Playing an important role in determining market sentiment, analyzing the performance of major stock indexes like the FTSE, CAC and STOXX 600 can prove a useful part of any multi-faceted trading strategy. Read more.

Stock market indices: Why are they important?

Commonplace in financial news coverage, the performance of major stock indexes, like the Dow Jones and FTSE, plays a key role in determining both market outlook and the perceived health of the global economy. While there is no doubt about the importance of stock indexes to the global financial narrative, there are three areas in particular where this importance can be best reflected: economic development, industry growth, and as a measure of investment success.

Point 1: Economic development

The value and performance of a stock market index can be used to judge current market sentiment on any given economy.

Highlighted in purple on the chart below, you can see both the 2008 subprime mortgage crisis and the 2020 COVID-19 pandemic, respectively. As could be expected during both of these periods, the S&P 500 declined sharply in value. This could suggest the market, in broad, was less confident in the U.S. economy.

Point 2: Industry growth and company value

The performance of a stock index can be used to show development, evolution, and growth in a certain industry or section of any given economy. When an individual company's performance improves, the stock price is likely to rise, with the respective stock index it belongs to following suit.

For instance, the Nasdaq-100, a primarily tech-based index, can be used as a means to assess the perceived health, stability, and future growth prospects of the U.S. tech industry. As a consequence, broader market themes that affect U.S. tech companies disproportionately, for example, a Chinese ban on U.S. tech imports, would have a large impact on the Nasdaq-100's value, as many constituent stocks are likely to be affected.

For reasons discussed in a previous article, this would especially apply for large-cap tech stocks such as Apple, whose changes in stock value would have a larger influence on the Nasdaq-100's performance when compared to constituent stocks of a lower market cap.

Read: How can the value of a stock market index be calculated?

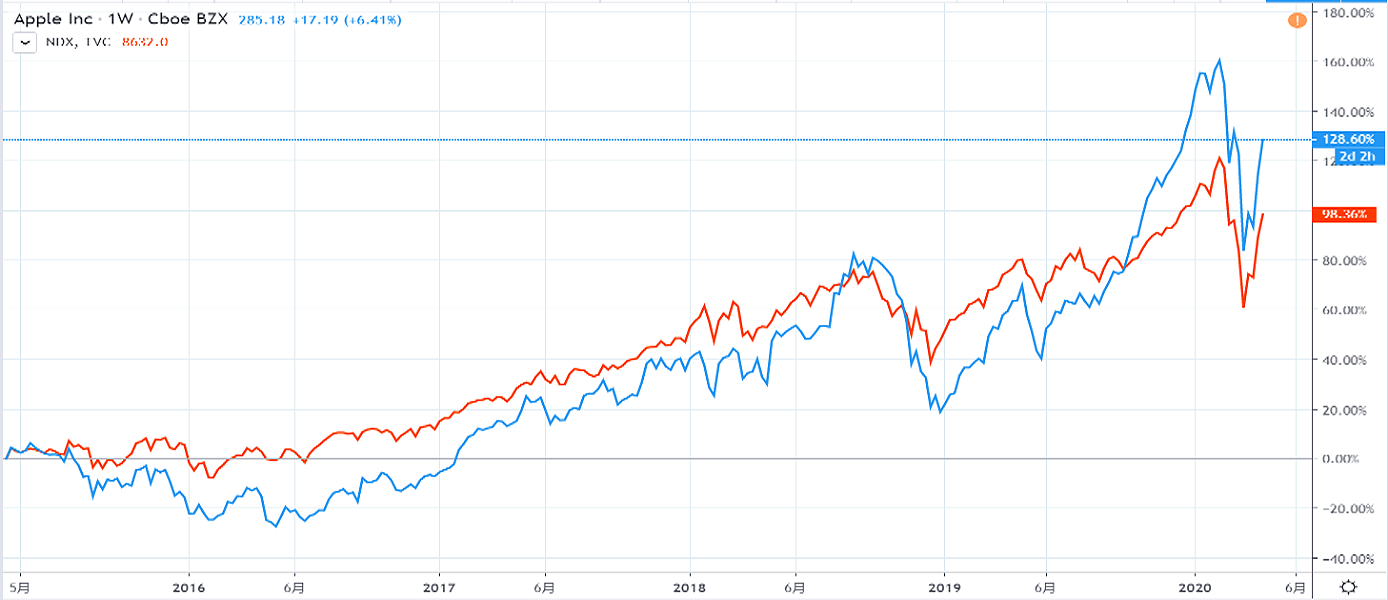

This is proven when looking at the relationship between the price performance of Apple (in blue) and the Nasdaq-100 (in orange), where prices are seen to be very closely correlated.

