In the wake of the US presidential election and the final month of 2024, here are five currency pairs to add to your December watchlist.

Five currency pairs to watch this month

With seven of the eight major currencies all scheduled for interest rate decisions this month, December 2024 looks set to end the year in some style.

Here are five currency pairs to watch this month, as well as some key dates in December to mark in your calendar.

EUR/USD: A White House return

In a race not as close as once thought, Donald Trump’s victory in the 2024 US Election has brought about some welcome volatility to the markets, and nowhere is this perhaps more apparent than when looking at euro-dollar.

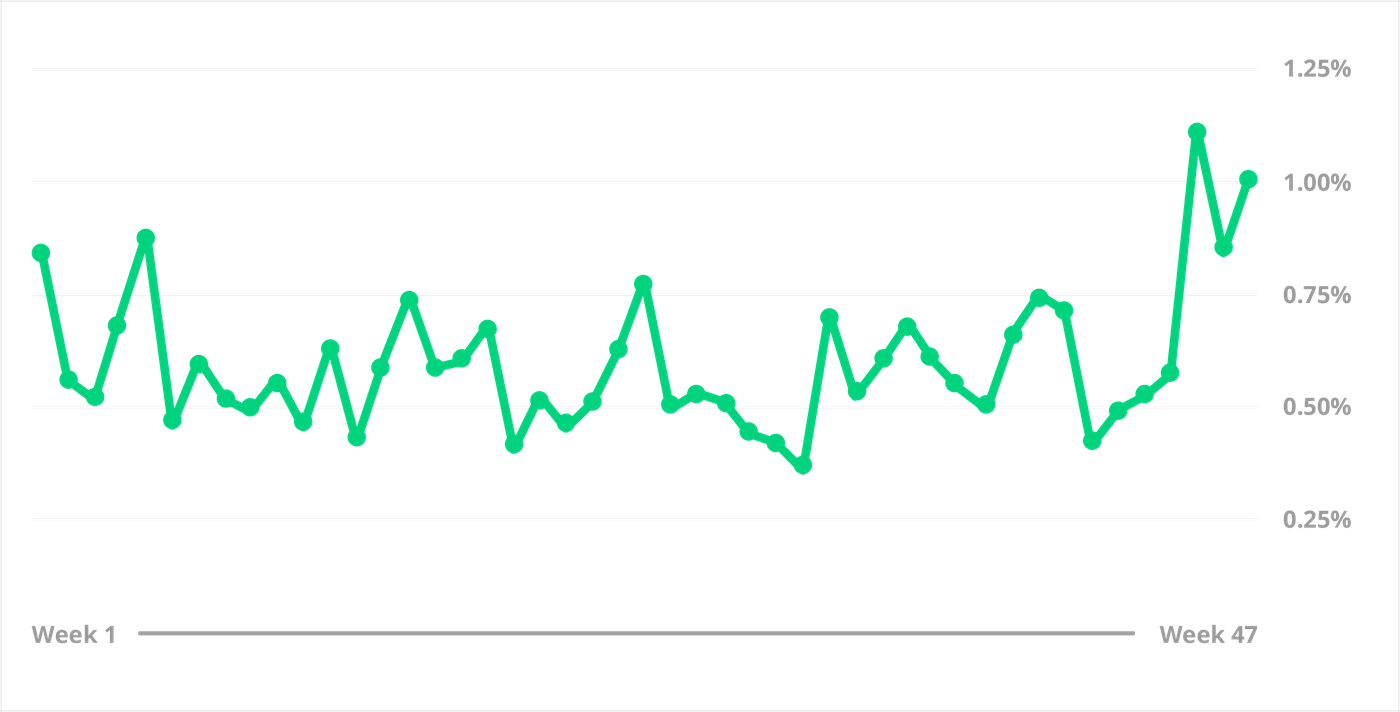

A chart showing market volatility of EUR/USD in 2024. Market volatility determined by % value difference in daily candle high and low. Past performance is not indicative of future results.

