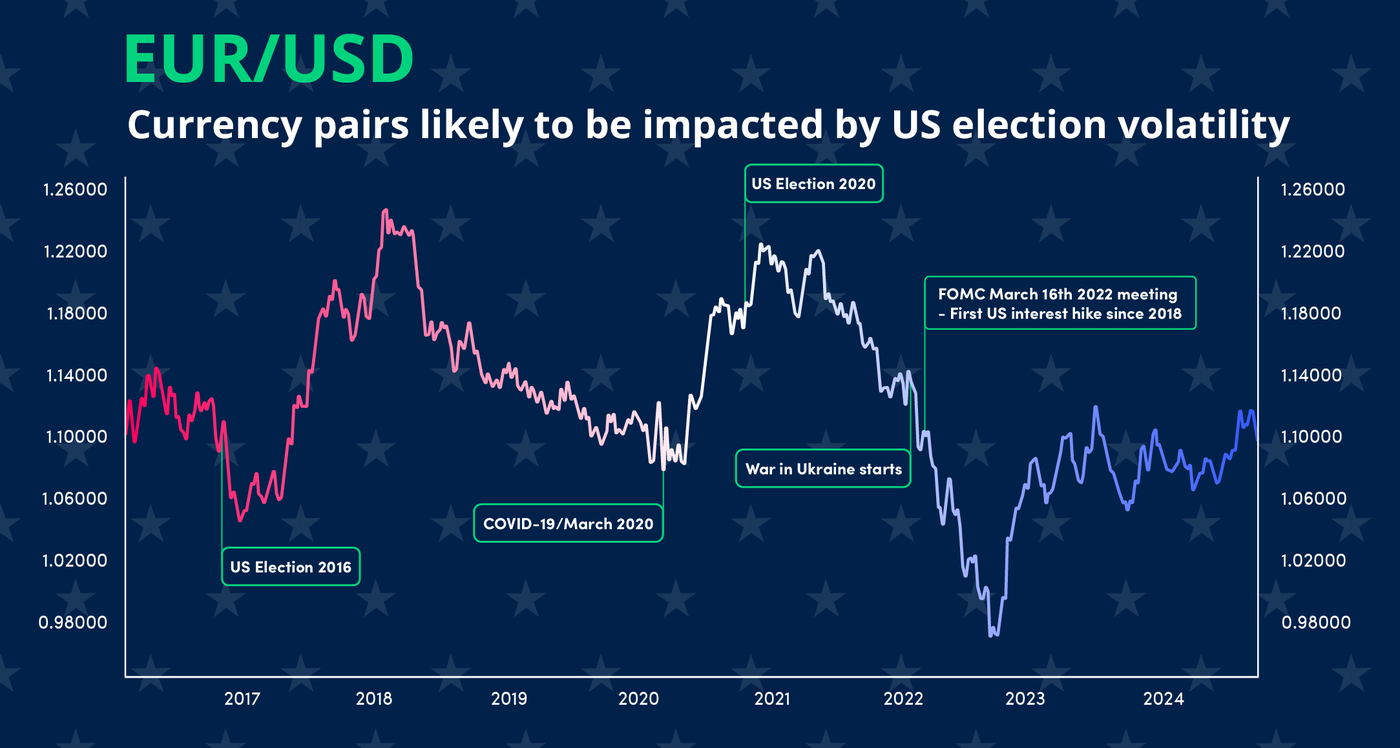

EUR/USD: Eyes on the Federal Reserve and ECB

In a surprise to no one, monetary policy remains one of the most dominant forces in determining EUR/USD performance this November.

With the Federal Reserve cutting rates for the first time in over four years in their September decision by an astounding 50 basis points, the question now becomes in what manner will the Fed continue its easing campaign, with most predicting a 25 basis point cut in November.

A chart showing the recent candlestick price action of EUR/USD. TradingView, 05/31/2024 - 10/30/2024. Past performance is not indicative of future results.

As for the European Central Bank, however, things are arguably more unclear.

