Navigate the NASDAQ 100 with our guide. Explore the index's methodology, high-tech leaders, and market insights for savvy investing. From non-financial stocks to performance trends, enhance your financial literacy and make informed decisions with our comprehensive NASDAQ 100 overview.

Introduction to the NASDAQ 100

The NASDAQ 100 is a stock index that represents the performance of 100 of the largest non-financial companies listed on the Nasdaq Stock Market, one of the major stock exchanges in the United States. This index is used to gauge the overall performance of various industries, including the technology and biotechnology sectors, and it excludes financial companies.

What is the Nasdaq?

The Nasdaq is one of the major stock exchanges in the United States, alongside the New York Stock Exchange (NYSE). It plays a pivotal role in the U.S. financial markets. Nasdaq is recognized for listing a substantial number of high-tech and information technology (IT) companies. Furthermore, it holds the distinction of being the largest stock market globally for new venture companies, showcasing its significance as a platform for emerging businesses and initial public offerings (IPOs).

There are about 3,000 listed companies on the Nasdaq. Through the NASDAQ 100, which consists of the top 100 companies by capitalisation, it is possible to further determine the trend of the high-tech and IT sectors.

In February 2004, the NASDAQ 100 index stood at approximately 7,500 points. Fast forward to February 7, 2023, and it had surged to 12,500 points, marking an impressive nearly eight-fold increase over the span of 19 years. This remarkable growth trajectory, coupled with its demonstrated potential for sustained expansion over the long term, has positioned the NASDAQ 100 as an attractive target for prospective investments.

This article will explain the NASDAQ 100, its outlook, and how to use it.

Contents

- What is the NASDAQ 100?

- Constituent stocks

- Calculating the NASDAQ 100

- The movement of the NASDAQ 100

- Outlook

- Another three key USD stock indices

- How to invest in the NASDAQ 100

- How to trade the NASDAQ 100 CFDs with OANDA

What is the NASDAQ 100?

The NASDAQ 100, a leading stock index, comprises the foremost 100 stocks based on market capitalisation, intentionally excluding the financial sector. This selection process is conducted from a pool of approximately 3,000 stocks listed on various Nasdaq exchanges, establishing the NASDAQ 100 as a representative benchmark of high-performing companies across diverse industries, with a deliberate focus on excluding financial entities.

What is a stock index?

A stock index tracks the prices of stocks across an entire exchange or a specific stock category. By examining the historical data of the index, you can gauge the fluctuation in stock prices and the movement and performance of a portfolio of holdings..

The inception of the NASDAQ 100 dates back to 1985, with constituent stocks meticulously chosen from various sectors such as technology, health care, consumer goods, and services. Iconic companies like Apple, Microsoft, and Alphabet (operated by Google) exemplify the caliber of stocks included in this index. The selection process employs a capitalisation-weighted average methodology.

Unlike the comprehensive Nasdaq Composite Index, which includes all stocks listed on Nasdaq, the NASDAQ 100 stands out due to its deliberate exclusion of the financial sector. Restrained to the top 100 stocks strategically weighted by market capitalisation, it provides a more accurate representation of high-tech stocks.

This specificity makes the NASDAQ 100 a particularly valuable instrument for investors seeking insights into the performance of leading companies in technology and related sectors. Now, let's delve into the constituent stocks that comprise the NASDAQ 100.

Constituent stocks

The NASDAQ 100 comprises the foremost 100 stocks within the NASDAQ market, strategically weighted by market capitalisation and excluding the financial sector.

Here are the top ten stocks in the NASDAQ 100.

| Ranking | Stock name | Stock symbol |

|---|---|---|

| 1 | Apple Inc | AAPL |

| 2 | Microsoft Corp | MSFT |

| 3 | Amazon.com Inc | AMZN |

| 4 | Broadcom Inc | AVGO |

| 5 | Meta Platforms Inc | META |

| 6 | NVIDIA Corp | NVDA |

| 7 | Tesla Inc | TSLA |

| 8 | Alphabet Inc | GOOGL |

| 9 | Alphabet Inc | GOOG |

| 10 | Costco Wholesale Corp | COST |

The following companies were excluded/added during the stock reweighting in December 2023.

