This comprehensive guide explores the relationship between commodity prices and currency values, focusing on commodity currencies. Delve into the factors influencing these currencies, from economic growth to geopolitical tensions. Measuring correlations between commodity prices and exchange rates and discovering practical trading strategies using tools like TradingView. Navigate the complexities of the forex market with a deeper understanding of commodity currencies and their unique dynamics.

Commodity currencies and strategic commodities

Commodity currencies are the currencies of countries that possess large quantities of natural resources and commodities. Their value is heavily influenced by the prices of these commodities in the global market.

Strategic commodities are essential for a country's economic and national security. The specific commodities considered "strategic" can vary, depending on a country's circumstances, but some of the most commonly cited examples include:

- Crude Oil: Oil is a critical energy source for transportation, industry, and many other sectors. Its price and availability can significantly impact a country's economy and security.

- Natural Gas: Natural gas is another essential energy source for heating, electricity generation, and industrial processes.

- Raw Metals: Iron ore, copper, aluminum, and rare earth elements are essential for manufacturing and infrastructure development.

- Food: Food security is a crucial concern for all countries. Strategic food commodities can include grains such as wheat, soy, rice, corn, and other essential food items.

These commodities are considered strategic because scarcity or disruption in supply can have severe consequences for a country's economy and well-being. Therefore, governments often take measures to ensure access to these commodities, such as stockpiling, investing in domestic production, or establishing strategic partnerships with other countries.

The impact of economic growth and commodity prices on commodity currencies

Economic growth significantly impacts commodity prices. During periods of strong economic growth, demand for commodities typically increases, driving up their prices. This is because commodities are essential inputs for various industries, and increased economic activity leads to greater consumption of these raw materials.

Conversely, commodity demand weakens during economic downturns, putting downward pressure on prices. Additionally, factors like supply disruptions, geopolitical tensions, and changes in monetary policy can influence commodity prices independently of economic growth.

Commodity price changes can significantly impact commodity currencies. Rising commodity prices generally lead to an appreciation of the commodity currency. This is because higher commodity prices increase the export revenues of the commodity-producing country, attracting foreign investment and boosting demand for its currency. Falling commodity prices can lead to a depreciation of the commodity currency. Lower commodity prices reduce export revenues, potentially leading to capital outflows and decreased currency demand.

Therefore, the value of commodity currencies is closely linked to the fluctuations in the global commodity markets.

Commodity currencies examples:

- The Canadian dollar (CAD) is a classic example of a commodity currency. Canada is a major exporter of commodities such as oil, lumber, and minerals. When the prices of these commodities increase in the global market, the Canadian dollar typically strengthens against other currencies. Conversely, if commodity prices decline, the Canadian dollar may weaken.

- The New Zealand dollar (NZD) is a commodity currency because much of New Zealand's economy relies on exporting commodities such as dairy products, meat, and wood. Therefore, the value of the New Zealand dollar is often influenced by the prices of these commodities in the global market.

- The Australian dollar (AUD) is considered a commodity currency. Australia is a major exporter of commodities such as iron ore, coal, gold, and natural gas, so the price of these commodities in the global market significantly influences the Australian dollar's value.

Understanding this relationship between commodity prices and currencies is crucial for foreign exchange investors and traders. It allows them to anticipate potential currency value movements based on commodity market trends.

Measuring correlation between commodity prices and currency exchange rates

The degree of correlation between commodity price and currency exchange rate can be measured using statistical methods, primarily by calculating the correlation coefficient.

Correlation coefficient:

- This statistical measure quantifies the strength and direction of the relationship between two variables.

- The correlation coefficient ranges from -1 to +1.

- A positive correlation coefficient indicates a positive relationship (when commodity prices increase, the currency exchange rate also tends to increase).

- A negative correlation coefficient indicates a negative relationship (when commodity prices increase, the currency exchange rate tends to decrease).

- A correlation coefficient of 0 indicates no relationship between the two variables.

- The closer the coefficient is to +1 or -1, the stronger the correlation

Interpreting the correlation coefficient

- A high positive correlation (e.g., above 0.7) suggests a strong positive relationship.

- A high negative correlation (e.g., above -0.7) suggests a strong negative relationship.

- A low correlation (e.g., close to 0) suggests a weak or no relationship.

Additional considerations when analyzing commodities correlation:

- Correlation change: It is important to remember that correlation doesn't stay the same; it changes over time depending on many other factors that can influence exchange rates (e.g., interest rates, economic growth, political stability).

