This in-depth analysis explores the potential repercussions of President-elect Trump's proposed tariffs on the Canadian and Mexican economies, focusing on the fluctuations of the USD/CAD and USD/MXN currency pairs. Delve into the historical impact of tariffs, the intricacies of North American trade relations, and the potential ramifications for forex traders navigating this evolving landscape.

What are tariffs, and how do they work?

Tariffs are simply charges or fees added to the cost of imported goods. They can be called a tax or a levy on imports. Tariffs are an extra cost added to the overall value of the imported goods, which the importers then pass on to the final consumers.

Tariffs are known to cause inflation since they lead to higher prices. However, higher tariffs can only impact a country's currency to a certain extent, as exchange rates are governed by other significant factors such as supply and demand, interest rates, and political and economic stability.

Countries may impose tariffs to protect specific industries or adjust trade imbalances among their trading partners. Depending on the trade agreements and many other factors, tariffs can be applied to all countries or specific ones.

Trump's tariff plans

During the presidential campaign, President-elect Donald Trump mentioned tariffs many times. He vowed to resume his tariff plans, which began in his first term, citing that their impact on inflation was minimal and that Biden’s administration has kept them in effect. President Trump has also said that tariffs can be used as a negotiating tool with countries and has referenced multiple times that border control is the primary concern with the US neighbors and main trading partners, Canada and Mexico.

In 2018, during Trump’s first term, the US signed the USMCA, a free trade agreement between the US, Canada, and Mexico. According to the Office of the United States Trade Representative, the agreement is meant to be “mutually beneficial for North American workers, farmers, ranchers, and businesses.”

Although President-elect Donald Trump promised tariffs on imported goods, mentioning different percentages, the latest was a post on his social media platform, Truth Social, where the president said he would implement an additional 25% tariff on Canada and Mexico and an additional 10% tariff on China.

When asked about the impact of tariffs on inflation during an exclusive interview with NBC News on December 8th, 2024, President-elect Donald Trump used the term “If properly used” regarding the implementation of tariffs. Mr. Trump said that “tariffs solved many problems and can serve different purposes if properly used.”

Although the president has the power to implement tariffs and can do so unilaterally on day one, the administration is likely to take a cautious, informed approach, weighing the options and exhausting negotiations before implementing any tariffs or agreements.