| Excluded | Added |

|---|---|

| Align Technology, Inc. (Nasdaq: ALGN), eBay Inc. (Nasdaq: EBAY),Enphase Energy, Inc. (Nasdaq: ENPH), JD.com, Inc. (Nasdaq: JD), Lucid Group, Inc. (Nasdaq: LCID),Zoom Video Communications, Inc. (Nasdaq: ZM). | CDW Corporation (Nasdaq: CDW), Coca-Cola Europacific Partners plc (Nasdaq: CCEP), DoorDash, Inc. (Nasdaq: DASH), MongoDB, Inc. (Nasdaq: MDB), Roper Technologies, Inc. (Nasdaq: ROP), Splunk Inc. (Nasdaq: SPLK) |

| Source | NASDAQ |

Calculating the NASDAQ 100

The NASDAQ 100 is calculated as a capitalisation-weighted average.

What is the capitalisation-weighted average?

The capitalisation-weighted average is a metric calculated by summing the market capitalisation of individual stocks and dividing this total by the overall capitalisation at the registration date. This approach enables an assessment of the capitalisation growth rate over a defined period, facilitating an estimation of the evolution of collective stock market value from historical data to the present. Essentially, it provides a nuanced and comprehensive measure that reflects the relative significance of each stock in the overall market capitalisation calculation.

In addition to the NASDAQ 100, stock indices such as the Nasdaq Composite Index, the S&P 500, and Japan's TOPIX also use the capitalisation-weighted average.

To summarize the NASDAQ 100 :

- The constituent stocks of the NASDAQ 100 are the top 100 stocks listed in Nasdaq by capitalisation

- Typical stocks are Apple, Microsoft, and other tech companies

- It is calculated by capitalisation-weighted average

- With the capitalisation-weighted average, you can estimate the growth rate of capitalisation from the past to the present

- The NASDAQ 100 is a better indicator of what is going on in the high-tech sector than the Nasdaq Composite Index

Here's a look at how the NASDAQ 100 has moved in the past.

The movement of the NASDAQ 100

The following chart tracks the NASDAQ 100 over the last 20 years (2003–2023).

Several events have impacted the NASDAQ 100 during the past 20 years.

2008: Lehman Brothers Collapse

While the 2007 subprime crisis was still ongoing, the large American investment bank Lehman Brothers filed for bankruptcy in 2008. The entity’s collapse caused the global financial crisis. The NASDAQ 100 traded at 2,000 in May 2008 but fell below 1,200 in November 2008.

2020: COVID-19

The global outbreak of COVID-19 began in December 2019. The inevitable imposition of traffic restrictions and lockdowns worldwide has led to a sluggish global economy.

The NASDAQ 100 was still at 9,000 in early February 2020 but temporarily dropped to 6,800 in March 2020.

2022: The Russia-Ukraine crisis

In February 2022, the conflict between Russia and Ukraine caused chaos in global supply chains and severe inflation globally.

The US Federal Reserve Board (FRB) started a series of tightening measures (interest rate hike) to control domestic inflation. The NASDAQ 100 was impacted by the new course of action. While it stood at 16,000 in January 2022, it fell to around 11,000 in June 2022.

After the Lehman Brothers collapse and the COVID-19 crisis, it reached 16,700 in 2021, recording the highest price in its history.

Despite the Russian-Ukrainian war in 2022, the market managed to correct, ending at around 11,000.

The next section looks at other stock indices to help predict the NASDAQ 100 market.

The other three key US stock indices

In addition to the NASDAQ 100, the following are three key stock indices in the United States.

- Dow Jones

- S&P 500

- Russell Index

Let's compare the differences between the NASDAQ 100 and other stock indices.

NASDAQ 100 versus Dow Jones

The Dow Jones Industrial Average (DJIA), or simply ‘the Dow’, is a stock market index of 30 prominent companies listed on stock exchanges in the United States, calculated and published by S&P Dow Jones Indices. It selected 30 of the most-traded stocks from the New York Stock Exchange (NYSE) and the NASDAQ. The stocks that pass the rigorous examination are considered outstanding, also known as "blue chip companies".Here are the differences between the NASDAQ 100 and the Dow Jones:

| Item | NASDAQ 100 | Dow Jones |

|---|---|---|

| Launched | 1985 | 1896 |

| Calculation & publication company | NASDAQ | S&P Dow Jones Indices |

| Number of constituent stocks | 100 stocks (NYSE and NASDAQ listed companies) | 30 stocks (NYSE and NASDAQ listed companies) |

| Calculation method | Capitalisation-weighted average | Price-weighted average |

| Features | Stock index for high tech and IT sectors (except financial) | A stock index consisting of 30 stocks, excluding those in capital goods, service, transportation, public utility sectors |

