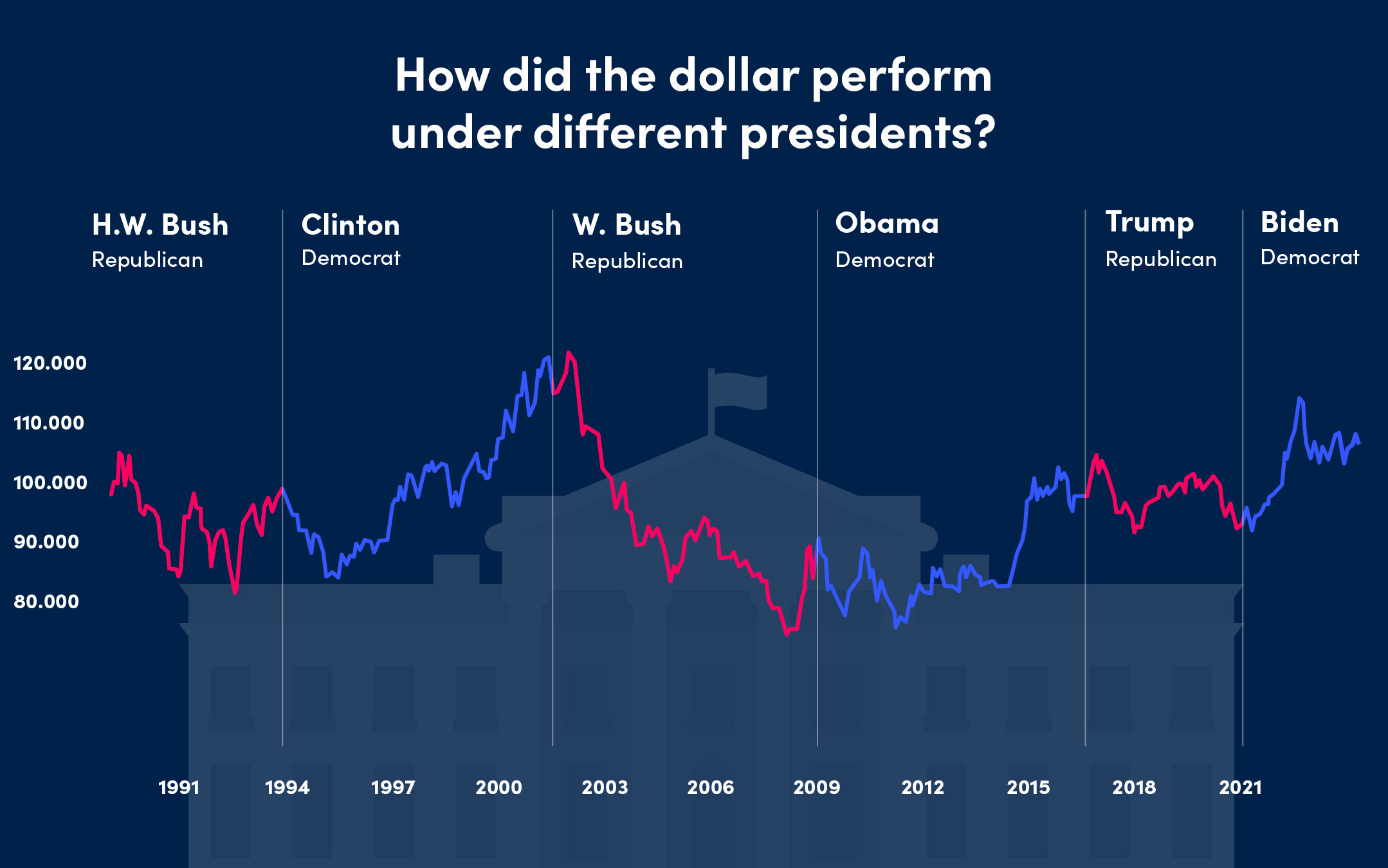

- Of the past six administrations, the dollar performed best under President Clinton, gaining 19.61% in value.*

- The dollar performed worst under President W. Bush, losing 22.00% in value.*

- In aggregate across all Republican terms, the dollar lost -36.17% in value while gaining 54.37% while under Democrat leadership*

- *DXY, tradingview.com. Past performance is not indicative of future results.

*tradingview.com 01/20/1989 - 05/28/2024. Past performance is not indicative of future results.