Despite cutting rates decisively earlier than the Federal Reserve, commentary from the ECB suggesting their likely next move since has been noticeably sparse, essentially leaving traders to their imagination—at least for now.

At the time of writing, the European Central Bank maintains a benchmark interest rate ~1.6% lower than the Federal Reserve, which can be said to typically support EUR/USD weakness in the longer term, assuming all other variables remain unchanged.

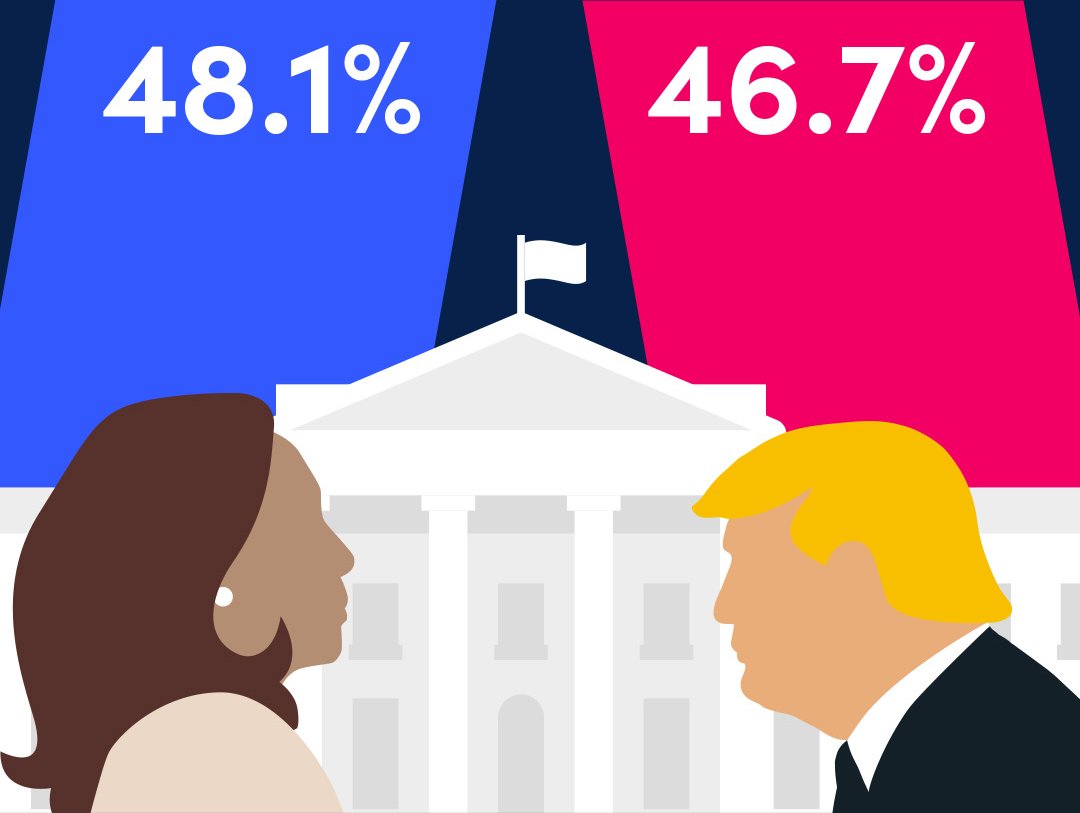

Otherwise, there is the small matter of the US Presidential Election, the outcome of which is likely to significantly impact EUR/USD, especially with current polling suggesting the closest race seen for some time.

Traders can expect the FX markets to remain volatile during and around election night, with EUR/USD likely to take center stage.

EUR/USD: Technical analysis for November 2024

- Finding support near lows of 1.07612, EUR/USD currently trades just below the 21-day moving average. If price is able to break above this level and retest, further upside is likely.

- According to the Relative Strength Index, EUR/USD currently trades in bearish territory. If able to break above the midpoint of 50.00, support may be found, allowing for a further leg higher.