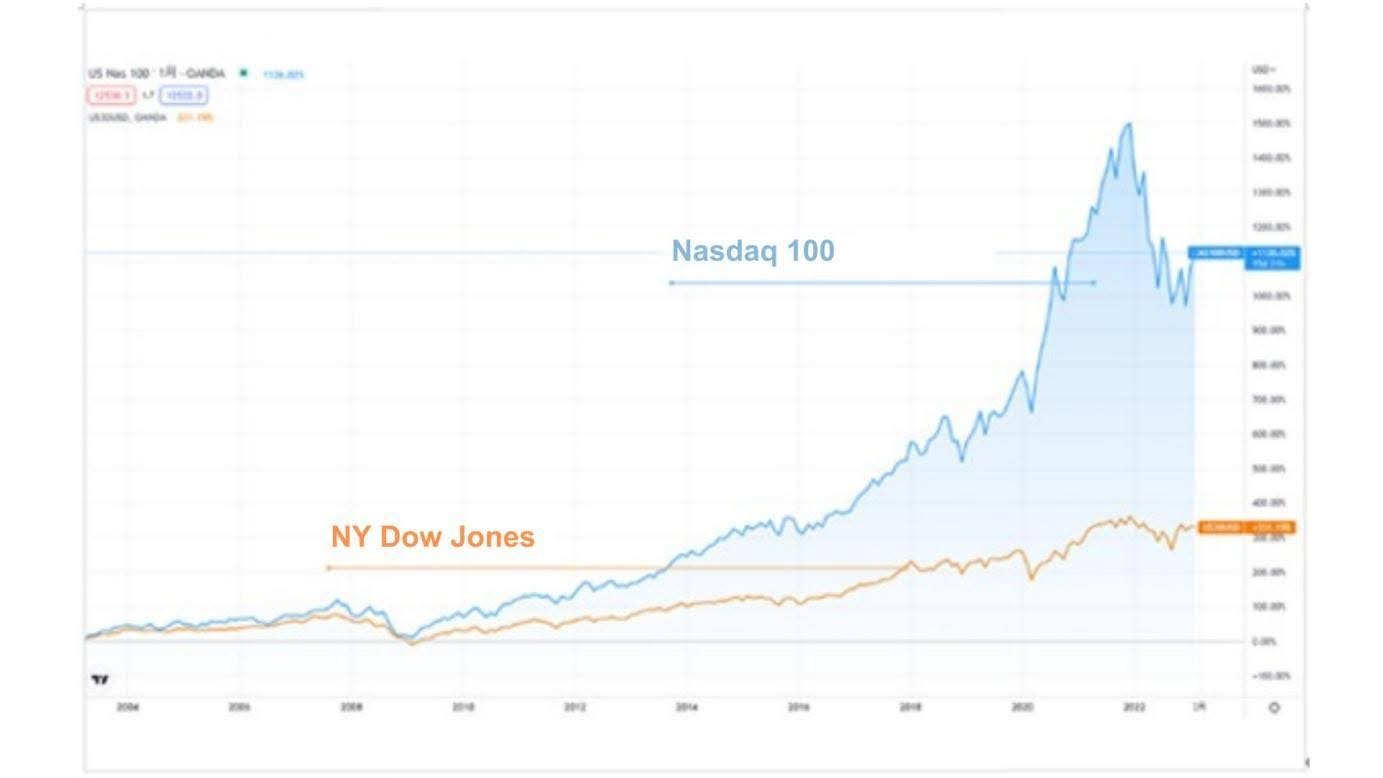

Next, let’s compare the performance of the NASDAQ 100 with that of the Dow Jones.

| Stock Index | March 2003 | February 2023 |

|---|---|---|

| NASDAQ 100 | 0% | About + 1,126% |

| Dow Jones | 0% | About + 331% |

NASDAQ 100 versus S&P 500

The S&P 500 selects 500 leading publicly traded stocks from companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. It covers about 80% of the capitalisation of the US stock market. As the benchmark of the US stock market, it is followed by many investors.