On this basis, analysing the performance of an industry-specific stock index can help identify potential trading opportunities.

Point 3: As a measure of investment success

When judging the past, or expected, return of any investment, a common benchmark is the performance of a major stock index within the same time period. As investments in major stock indexes, like the S&P 500, are typically viewed as a 'safe' form of investment, a riskier alternative should be justified with a higher rate of potential return.

Put simply, the aim of any investment should be to beat the return you would have received if you chose to invest in a major stock index instead.

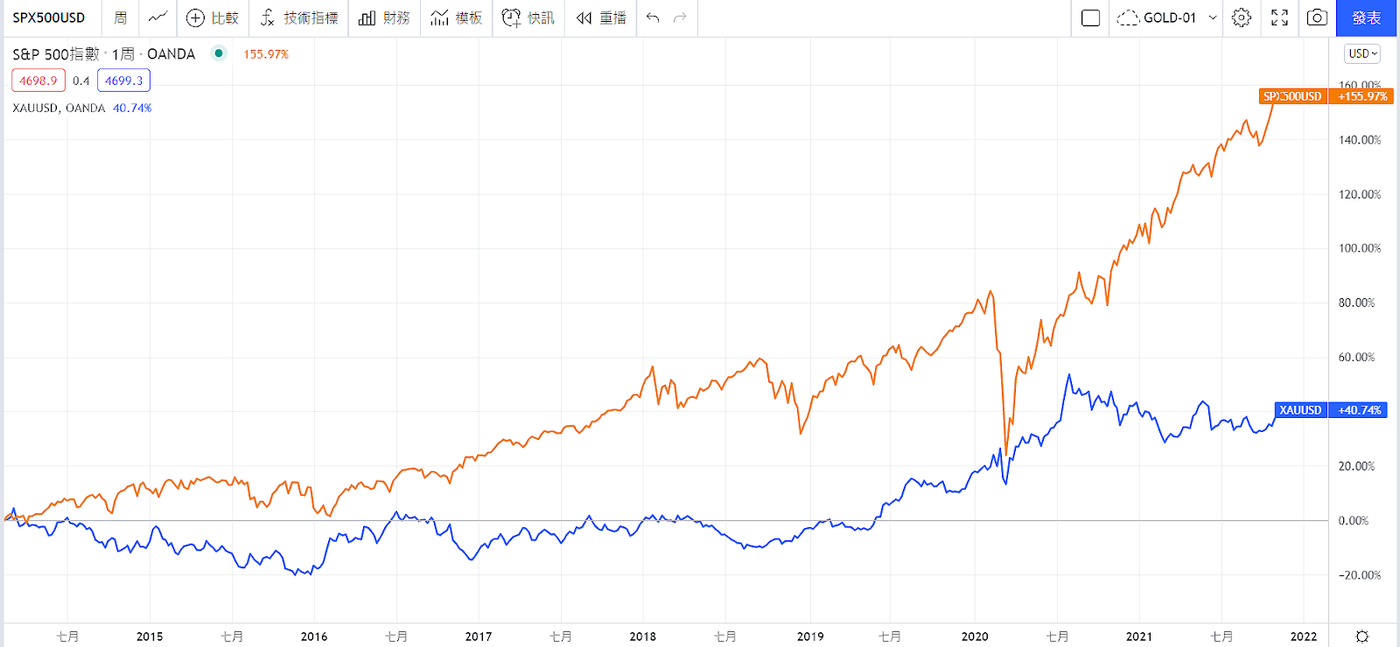

As seen in the chart below, price action is compared between gold (in blue) and that of the S&P 500 (orange line) from 2015 to 2021.

When using the performance of the S&P 500 as a point of comparison, it can be said that in this instance, investing in gold would have been an inferior choice.