- Correlation vs causation: Correlation is a necessary but not sufficient condition for causation. Just because two variables are correlated does not mean one causes the other. Correlation indicates a statistical relationship between two variables. They tend to move together (positive correlation) or in opposite directions (negative correlation). However, correlation does not imply that one variable causes the other to change. Causation suggests a cause-and-effect relationship. One variable directly influences the change in another variable.

- Time lag: Consider that there might be a time lag between changes in commodity prices and their impact on the currency exchange rate.

- Other factors – statistical significance: Assess the correlation coefficient's statistical significance to ensure the relationship is not due to chance.

Using correlation on TradingView

TradingView charting software offers various tools that traders can utilize to help them identify how different currency pairs correlate to commodities. The tools can also be customized to identify correlations between different currency pairs and different tradable instruments across various markets.

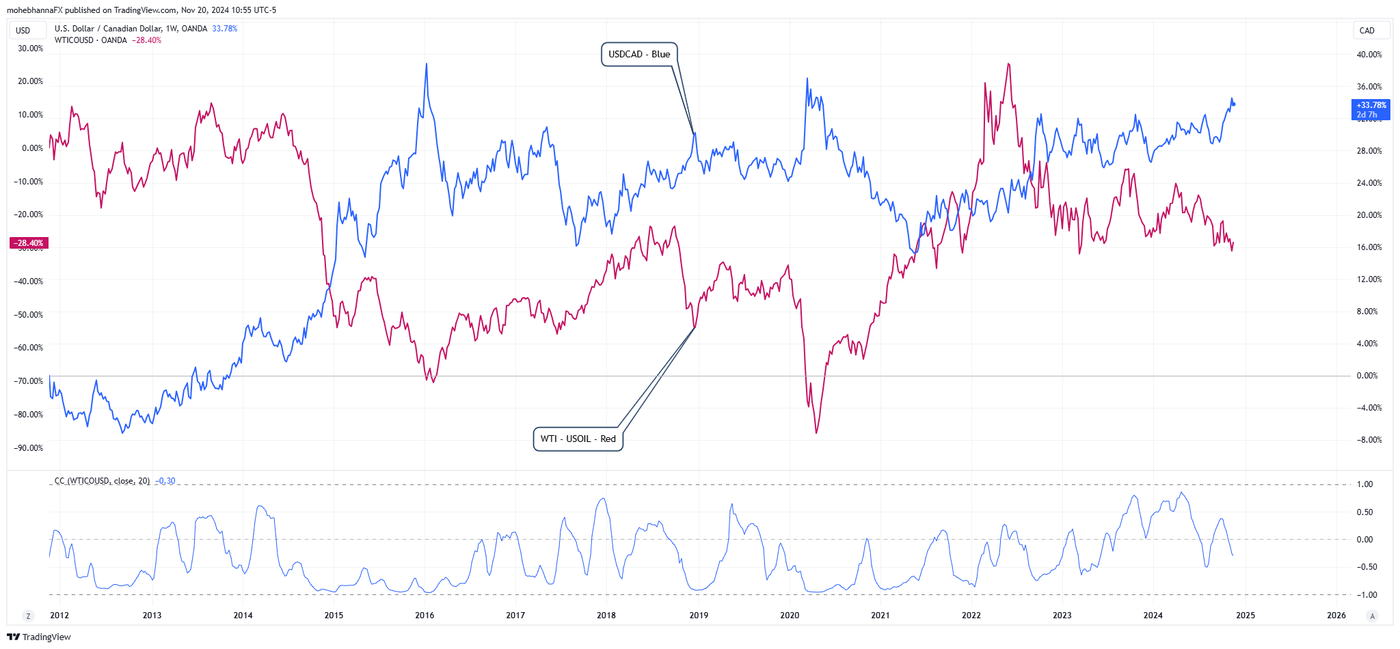

Example 1

The above chart shows the correlation between the Canadian dollar and oil. It reflects the weekly correlation for USD/CAD and how it changes over time. Although the correlation between oil and the Canadian dollar is positive, because the Canadian dollar is the “Quote currency” in this pair, the Canadian dollar is inverted in this case on the chart.

The correlation coefficient indicator is applied on the lower pane of the chart, showing how the correlation between the Canadian dollar and oil changes over time.