Potential impact of tariffs on Canada

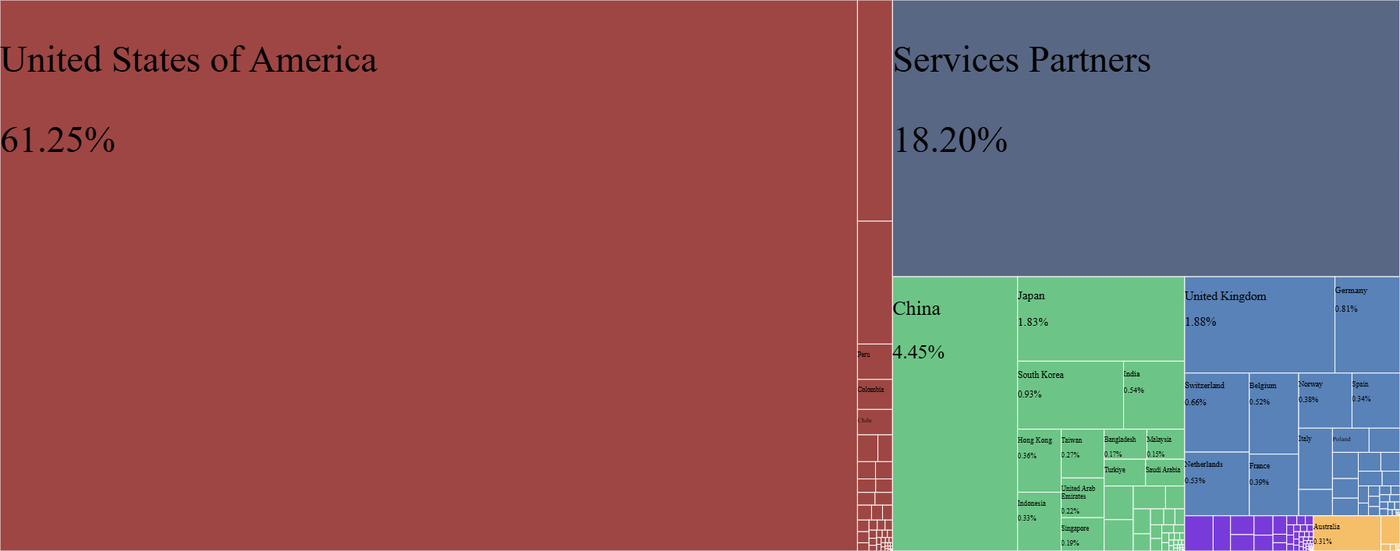

Growth Lab, the Atlas of Economic Complexity, shows that in 2022, 61.25% of Canada’s exports were to the United States of America, $447B out of a total value of $792B. Canada’s main exports to the USA include oil, aluminum, fruits, and vegetables. Applying a 25% tariff on these products can significantly impact Canada’s GDP.

According to Bloomberg, “Trevor Tombe, a University of Calgary economics professor, estimates a 25% tariff would shave off about 2.6% from real GDP annually and drive Canada into a recession next year.” Other economists have also voiced concerns about shrinking GDP at different percentages. Trade between the US and Canada is complex, and any change in trade policy can cause disruptions in supply chains, impacting many businesses and workers in both countries.

Last week, Canada’s Prime Minister Justin Trudeau was the first head of state to visit President-elect Donald Trump at his Mar-aLago residence in Florida after winning the elections and before inauguration day. The prime minister and the president-elect were willing to cooperate and spoke positively following their meeting. However, as Donald Trump renewed his tariff threats, Trudeau responded, “We will, of course, as we did eight years ago, respond to unfair tariffs in a number of ways, and we are still looking at the right ways to respond.” Trudeau said this on Monday, December 9th, 2024, at an event organized by the Chamber of Commerce in Halifax, Nova Scotia.

Canada’s trade deficit with the US recently narrowed again in October, highlighting the importance of the US markets to Canadian exports; however, if Canada finds itself in a position where it has to retaliate, a levy on oil exports would be one to consider as a final resort, which can disrupt oil markets, leading to higher oil prices.

Impact of USMCA and other events on USD/CAD exchange rate

Weekly chart showing price action before, during, and after the agreement signature date and the date it went into effect. Source: Tradingview.com, 12/10/2024. Past performance is not indicative of future results.

The USMCA agreement was signed on November 30th, 2018, and went into force on July 1st, 2020. The above weekly chart shows price action before, during, and after the agreement signature date and the date it went into effect. The price movements showed some volatility. The US dollar rose initially by approximately 3.5% in both cases; however, it returned to its previous price range within approximately two weeks.

The above weekly chart also highlights how the exchange rate for USD CAD was impacted by other global events that preceded and followed the agreements. The impact of COVID, the war in Ukraine, and its impact on oil prices due to its correlation to the Canadian dollar. And, of course, the Federal Open Market Committee (FOMC) and Bank of Canada (BOC) interest rate decisions.

Following the US election results, the US dollar rose against the Canadian dollar, breaking above the critical range of 1.3800 - 1.4000, a range it had failed to break since mid-2022. Trump's 25% tariffs threat post on his Truth Social app further accelerated the break, and USD/CAD has been trading above the 1.4000 level for the past eight weeks.

Potential impact of tariffs on Mexico

As of September 2024, Mexico is the United States' largest trading partner. Mexico exports various goods to the United States, the vast majority of which are manufactured goods, including cars, machinery, electronics, and medical supplies. Mexico is also a significant exporter of agricultural products to the United States. The proximity of Mexico and the US has led to the development of integrated supply chains in many industries, particularly the automotive sector.