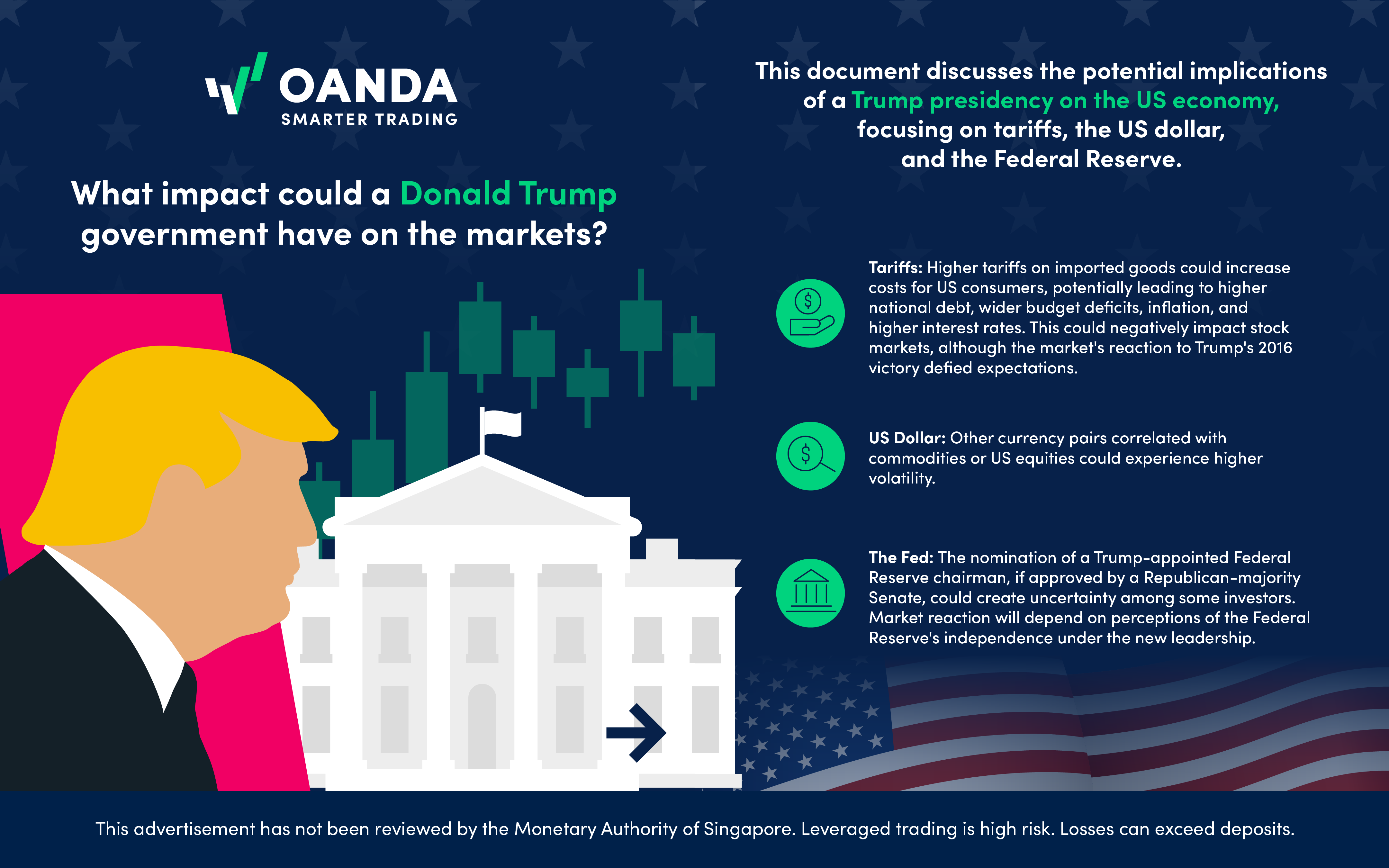

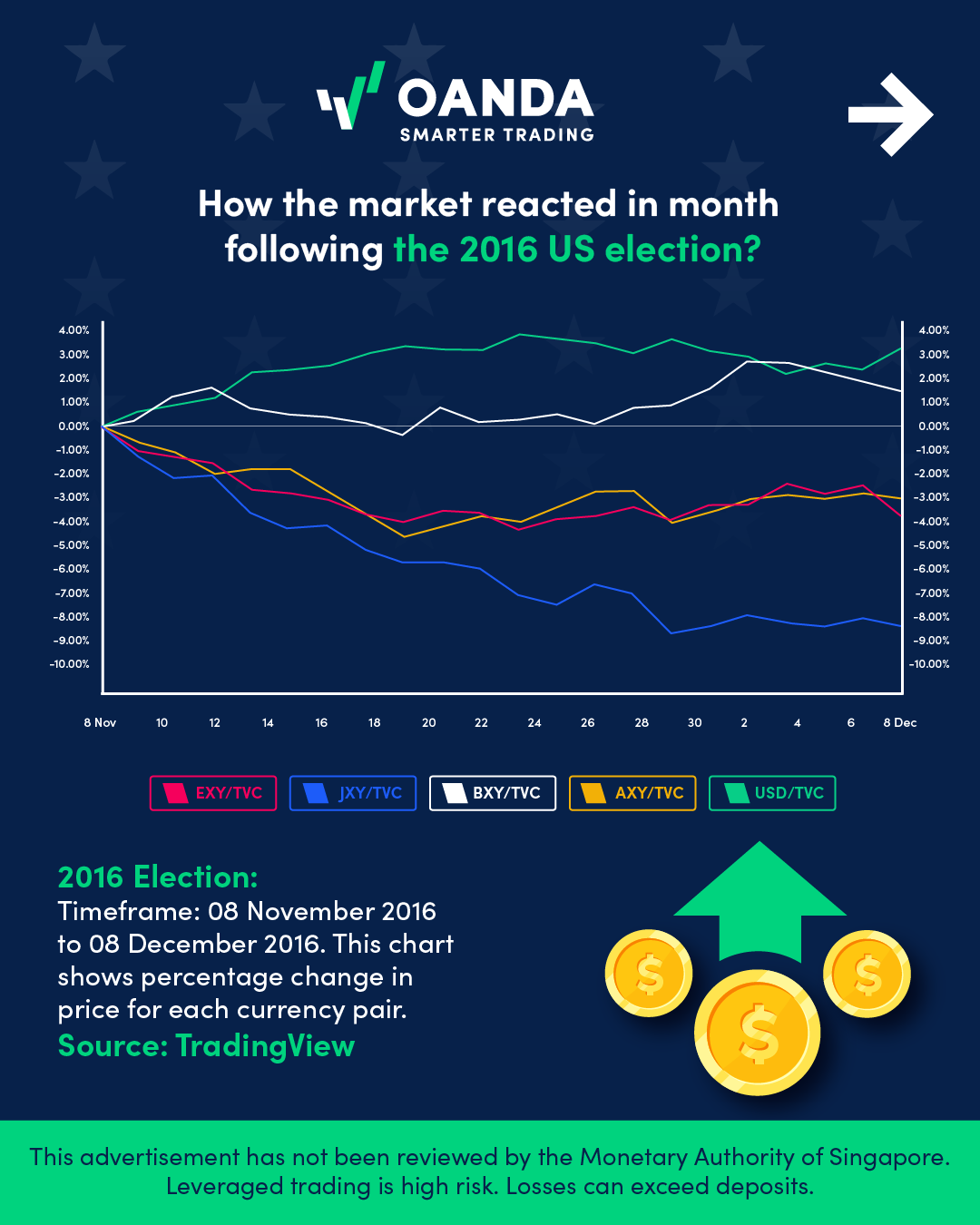