In a phenomenon better known now as ‘Trump Trades,’ hopes of future deregulation, tax cuts, and fiscal stimulus come January have not only helped boost US equities to new heights but have also sent a wave of dollar strength through the markets, with the U.S. dollar trading at its highest level versus the euro in over 24 months.

Otherwise, and in a return to regularly scheduled programming, the Federal Reserve and ECB's choices on monetary policy look set to continue being amongst the most significant deciding factors for EUR/USD this December.

At the time of writing, markets generally predict a 25 basis point cut for both banks in December, despite recent data showing that the picture on inflation is becoming somewhat unclear in both European and American economies.

Currently maintaining a headline rate ~1.35% higher than its European counterpart, the dollar can be expected to strengthen against the euro in the short term, assuming all other factors remain unchanged.

EUR/USD: Technical analysis for December 2024

- Euro-dollar currently trades around 1.04842, over 3.6% lower than its value on election day.

- On the monthly timeframe, EUR/USD currently trades at a historical support level of around 1.05744. If price can close convincingly below this level, EUR/USD may risk a further leg down.

EUR/USD: Key dates to watch this month

Thursday, December 12th: ECB Interest Rate decision

With eurozone inflation at a four-month high, traders will keenly await how the European Central Bank votes on interest rates this December.

With headlines suggesting a 25 basis point cut is still the most probable outcome, any deviation from this expectation may cause an adverse market reaction.

Wednesday, December 18th: Fed Interest Rate decision

With Jerome Powell committing to “finishing the job” by returning inflation towards a target of 2%, the Federal Reserve is set to meet in Washington on December 18th to vote on monetary policy.

Following Donald Trump's less-than-complimentary remarks on the Federal Reserve last month, the December decision will be the last made before Trump assumes office again on January 20th.

USD/CAD: Tariffs tremors

With Trump ready to assume office once again in January, it would seem that tensions aren’t exclusive to just the southern border.

As expected, Donald Trump's success in the US election has reignited talk of new tariffs on Canadian imports to the US, ultimately weighing negatively on the Canadian dollar, with USD/CAD trading at highs not seen since 2020.

How commentary develops in December will likely remain a key factor for USD/CAD traders this month, with some market news coverage already making mention of the dreaded 25% tariff - an outcome the Canadian economy will be keen to avoid.

Read more: Post-Election Forex Trading Landscape: Tariffs, Fiscal Policy, & Interest Rates

On a different topic, the Bank of Canada will first decide on monetary policy this month, with a meeting scheduled for the second week of December. The Federal Reserve is expected to meet in the week following.

As things stand, markets expect the BoC to maintain rates while the Federal Reserve is predicted to cut, which may support CAD strength in the near term.

Otherwise, and as always, USD/CAD traders should monitor world oil prices throughout December, which have been shown to positively correlate with USD/CAD previously.

USD/CAD: Technical analysis for December 2024

- Reaching highs of 1.41781 in late November, USD/CAD is currently trading at its highest point in over 55 months.

- On the daily chart, USD/CAD currently trades towards the top of the upper Bollinger band, suggesting that a pullback might be needed before a leg higher.

USD/CAD: Key dates to watch this month

Friday, December 6th: Nonfarm Payrolls

Coupled with the significance of another interest rate decision on December 18th, the United States Department of Labor is expected to release the Nonfarm Payrolls report on December 6th.

Often promoting higher levels of trading volatility, the event will also set expectations for how the Federal Reserve will vote on monetary policy this month.

If the poor streak of nonfarm payroll results continues this month, we can typically expect USD/CAD to fall in the near term.

Wednesday, December 11th: BoC Interest Rate decision

Expected the second week of December, the Bank of Canada is scheduled to meet in Ottawa to vote on its next monetary policy decision.

Although rates are widely expected to remain unchanged this December, any deviation from this will likely stoke USD/CAD market volatility.