EUR/USD: Key dates to watch this month

Tuesday, November 5th: US Presidential Election

With headlines suggesting the closest race for the White House in some time, the US Presidential Election, if nothing else, will likely introduce some welcome volatility to the FX markets, with EUR/USD proving no exception.

Now less than a week away, how the victor of the US Election will affect EUR/USD performance in the long term is yet to be entirely understood. At the very least, traders would be well-advised to proactively manage risk and position size around November 5th, as any shock result could trigger sharp movements in price.

Thursday, November 7th: Federal Reserve Interest Rate Decision

In the midst of election week, the FOMC is set to meet in Washington, D.C., to cast votes on the new target interest rate.

Whilst the current consensus suggests a 25-basis-point cut is the most likely outcome, any further decreases in the base interest rate differential of the euro and the dollar may increase bullish sentiment for EUR/USD.

The ECB’s next meeting on monetary policy is expected in early December.

USD/CHF: Safe Haven Showdown

Both hailed as ‘safe-haven’ currencies, the relationship between the United States dollar and the Swiss Franc is unique to the FX markets.

Typically bought and held during times of economic uncertainty and low-risk appetite, ‘safe-haven’ currencies offer a unique mix of stability, low risk, and ample liquidity, allowing large volumes to be bought and sold with relative ease.

A chart showing the recent candlestick price action of USD/CHF. TradingView, 03/15/2024 - 10/31/2024. Past performance is not indicative of future results.

However, not all ‘safe-haven’ currencies are created equally.

In recent times of economic downturn and instability, the market has typically voted in favor of the Swiss franc as the premier choice for capital preservation over the dollar, often causing USD/CHF to fall.

Known for its active role in the FX market by means of intervention, the Swiss National Bank has helped achieve this apparent preference for the franc through years of policy promoting stability as its first priority.

As for this month, this dynamic is arguably as important as ever, with the US Presidential Election likely to weigh heavily on the dollar and, consequently, USD/CHF.

USD/CHF: Technical analysis for November 2024

- Set to erase all year-to-date gains in late September, USD/CHF has since found support. At the time of writing, it trades at three-month highs around 0.86816.

- After a recent rally, the MACD indicator recently confirmed USD/CHF as ‘overbought,’ suggesting some short-term bearish pressure may be likely.

USD/CHF: Key dates to watch this month

Tuesday, November 5th: US Presidential Election

With the eventual outcome playing a large part in determining market risk appetite, we can expect the US Presidential Election to boost USD/CHF volatility.

A contested or unclear result could promote risk aversion and cause USD/CHF to fall, whereas a decisive victory for either party could cause USD/CHF to rally.

Friday, November 29th: Swiss Gross Domestic Product

As one of the leading performance metrics of any world economy, SECO is expected to release Swiss GDP numbers on November 29th.

The release will likely set the tone for the upcoming SNB interest rate decision expected December 12th, especially with commentary suggesting the door is ‘wide-open’ for further cuts with inflation seemingly under control.

If the Swiss economy's trend of positive GDP numbers continues, USD/CHF can be expected to fall in the short term.