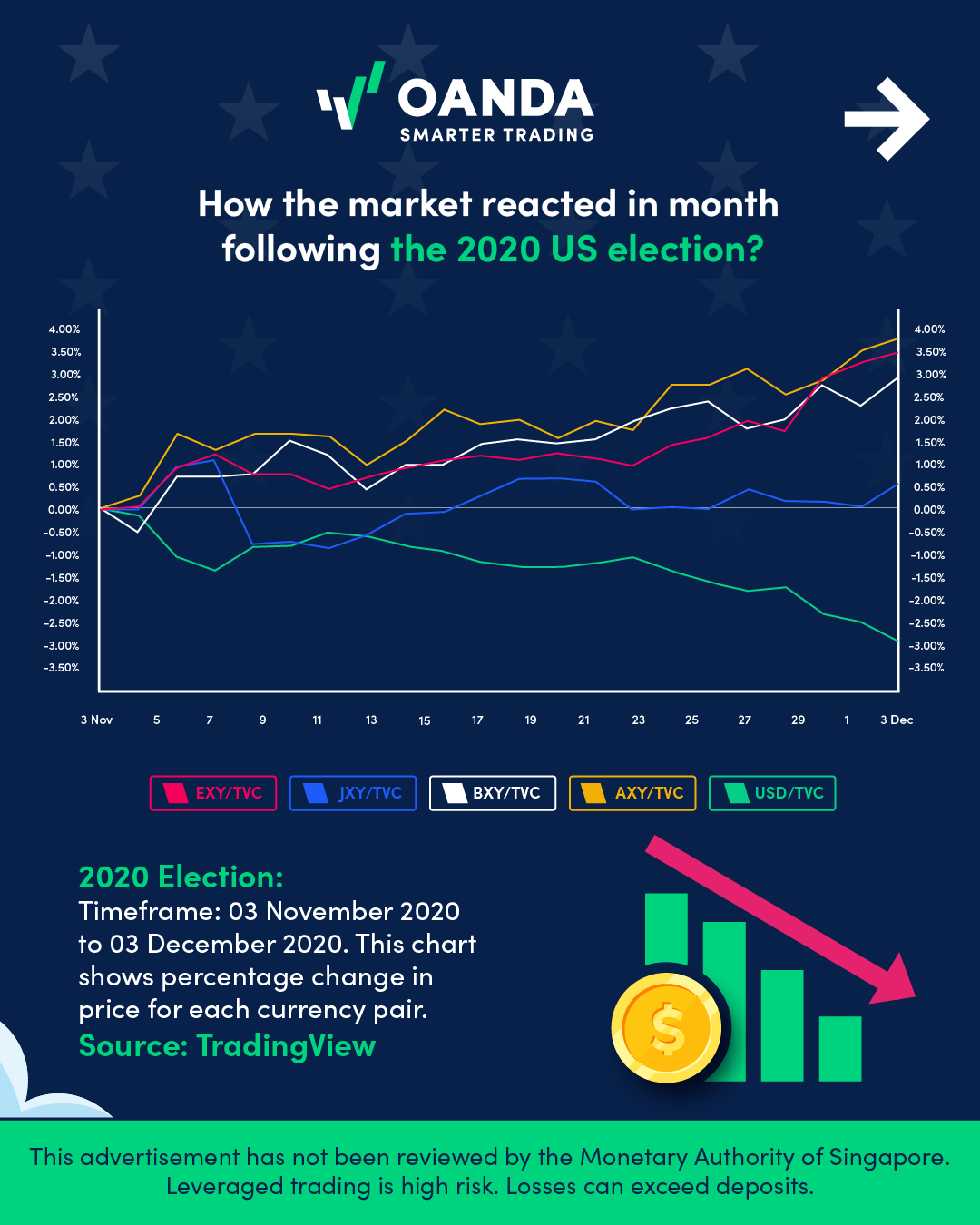

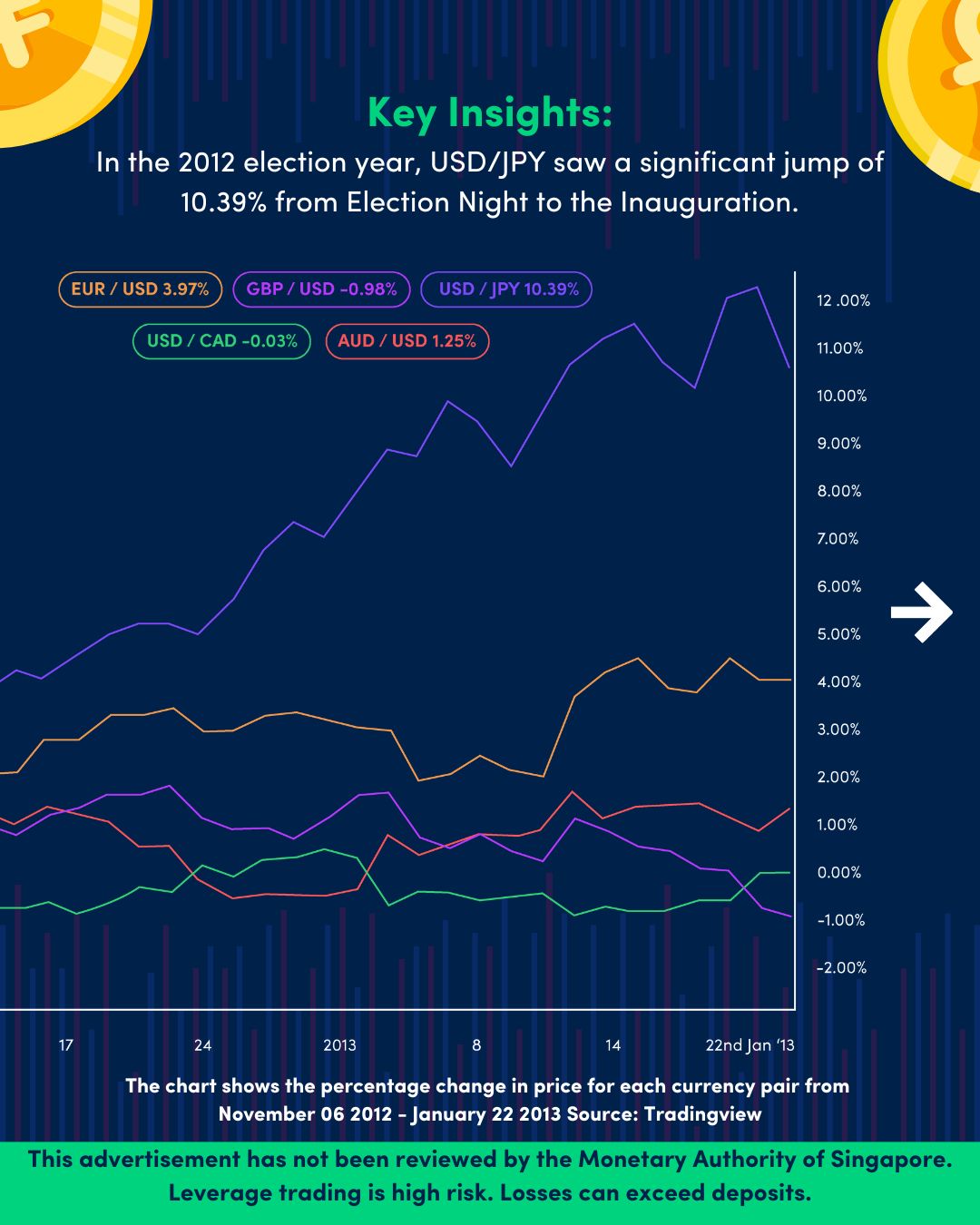

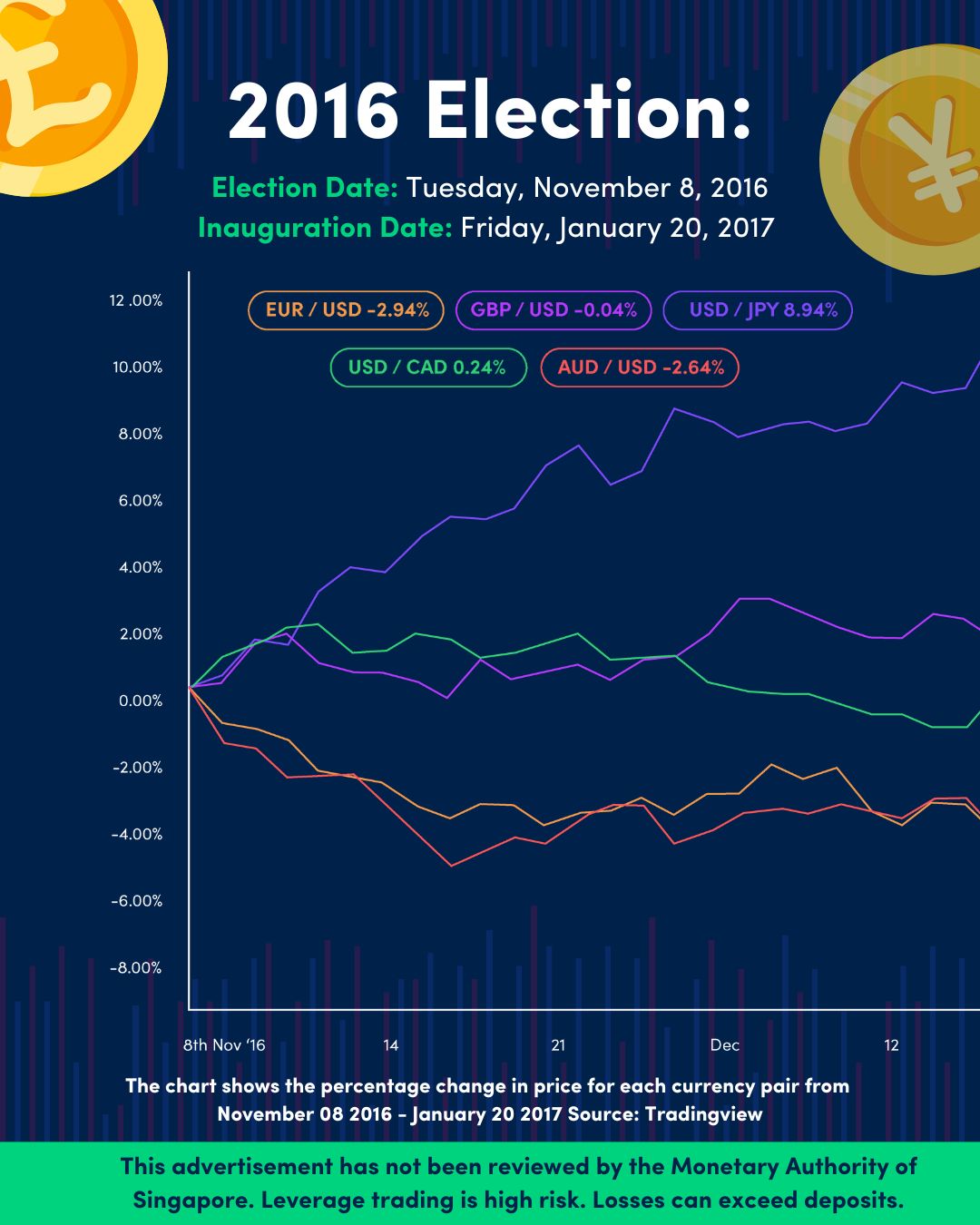