USD/JPY: Unfamiliar

Undeniably, 2024 has been a year of change for the Japanese yen.

After ending its synonymous negative interest policy in Spring, the Bank of Japan is looking to hike rates for the third time this year in December–a move not seen since 1989.

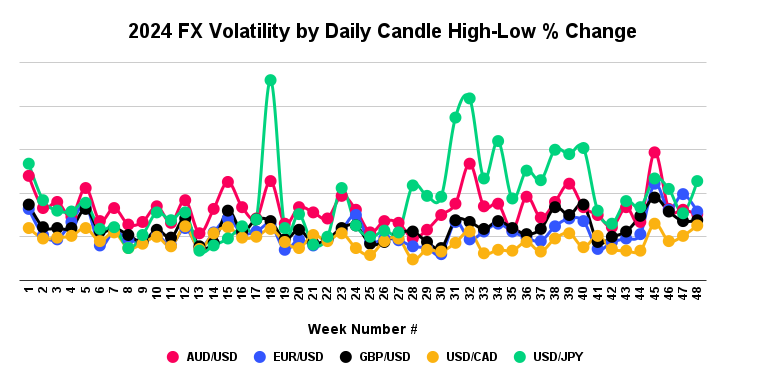

Coupled with numerous interventions by the Bank of Japan in 2024, the outcome of these changes can be summed up in one word: volatility.

The Japanese yen has proven to be one of the most volatile currencies of the year, having fallen to all-time lows versus the dollar back in July.

A chart comparing the volatility of various currency pairs in 2024. Volatility calculated as a percentage change of daily candle high-low, averaged by week. TradingView, 01/01/2024 - 12/29/2024. Past performance is not indicative of future results.

With Governor Kazuo Ueda hinting at future rate hikes in recent commentary, the Bank of Japan is to meet late this month to vote on monetary policy, the burning question being whether they will raise rates for a third time this year or choose to stave off until January.

Much like the rest of the year, USD/JPY remains a currency pair to watch in December.

USD/JPY: Technical analysis for December 2024

- In the last four years alone, the Japanese yen has devalued almost 50% against the US dollar. Following a bearish close to November, USD/JPY will need to break weekly consolidation around 143.000 to go lower.

- When using the Average Directional Index (ADX) on the Daily timeframe, the current reading is 30.03, suggesting moderate trend strength.

USD/JPY: Key dates to watch this month

Sunday, December 8th: Japan Gross Domestic Product

Falling on a Sunday in the United States, the Bank of Japan will release GDP numbers on December 8th.

GDP is a key indicator of economic growth and prosperity, so any result above consensus will likely boost the yen’s value, especially following rate hikes earlier this year.

Wednesday, December 18th: BoJ Interest Rate decision

Following a decision by the Federal Reserve released earlier in the day, the Bank of Japan is due to meet in Tokyo on December 18th to vote on monetary policy.

Following an all-too-common recent commitment of ‘following the data,’ how the Bank of Japan votes will not only bookend a year of significant change but also set the tone going into the new year.

If, however, the Bank of Japan chooses to raise rates in their December decision, we can expect some moderate buying pressure in the USD/JPY markets.

GBP/USD: Dead heat

Currently trading only 0.04% higher since the start of the year, GBP/USD looks to finish this year virtually unchanged in value, trading at around 1.27356.

A chart showing the recent price action of GBP/USD, black line marking 01/01/2024 opening price. TradingView, 05/12/2024. Past performance is not indicative of future results.