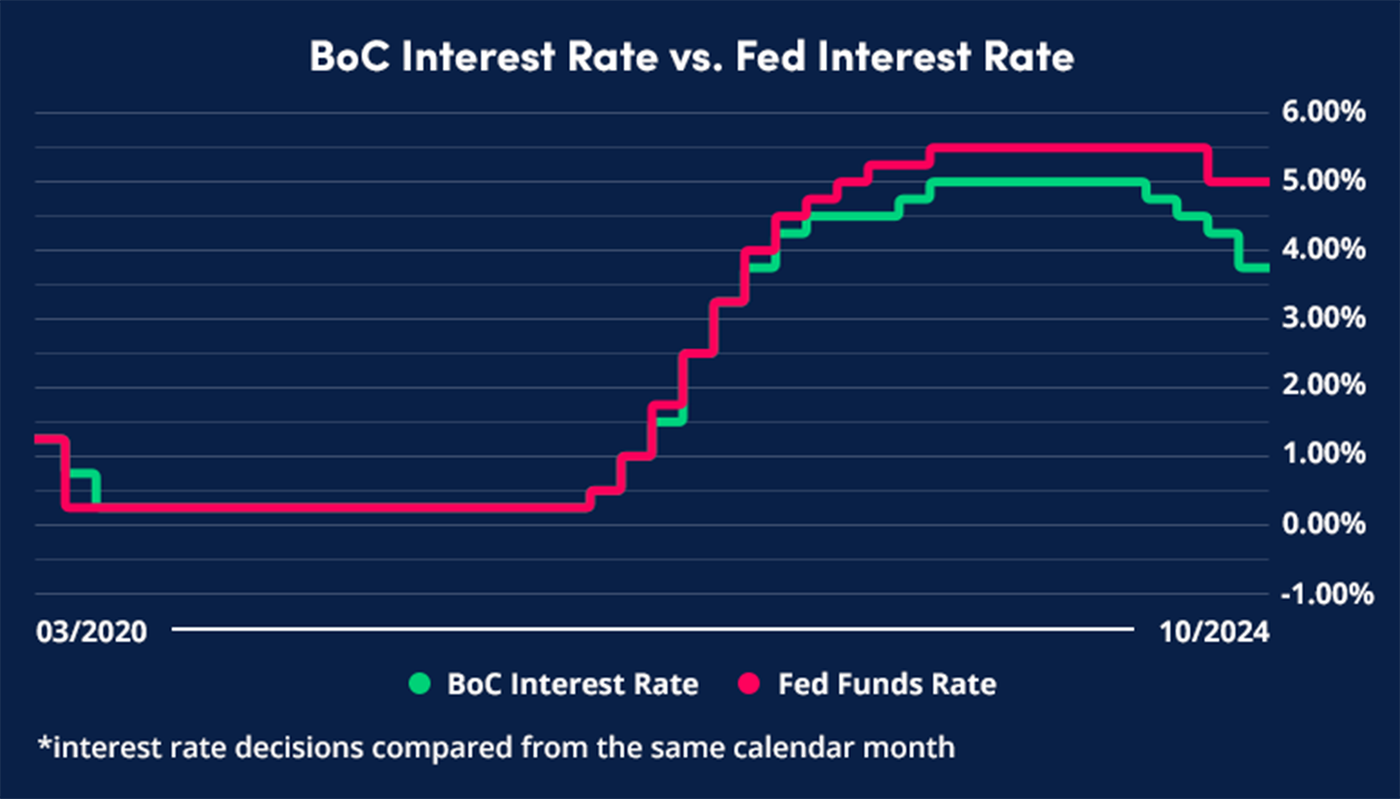

USD/CAD: Ahead of the Curve

The United States and Canada share obvious similarities culturally, politically, and geographically. But despite all this, their stances on monetary policy this year could not have been more different.

A chart showing the recent candlestick price action of USD/CAD. TradingView, 07/15/2024 - 11/01/2024. Past performance is not indicative of future results.

Joining the ranks of the ECB, the Bank of Canada not only chose to cut rates in October but did so by a bumper 50 basis points - extending its 2024 ‘lead’ from the Federal Reserve handsomely:

- Bank of Canada: 125 basis points worth of cuts across seven decisions

- Federal Reserve: 50 basis points worth of cuts across six decisions

Separate from monetary policy matters, the US Presidential Election will, of course, impact USD/CAD with concerns over the future of trade agreements and general bilateral relations.

Both election candidates have gone on record saying they, by one means or another, wish to re-negotiate the current terms of the United States-Mexico-Canada trade agreement (USMCA), with its predecessor, the NAFTA, previously dubbed the “worst trade deal ever made” by Donald Trump.

Read more: What are the key factors influencing the USD/CAD outlook in the short term?

USD/CAD: Technical analysis for November 2024

- After an impressive bull run starting in late September, USD/CAD trades at its highest level since October 2022.

- On the daily timeframe, the RSI signals USD/CAD as ‘overbought,’ but the MACD is yet to give a converging signal. If the RSI and MACD signals agree on ‘overbought’ conditions, this could introduce some short-term bear pressure.