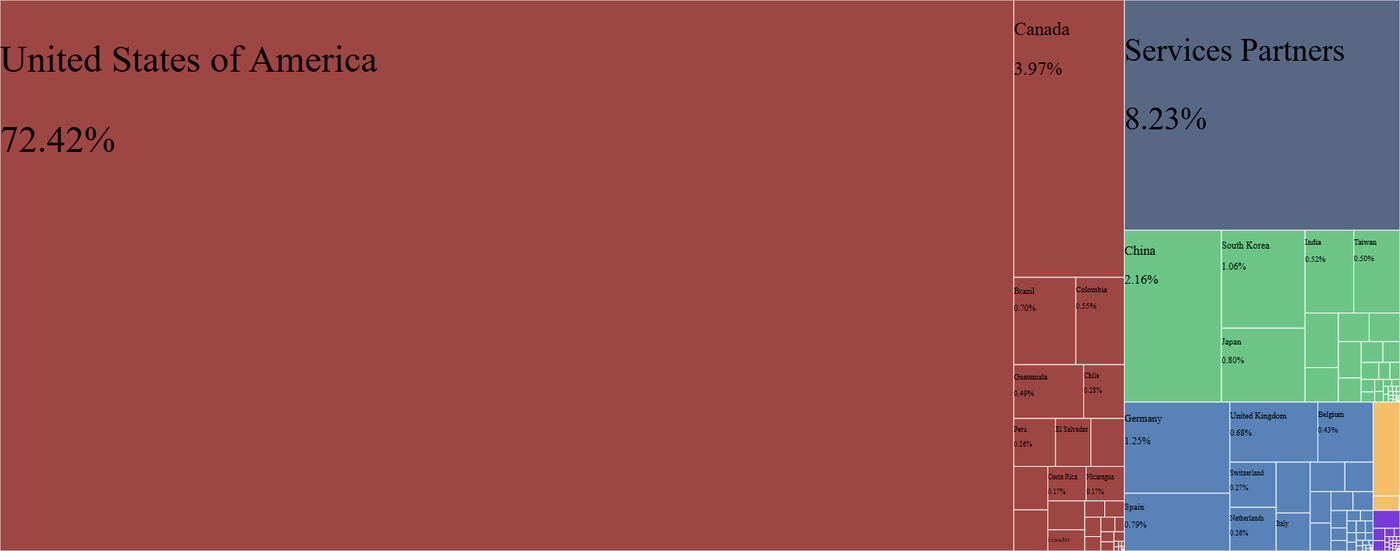

Growth Lab's Atlas of Economic Complexity shows that in 2022, 72.42% of Mexico’s exports were to the United States of America, $459B out of a total value of $634B.

According to Bloomberg, Mexican President Claudia Sheinbaum said, "The US-Mexico-Canada trade agreement—USMCA—is the only way for North America to compete commercially and economically with China.” Sheinbaum also stressed the importance of cooperation between Mexico and the US on drugs and arms trafficking.

Impact of USMCA and other events on USD/MXN exchange rate

The above weekly chart shows price action during and after the USMCA agreement's signature date in 2018 and the date it went into effect in 2020. The price movements showed some volatility. The US dollar rose initially by approximately 8.5% in both cases; however, it did return to its previous price range within approximately four weeks.

The chart also highlights how the exchange rate for USD/MXN was impacted by other global events that preceded and followed the agreements. COVID-19, the Federal Open Market Committee (FOMC), and Banco De Mexico (BdeM) interest rate decisions have significantly impacted the exchange rate.

Following the US election results, the US dollar rose against the Mexican peso, attempting to break above the critical level of 20.00 - 21.00, a range it has failed to break since early 2021. The break was accelerated by Trump's 25% tariff threat post on his Truth Social app; however, price action remained near the 20.30 range.

Summary

In conclusion, the potential impact of Trump's proposed tariffs on Canada and Mexico remains a significant area of uncertainty with far-reaching implications for the North American economies and global trade. While the exact consequences are difficult to predict, the historical data and expert opinions suggest that the tariffs could lead to a decline in GDP, disruptions in supply chains, and heightened political tensions. The reactions of the Canadian and Mexican governments and the USMCA agreement's intricacies will play crucial roles in shaping the final outcome. Forex traders should closely monitor developments in this situation, as the USD/CAD and USD/MXN exchange rates will likely experience volatility in response to news and policy changes. Ultimately, the effectiveness of tariffs as a negotiating tool will depend on the delicate balance between economic interests and political considerations.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.