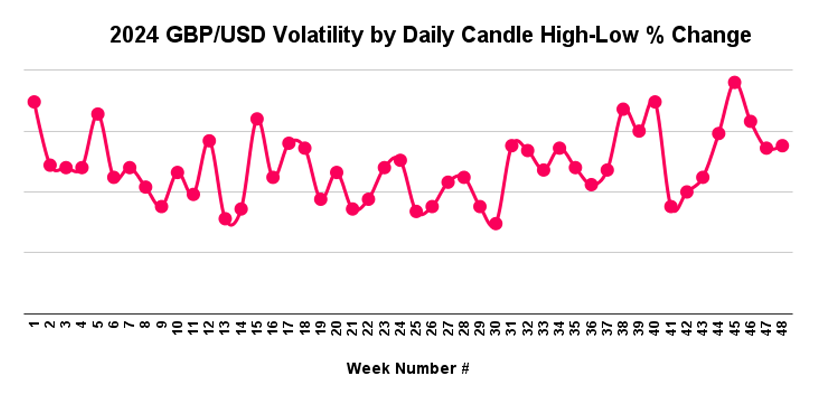

That isn’t to say, however, that trading GBP/USD has been uneventful this year.

With political changes both in the United Kingdom and the United States and the current interest environment, GBP/USD has experienced periods of increased volatility in 2024, especially following Donald Trump’s victory in the US Presidential Election.

With the appetite for risk rising ahead of Trump’s second presidency, currency pairs like GBP/USD often see much of the action, with 2024 proving no exception.

A chart measuring the volatility of GBP/USD in 2024. Volatility calculated as a percentage change of daily candle high-low, averaged by week. TradingView, 01/01/2024 - 12/29/2024. Past performance is not indicative of future results.

As for this month, the keystone event is undoubtedly the Bank of England rate decision on December 19th, which will be the last interest rate decision of any major currency before the turn of the year.

Having already committed to four rate cuts in 2025, the consensus is that a Bank of England rate cut this December seems unlikely. However, any commentary suggesting a future strategy for these aforementioned rate cuts will likely pique market interest and boost market volatility.

GBP/USD: Technical analysis for December 2024

- After reaching highs in late September, GBP/USD has fallen almost 5%. Currently, trading close to break-even for 2024, GBP/USD will need to find support around the 1.27400 mark before closing higher.

- The Relative Strength Index reads 49.70 on the daily timeframe, suggesting a lack of trend direction. As the RSI is a lagging indicator, traders would be well advised to see how the next few candles affect its value.

GBP/USD: Key dates to watch this month

Wednesday, December 11th: US Consumer Price Index

As a leading measure of inflation, the significance of the US CPI report is well-known by traders.

With the US's progress on taming inflation somewhat shaky in recent months, traders will be keen to see if this trend continues, especially considering the interest rate decision in the following week.

Thursday, December 19th: BoE Interest Rate dDecision

On December 19th, the Bank of England will meet in London to vote on monetary policy.

Although widely expected to maintain rates this month, traders should pay attention to the monetary policy report, which may offer insight into the timescale for future rate decisions.

Generally speaking, GBP/USD can be expected to rally if the interest rate differential between the pound and the dollar decreases.

USD/MXN: Downgraded

Similarly to the Canadian dollar, the Mexican peso is back in traders’ minds following Trump’s victory in the US election.

Unlike its Canadian counterpart, however, it would seem that the market has already started to vote with its feet, seeing USD/MXN trade at two-year highs on November 6th - the day Trump was declared victor.

As such, and in the days that followed the US election result, many fund managers either trimmed or entirely downgraded growth projections for the Mexican peso while the dollar surged in value.

In a break from the usual interest rate rhetoric, traders would be well advised to keep up-to-date on political developments between the US and Mexico, especially regarding trade tariffs and immigration policy.

USD/MXN: Technical analysis for December 2024

- Having traded at highs of 20.82786 last week, USD/MXN has fallen almost 3% in value. To maintain the higher lows expected in an uptrend, USD/MXN must stay above 20.0900.

- Using Stochastics on the daily timeframe, USD/MXN price action is approaching oversold conditions, suggesting a correction may be short-lived.

USD/MXN: Key dates to watch this month

Wednesday, December 25th: Christmas Day

In October, Mexico and America will observe Christmas Day festivities.

Lower trade volumes can be expected, especially in the case of the United States.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. It is not investment advice or a solution to buy or sell instruments.

Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.