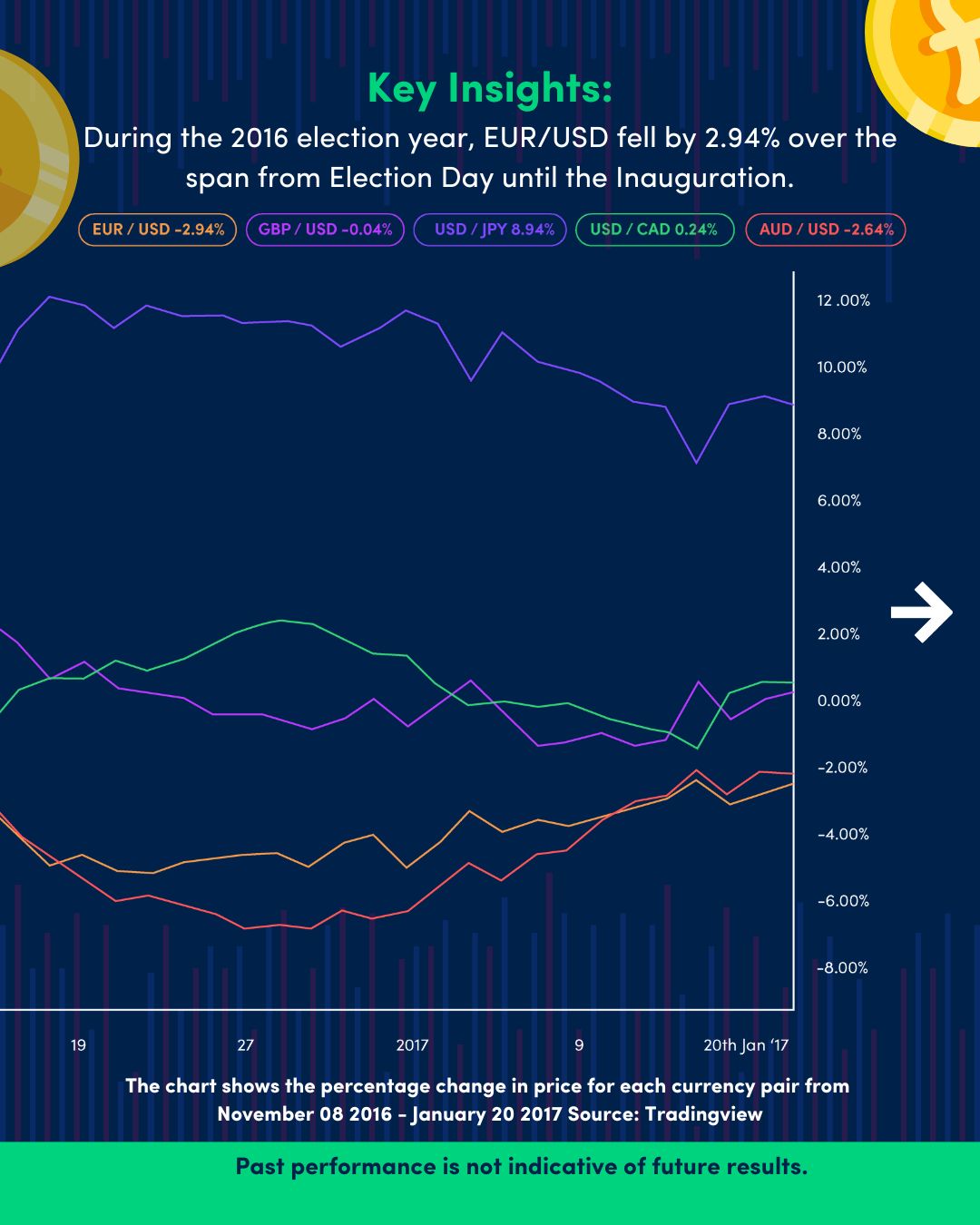

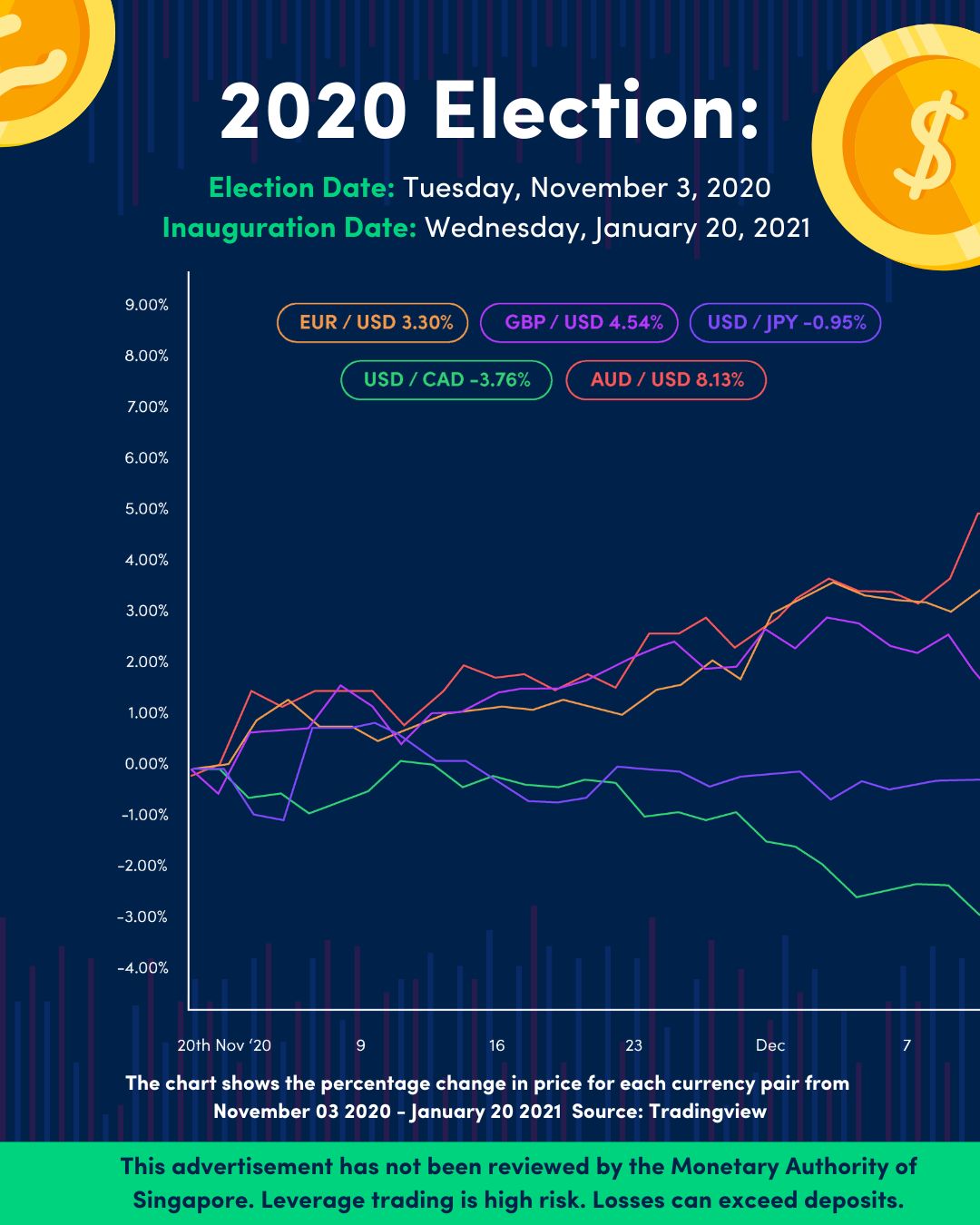