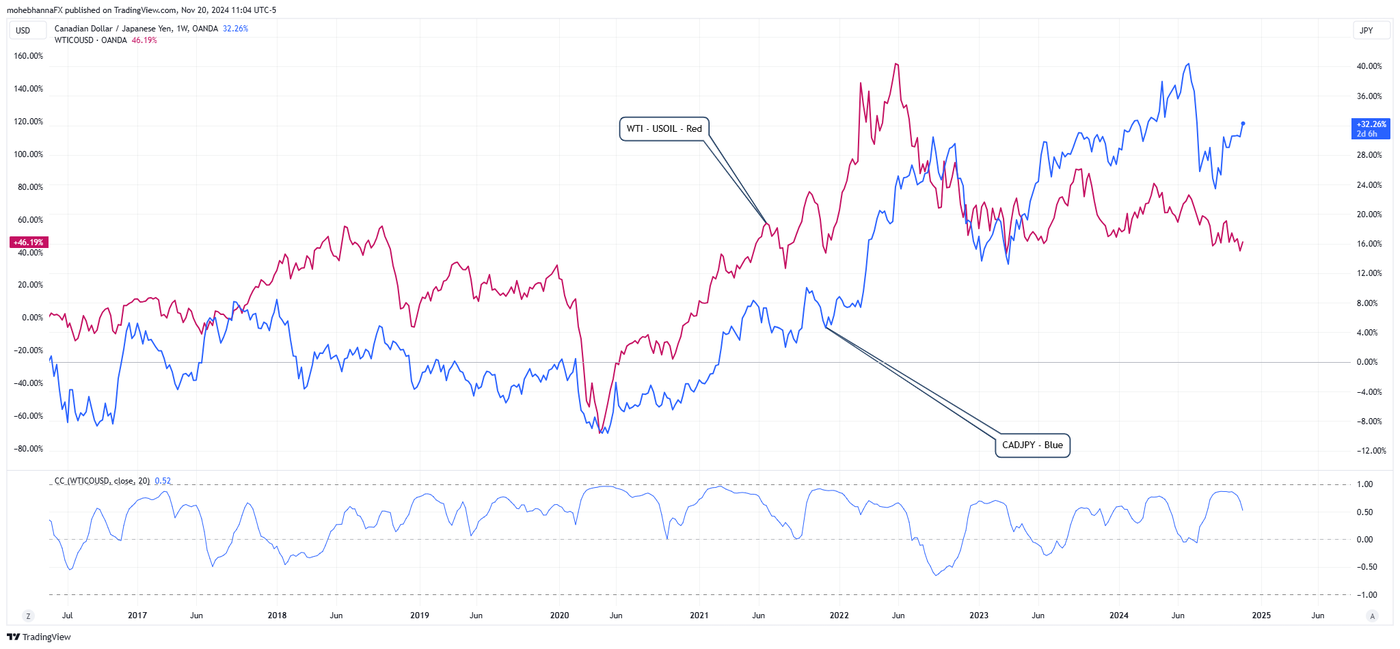

Example 2

The above chart is another example of correlation between the Canadian dollar and oil price, the currency pair CAD/JPY, and in this case, the Canadian dollar is the “Base Currency” in the pair, which makes it easier to visualize the correlation. The correlation coefficient indicator is applied to the chart.

Important considerations for using correlation tools on TradingView

- Overlay: When overlaying two instruments on a chart, there are multiple options to consider. Traders can use the same pane or a separate one – it depends on the traders’ preference.

- Scales: In some cases, it may make more sense to use “Percentage” scales rather than the “Regular” scales settings on TradingView, as it may provide better visualization.

- Overlay inputs: TradingView allows traders to overlay any instrument onto any other instrument, allowing traders to compare correlations across different markets. Traders need to ensure that the default instrument is updated to the one of their choice.

- Timeframe: By analyzing correlations across different timeframes, traders and investors can gain a deeper understanding of the relationship between variables and make more informed decisions. The choice of timeframe depends on the trader's or investor's investment horizon and trading strategy.

- A correlation that is strong in one timeframe may not be as strong or even present in another timeframe.

Trading commodities through forex takeaways

In conclusion, commodity currencies play a unique role in the global financial landscape. Their value is intrinsically linked to the prices of commodities, making them sensitive to fluctuations in the global commodity markets. Understanding the dynamics of commodity currencies, including their correlation with commodity prices and the influence of economic growth, is essential for investors and traders navigating the foreign exchange market. While correlation analysis provides valuable insights, it's crucial to distinguish between correlation and causation and consider other factors that can influence currency values. By carefully analyzing these factors and utilizing tools like TradingView's correlation indicators, market participants can make more informed decisions and manage their exposure to commodity currency risks effectively.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.