Here are the differences between the NASDAQ 100 and the S&P 500:

| Item | NASDAQ 100 | S&P 500 |

|---|---|---|

| Launched | 1985 | 1957 |

| Calculation & publication company | NASDAQ | S&P Dow Jones Indices |

| Number of constituent stocks | 100 stocks (NYSE and NASDAQ listed companies) | 500 stocks (NYSE and NASDAQ listed companies) |

| Calculation method | Capitalisation-weighted average | Capitalisation-weighted average |

| Features | The stock price index for high tech and IT sectors (except financial) | A closely watched stock index that serves as a benchmark for the US stock market |

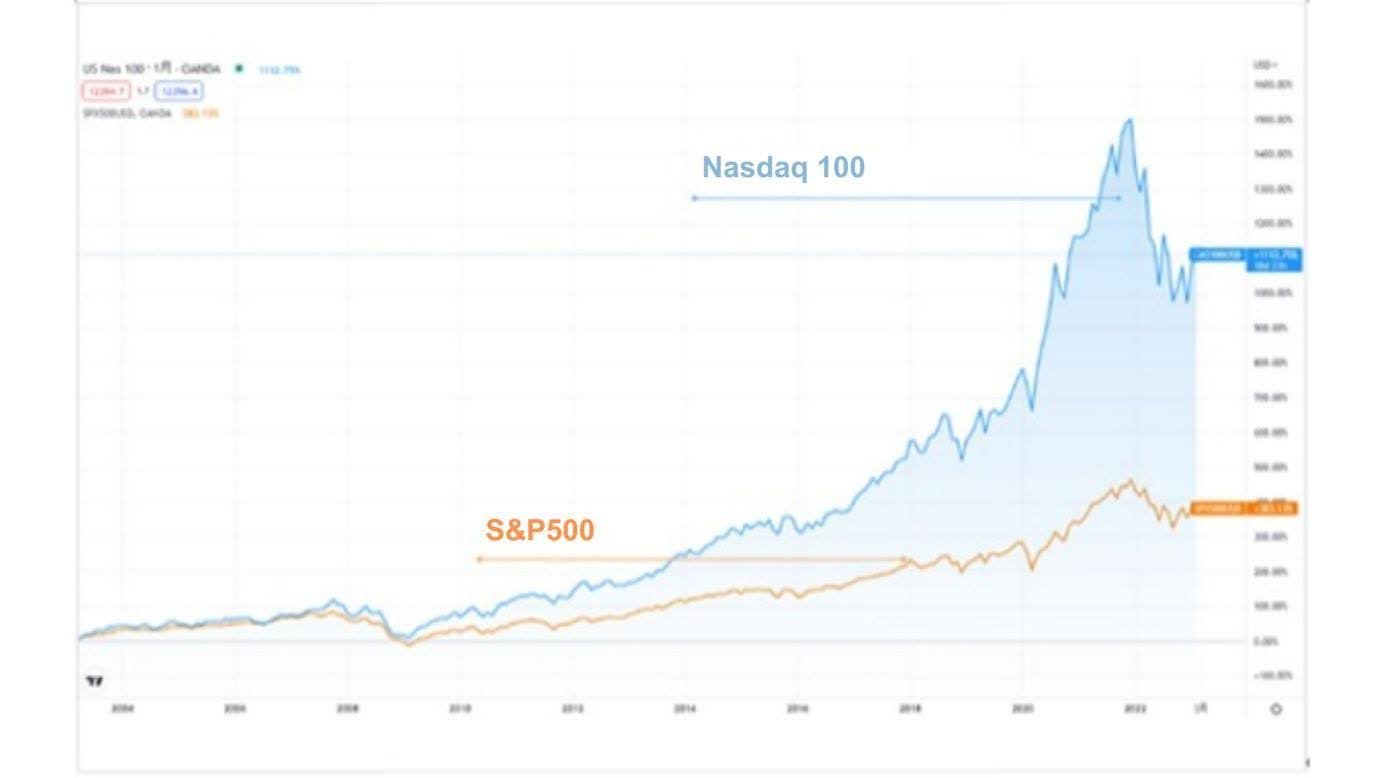

Next, let’s compare the performance of the NASDAQ 100 with that of the S&P 500.

| Stock Index | March 2003 | February 2023 |

|---|---|---|

| NASDAQ 100 | 0% | About + 1,112% |

| S&P 500 | 0% | About 383% |

NASDAQ 100 versus Russell 2000

The Russell 2000 is a stock index calculated and published by Russell Investments. By capitalisation, it selects 2,000 stocks listed on the NYSE and NASDAQ. Comprising small-cap stocks, it is more sensitive to economic trends than the NASDAQ 100, the S&P 500, and the Dow Jones. Also known as the "leading indicator of the collapse", it is a stock index many investors watch.