USD/CAD: Key dates to watch this month

Tuesday, November 5th: US Presidential Election

November 5th is a significant day for much of the FX market, with USD/CAD unsurprisingly proving no exception.

Of course, the aforementioned ‘safe-haven’ flow rules will also apply to USD/CAD, and traders would be well-advised to manage risk proactively and prepare for potential high volatility.

Tuesday, November 12th: OPEC Monthly Report

Further adding to a busy start to the month, OPEC is set to release its monthly report on November 12th.

With oil being Canada’s largest export, traders will be keenly watching to see how current production aligns with demand, especially in major-producing economies like China, and how tensions in the Middle East have affected the future outlook.

Long seen to positively correlate with world oil prices, USD/CAD can be expected to rally if the report suggests a potential for rising world oil prices.

AUD/USD: Risk Appetite Ultimate

Regarded by many as one of the most prominent risk-on-risk-off currency pairs available among the major currencies, AUD/USD has steadily declined since March 2021.

Where the Australian dollar is unique however, is in the Reserve Bank of Australia’s approach to monetary policy, having yet to perform a rate cut since November of 2020.

With inflation data continuing to fall and now within the RBA’s target of 2-3% for the first time since early 2021, the next few months are pivotal in establishing a trend of positive economic data, which may allow the RBA to cut rates—albeit better late than never.

According to market consensus, the RBA is expected to make its first rate cut in February 2025. In the meantime, traders should pay particular attention to the following economic data points to build a better impression of the RBA’s likely next move:

- Consumer Price Index (CPI)

- Labour Force

- Household spending

It should be noted, however, that the RBA still maintains a lower interest rate than the Fed despite not starting any easing campaign.

AUD/USD: Technical analysis for November 2024

- AUD/USD currently trades near the key level of 0.65000, a historical level of support. If price can find support at this level, some upside can be expected.

- Using the Average Directional Index (ADX) to measure trend strength, AUD/USD currently trades at 38.40, which indicates a ‘strong trend’.

AUD/USD: Key dates to watch this month

Tuesday, November 5th: RBA Interest Rate Decision

Kicking off US election day in some style, the board members of the RBA are expected to meet in Sydney November 5th.

Dubbed by some as careful and by others as hesitant, both the data and consensus suggest the RBA will maintain rates. Any shock results will likely offer some welcome volatility to AUD/USD markets.

Traders should also be aware of the Federal Reserve meeting on November 7th.

Tuesday, November 5th: US Presidential Election

With AUD/USD recently set to record its biggest drop since September 2022, the US Presidential Election may offer an opportunity to either buck this trend or exacerbate it further.

Traders are advised to practice solid risk management and use the appropriate position sizes.