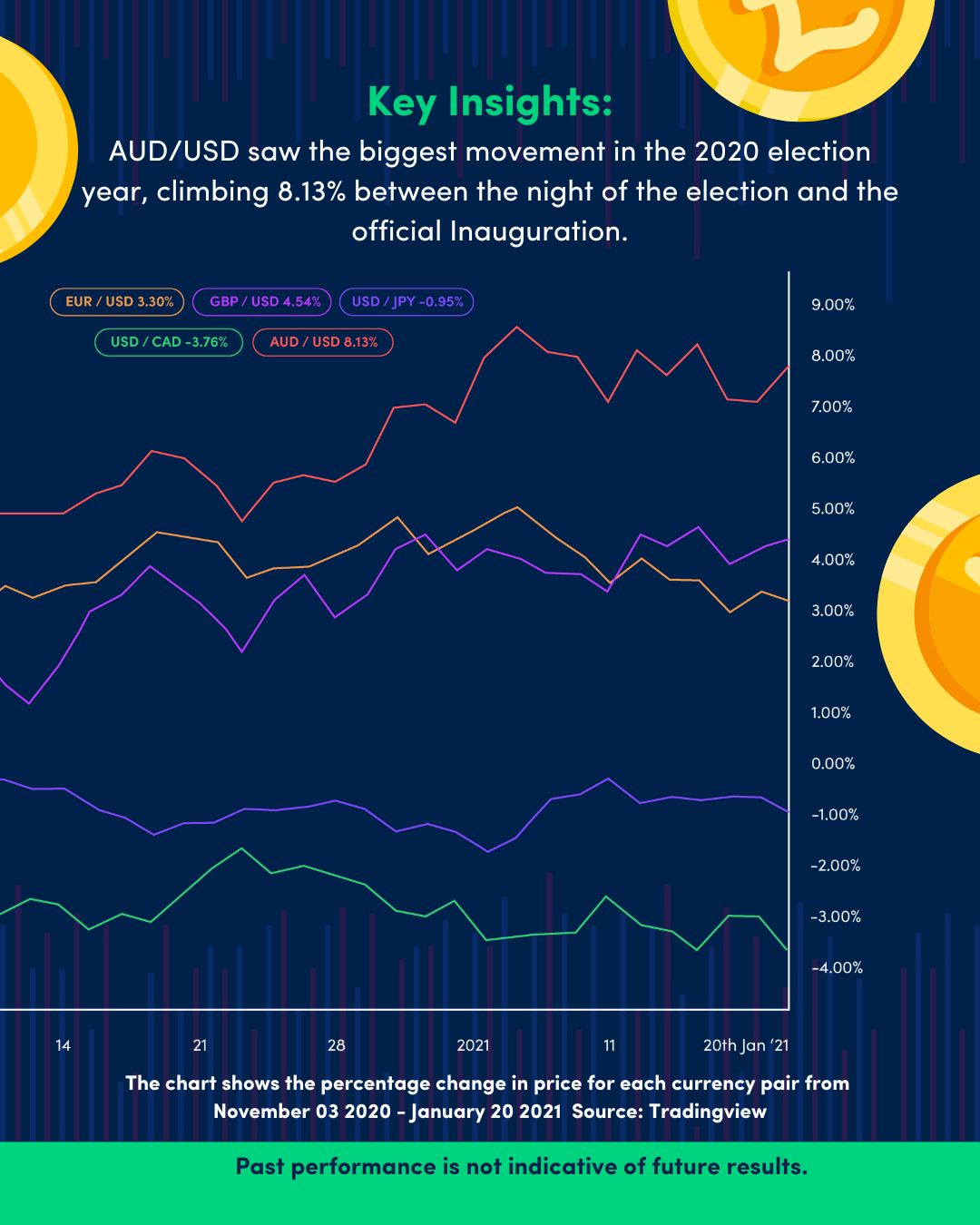

How have the markets reacted to previous US election results?

