Famed for its focus on small-cap stocks, the Russell 2000 is different from most major US stock indexes. In this article, we discuss these differences and how each can be applied to your trading. Read more.

What is the Russell 2000 Index?

The US Russell Index 2000, otherwise known as simply 'the Russell 2000', was founded in 1972 by Frank Russell and, in the modern day, is managed by FTSE Russell, a subsidiary of the London Stock Exchange Group.

With a primary focus on United States small-cap stocks, the Russell 2000 measures the performance of the 2000 smallest companies within the Russell 3000, another index managed by the FTSE group.

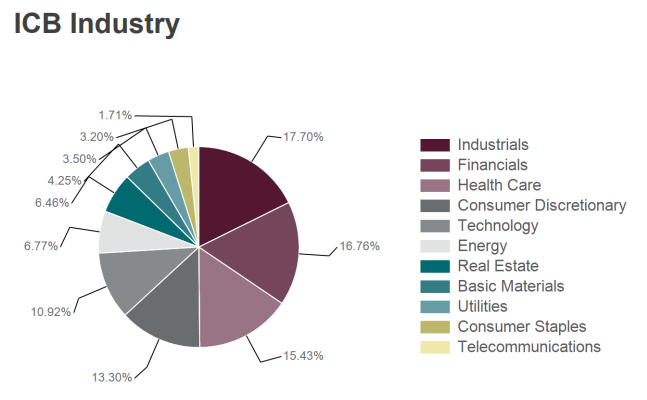

| Russell 2000 Index Weights - Vertical | % Weight |

|---|---|

| Industrials | 17.7% |

| Financials | 16.76% |

| Health Care | 15.43% |

| Consumer Discretionary | 13.30% |

| Technology | 10.92% |

| Energy | 6.77% |

| Real Estate | 6.46% |

Why is the Russell 2000 unique?

When compared to other US small-cap indices, such as the S&P 600 and the MSCI US Small Cap index, the Russell 2000 has almost 2000 constituent stocks, making it among the most comprehensive in terms of small-cap industry coverage.

Naturally, the market typically uses the Russell 2000 to assess the perceived health and future growth potential of US small-cap stocks as a whole.

Contrary to popular belief, however, the Russell 2000 does not contain 2000 stocks, having only 1742 as of September 2021. The reason for this is a self-imposed 'No replace rule', meaning that unlike other indexes, stocks are not replaced by others due to poor performance, insufficient liquidity, or any other reason.

Quick Summary:

- The Russell 2000 was launched on January 1st, 1984

- The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

- Its value is determined by ‘capitalization-weighted’ calculations

How can the Russell 2000 be used to measure the performance of the US economy?

Despite being focused solely on small-cap stocks, by virtue of covering multiple industries, the Russell 2000 can be used as a tool to measure the current performance and future prospects of the US economy as a whole.

By design, the capitalization of the Russell 2000 is much lower than that of other major US stock indexes. The Russell 2000 Index, which tracks US small-cap companies, has a high concentration of revenue coming from domestic sources, reflecting its focus on smaller, U.S.-based businesses. This domestic focus is significantly higher than that of the S&P 500 and the Dow Jones Industrial Average, which include many large multinational companies with substantial international revenue streams.

In part because of this and also because of the fundamental nature of small to medium-cap stocks, the Russell 2000 can be the first to show signs of recovery in periods of US economic downturn, which can prove to be valuable insight for traders alike.

| Company | Industry |

|---|---|

| Emcor Group Inc | Industrials |

| Iridium Communications | Telecommunications |

| Crocs Inc | Consumer Discretionary |

| Inspire Medical Systems | Health Care |

| Saia Inc | Industrials |

| Kinsale Capital Group | Financials |

| Texas Roadhouse Inc | Consumer Discretionary |

| Shockwave Medical | Health Care |

| Rbc Bearing Inc | Basic Materials |

| Halozyme Therapeutics | Health Care |

How does the Russell 2000 compare to other major US stock indexes?

When comparing the Russell 2000 to the S&P 500, there are many things to consider.

Within the realms of 'traditional trading wisdom', most share the opinion that volatility is greater within small-cap stocks, which, if true, may pose one advantage the Russell 2000 has over the S&P 500 for the average trader.

However, at some points in recent history, empirical data would suggest otherwise.

1979-1983: the Russell 2000 outperformed the S&P 500 by 80% during a period of extreme economic turbulence in the stock market

1983-1990: during the long economic expansion in the 1980s, large caps rebounded, leaving small caps in the dust. During this period of increased economic certainty, the S&P 500 outperformed the Russell 2000 by 91%, more than recovering its 1979-83 period of underperformance.

1990-1994: during the 1990-91 recession and its immediate aftermath, small caps again outperformed the S&P 500 by nearly 50%.

1994-1999: during the strongest phase of the 1990s expansion, the S&P 500 large caps again outperformed the Russell 2000 small caps

1999-2014: in a new era of turbulence (tech wreck, 9/11, Afghanistan and Iraq wars, subprime bubble, economic meltdown and quantitative easing, small caps swiftly outperformed large caps once again, with the Russell 2000 drubbing the S&P 500 by 114%.