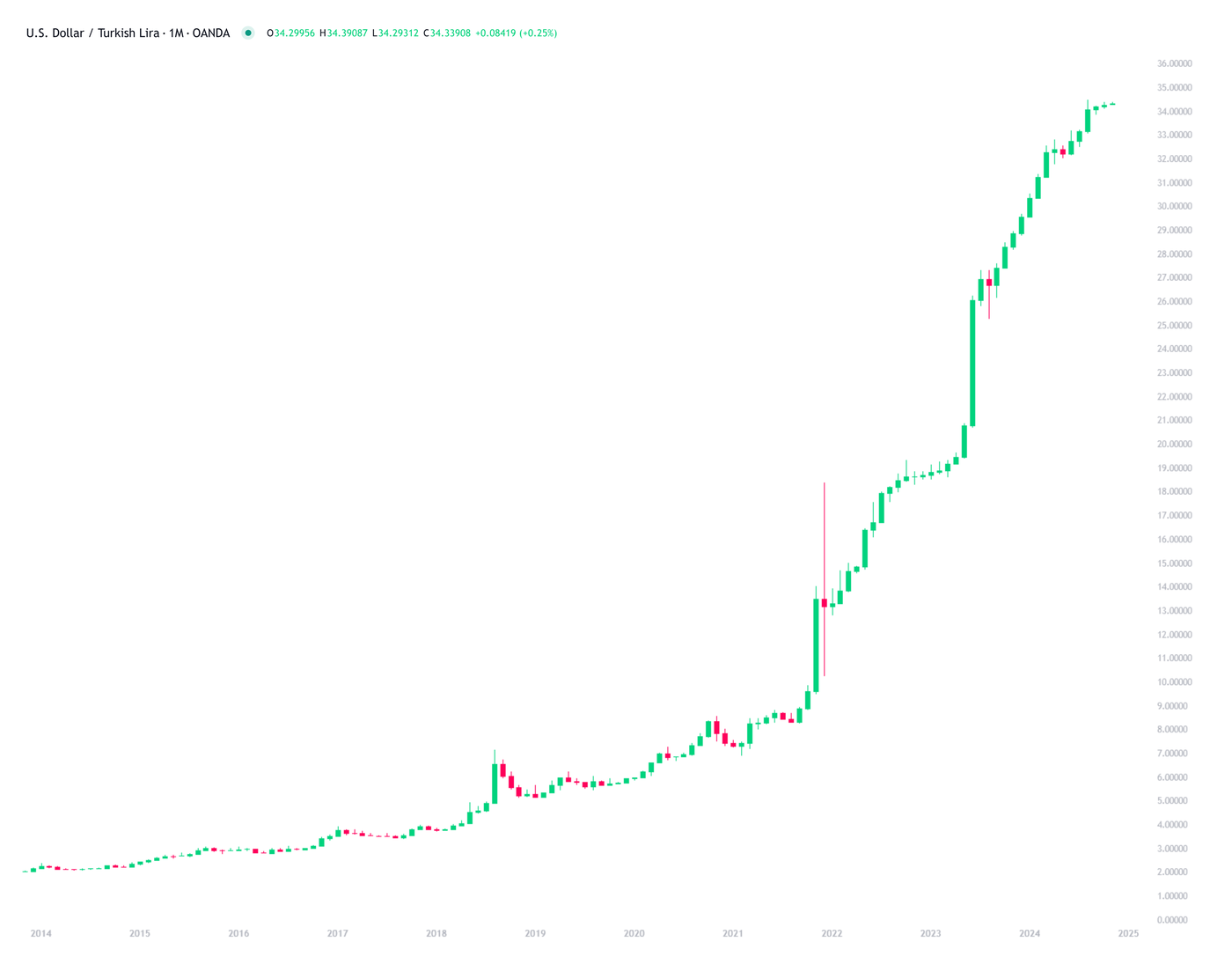

USD/TRY: Unrecognizable

When looking at a chart of USD/TRY in the past few years, you’d be forgiven for thinking it was the price action of a previously unknown cryptocurrency, not the relationship between two fiat currencies.

Embroiled in a litany of political and economic crises, traders will study the collapse of the Turkish lira for years to come.

Losing more than 80% in value in the last five years alone, the current attitude towards risk, coupled with a strengthening dollar, looks to bring about record lows again for the first time in five months.

USD/TRY: Technical analysis for November 2024

- Trading at its weakest point versus the dollar in August, USD/TRY currently trades at around 34.33752, less than 0.50% away from all-time highs.

- USD/TRY price action currently trades in the upper Bollinger band, suggesting that a retracement to the mid-point may be needed before the price can close higher.

USD/TRY: Key dates to watch this month

Tuesday, November 5th: US Presidential Election

As a relatively minor currency compared to EUR, CAD, and AUD, any developments on election night that change the overall market risk appetite will likely weigh heavily on USD/TRY pricing.

Wednesday, November 27th: FOMC Minutes

Typically released three weeks to the day after the latest policy decision, minutes of the Federal Open Market Committee meeting are due to be released on November 27th.

The generally tonality of the meeting, categorized as either dovish or hawkish, is likely to offer some volatility to USD/TRY.

Footnotes

¹https://www.tradingview.com/broker/OANDA/

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. It is not investment advice or a solution to buy or sell instruments.

Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.