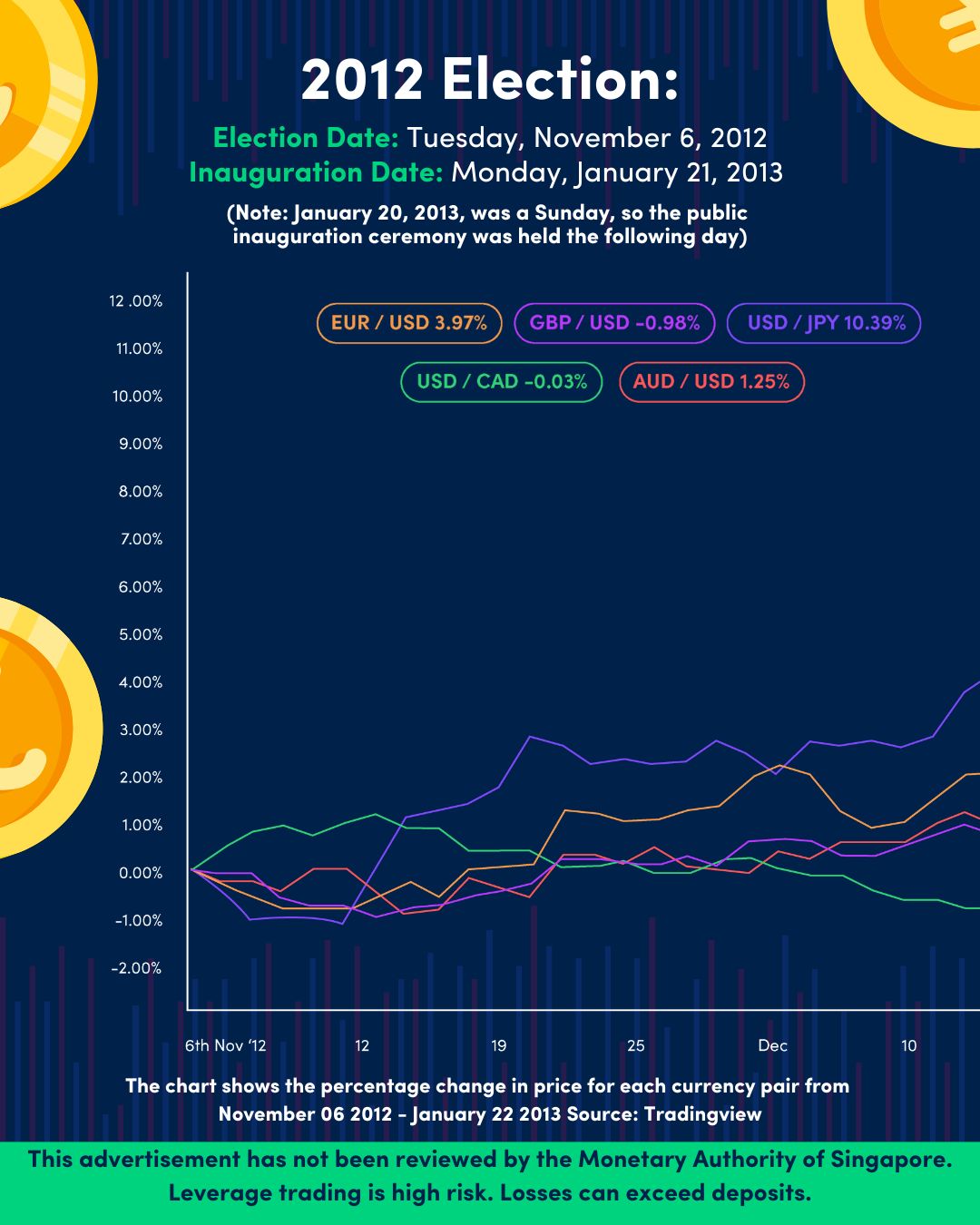

How volatile is the period between election day and inauguration?

Live Markets

Leveraged trading is high risk. Losses can exceed deposits.

Trade popular Forex CFD pairs with OANDA

We offer competitive spreads and a range of powerful platforms.