Since 2014:Since early 2014, the S&P 500 has outperformed Russell 2000 by 56% as of mid-April 2020.

Over the past five years, the Russell 2000 index has lagged the large-cap dominated S&P 500 SPX index by 5.9 annualized percentage points.

Source: CME Group and Market Watch

How can you trade the Russell 2000?

As the Russell 2000 is only a statistical number, trading must be based on its derivative products, such as a CFD.

CFD - or Contract for Difference - is a financial instrument that allows traders to trade on the price movement of an underlying asset class, such as currency pairs, indices, commodities, bonds or metals, without actually owning the underlying asset.

Steps to Trade Russell 2000 CFDs:

- Choose a CFD Broker: Select a reliable CFD broker that offers trading on the Russell 2000 Index. Ensure the broker is regulated and provides a robust trading platform.

- Open and Fund Your Account: Register for an account with your chosen broker and deposit funds. Many brokers offer demo accounts to practice before trading with real money.

- Analyse the Market: Use technical and fundamental analysis to understand market trends and make informed decisions. Tools like chart patterns, economic indicators, and news updates are essential tools that can aid in your analysis of the market.

- Place a Trade: Decide whether you believe the Russell 2000 will increase (go long) or decrease (go short). Enter the trade by specifying the amount you want to trade and setting stop-loss and take-profit levels to manage risk.

- Monitor and Adjust: Continuously monitor your trade and the broader market. Be prepared to adjust your positions based on market movements and new information.

- Close the Trade: Close the trade to realize profits or cut losses.

Benefits of Using CFDs to Trade the Russell 2000:

- Access to Leverage: Leverage allows traders to maximize their exposure to the Russell 2000 with a relatively small initial investment. This can enhance returns but also increases the risk of losses.

- Ability to Go Long or Short: CFDs provide flexibility in trading. Traders can benefit from both rising and falling markets, which is not possible with traditional investing where profits are typically made only when the price of an asset increases.

- No Ownership of the Underlying Asset: Since CFDs are derivatives, traders do not need to own the actual stocks in the Russell 2000. This means there are no costs associated with owning the physical shares, such as custody fees or stamp duty in the US.

- Hedging: Investors who hold long-term positions in the Russell 2000 or specific stocks within the index can use CFDs to hedge their portfolios against short-term market volatility. For example, if an investor holds a substantial amount of Russell 2000 stocks but expects a temporary downturn, they can open a short CFD position to offset potential losses.

Risks of Using CFDs

- Leverage Risk: While leverage can amplify gains, it also amplifies losses. Leverage trading is high risk and traders can lose more than their initial deposits if the market moves against their position.

- Margin Calls: If the market moves unfavorably, traders may be required to deposit additional funds to maintain their positions. Failure to do so can result in the CFD provider closing the position, potentially at a loss to the trader.

- Counterparty Risk: CFD trading involves entering into an agreement with a broker or CFD provider. If the provider faces financial difficulties or insolvency, the trader might face risks related to the counterparty's ability to fulfill its obligations.

- Market Volatility: The value of CFDs can be affected by market volatility. Sudden price movements can lead to substantial gains or losses in a short period of time.

- Funding charges: Also known as ‘overnight interest,’ it is paid if a position is held from one day to the next. In the case of holding long positions, the accumulated funding charges may result in lower returns.

With over 25 years of history, OANDA is the world's leading CFD broker and offers CFD trading on the Russell 2000

OANDA holds six regulatory licenses worldwide and is proud to be one of the most secure Forex brokers in the world:

- UK Financial Conduct Authority

- US Commodity Futures Trading Commission

- Canadian Investment Industry Regulatory Organization

- Australian Securities and Investments Commission

- Japan Financial Services Agency

- Monetary Authority of Singapore

Why should you trade with OANDA?

OANDA offers CFDs on most of the world’s key indices, including the top three US stock indices, the UK’s FTSE 100, the German DAX 40, and the French CAC 40.

Here are the reasons why you should trade with OANDA:

- OANDA offers unique indicators and Expert Advisors (EAs)

OANDA offers dozens of unique technical indicators and EAs for beginners and professional traders.

- OANDA offers over 60 CFDs

OANDA offers quotes for CFDs on indices, currency pairs, commodities, and precious metals. We offer competitive spreads on many different products, including the S&P 500, Nasdaq and Dow Jones.

- Trade at home and on the go

You can trade with the OANDA Trade browser-based platform or MetaTrader 4 (MT4) desktop when you are at home or the OANDA Trade mobile and tablet app or MT4 mobile app on your phone or tablet devices when you are on the go.

OANDA has also partnered with TradingView which allows our clients to use an OANDA account on TradingView’s platform to combine TradingView’s community features, powerful charts and analytical tools with OANDA’s transparent pricing, fully-automated risk management systems and market data.