Here are the differences between the NASDAQ 100 and the Russell 2000

| Item | NASDAQ 100 | Russell 2000 |

|---|---|---|

| Launched | 1985 | 1984 |

| Calculation & publishing company | NASDAQ | Russell Investments |

| Number of constituent stocks | 100 stocks (NYSE and NASDAQ listed companies) | 2,000 stocks (NYSE and NASDAQ listed companies) |

| Calculation method | Capitalisation-weighted average | Capitalisation-weighted average |

| Features | Stock index for high-tech and IT sectors (except financial) | An index of small-cap stocks (more sensitive to economic trends than a large-cap index) |

Nasdaq 100 and Russell 2000 performance comparison chart- Source TradingView The graph above compares the growth rate over 20 years as from March 2003.

| Stock Index | March 2003 | February 2023 |

|---|---|---|

| NASDAQ 100 | 0% | About + 1,112% |

| Russell 2000 | 0% | About + 465% |

How to invest in the NASDAQ 100

NASDAQ 100 is an index representing the performance of certain stocks, and investors typically trade financial products derived from it rather than the index itself. Common methods for trading the NASDAQ 100 include Exchange-Traded Funds (ETFs) and Contracts for Difference (CFDs). ETFs allow investors to buy shares of a fund that tracks the performance of the NASDAQ 100, while CFDs are financial derivatives that enable traders to trade on price movements without owning the underlying assets.

ETFs are suitable for long-term investment due to their relatively high commissions. CFDs are better suited to those who prefer short-term trading or investments.

CFD trading

CFD stands for ‘Contracts for Difference’

CFDs can be traded via either long or short positions on underlying assets, such as stock indices, forex, precious metals or commodities, without actually owning the underlying asset.

How CFDs Work:

- Leverage: CFDs allow traders to use leverage, meaning they can control a larger position with a relatively small amount of capital. For example, if the leverage is 10:1, a trader can control a position worth USD10,000 with just USD1,000 of their own money. This amplifies both potential gains and potential losses.

- Two-way trading:

- Long Position: If a trader expects the NASDAQ 100 to rise, they can open a long CFD position. This means they will profit if the index's price increases.

- Short Position: Conversely, if a trader expects the NASDAQ 100 to fall, they can open a short CFD position. This means they will profit if the index's price decreases.

Benefits of Using CFDs to Trade the NASDAQ 100:

- Access to Leverage: Leverage allows traders to maximize their exposure to the NASDAQ 100 with a relatively small initial investment. This can enhance returns but also increases the risk of losses.

- Ability to Go Long or Short: CFDs provide flexibility in trading. Traders can benefit from both rising and falling markets, which is not possible with traditional investing where profits are typically made only when the price of an asset increases.

- No Ownership of the Underlying Asset: Since CFDs are derivatives, traders do not need to own the actual stocks in the NASDAQ 100. This means there are no costs associated with owning the physical shares, such as custody fees or stamp duty in the US.

- Hedging: Investors who hold long-term positions in the NASDAQ 100 or specific stocks within the index can use CFDs to hedge their portfolios against short-term market volatility. For example, if an investor holds a substantial amount of NASDAQ 100 stocks but expects a temporary downturn, they can open a short CFD position to offset potential losses.

Risks of Using CFDs:

- Leverage Risk: While leverage can amplify gains, it also amplifies losses. Leverage trading is high risk and traders can lose more than their initial deposits if the market moves against their position.

- Margin Calls: If the market moves unfavorably, traders may be required to deposit additional funds to maintain their positions. Failure to do so can result in the CFD provider closing the position, potentially at a loss to the trader.

- Counterparty Risk: CFD trading involves entering into an agreement with a broker or CFD provider. If the provider faces financial difficulties or insolvency, the trader might face risks related to the counterparty's ability to fulfill its obligations.

- Market Volatility: The value of CFDs can be affected by market volatility. Sudden price movements can lead to substantial gains or losses in a short period of time.

- Funding charges: Also known as ‘overnight interest,’ it is paid if a position is held from one day to the next. In the case of holding long positions, the accumulated funding charges may result in lower returns.

OANDA offers traders to trade CFDs on NASDAQ100,

Please visit the OANDA website to get started: