Amongst the ranks of top US stock indexes like the S&P 500, Nasdaq, and Dow Jones, the FTSE 100 is perhaps one of the most representative in determining the outlook of the global economy. Read more.

Introduction to the FTSE 100

What is the FTSE 100?

The FTSE 100, also known as the Financial Times Stock Exchange 100 index, was created by the FTSE group in 1984 and, in the modern day, ranks amongst the top three stock indexes in Europe, alongside the DAX and CAC.

The FTSE 100 Index includes the 100 largest companies listed on the London Stock Exchange, predominantly UK-based companies, covering a broad range of sectors such as finance, insurance, industry, energy, and healthcare, among others.

Many financial products, such as ETFs and derivative options, can be traded on the FTSE 100, which makes the FTSE 100, alongside the S&P 500, Nasdaq and Dow Jones, one of the most representative stock indexes in the world.

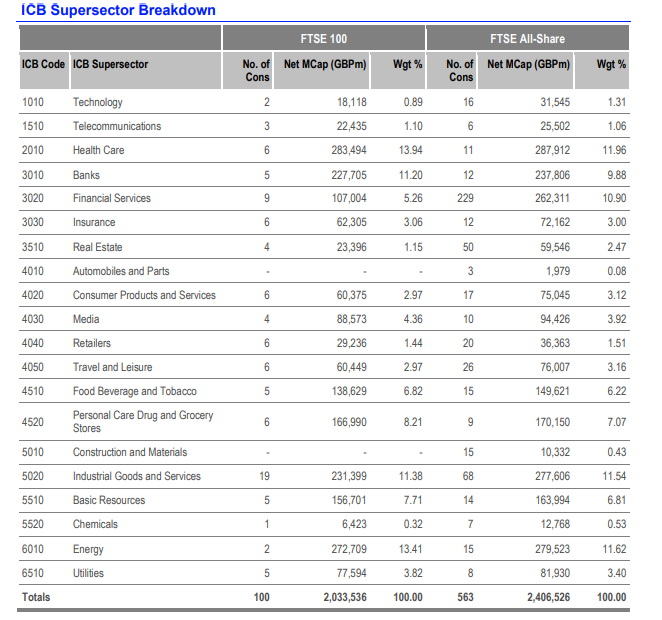

Industry Classification Benchmark is a hierarchical four-level system that classifies companies based on their main source of revenue. It is operated and managed by FTSE Russell, a subsidiary of London Stock Exchange Group (LSEG). It is currently one of the major classification systems for securities.

How is the value of the FTSE 100 calculated and which stocks are included?

Unlike some indexes, which opt for 'price-weighted', the FTSE 100 uses a ‘capitalization-weighted' method of calculation for determining market value.

To determine which stocks will constitute the FTSE 100, the Financial Times and the London Stock Exchange (LSE) cooperate in selecting the 100 companies with the highest market capitalization, as well as meeting a specified level of daily trading volume to ensure liquidity.

As can be expected, the performance of each constituent stock is closely monitored. The FTSE Russell Group, creators of the index, conduct a review each quarter. If a company’s market capitalization is to reach the top 90, it will be included as a constituent stock and removed if it is to fall below that of the 101st.

Quick Summary:

- The FTSE 100 was launched on the 3rd of January 1984

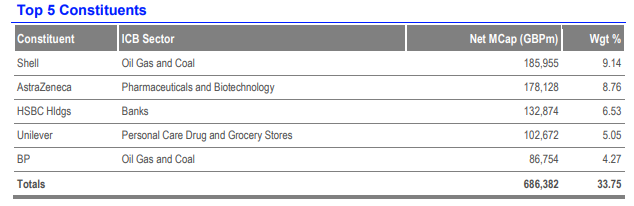

- It has 100 constituent stocks, typical examples being HSBC, Unilever and British Petroleum

- Its value is determined by ‘capitalization-weighted’ calculations

How can you trade the FTSE 100?

Contracts for Difference (CFDs) are financial derivatives that allow traders to trade on the price movements of various underlying assets, such as indices like the FTSE 100, without owning the underlying assets. Here's a more detailed explanation of how CFDs can be used to trade the FTSE 100:

How CFDs Work?

- Leverage: CFDs allow traders to use leverage, meaning they can control a larger position with a relatively small amount of capital. For example, if the leverage is 10:1, a trader can control a position worth £10,000 with just £1,000 of their own money. This amplifies both potential gains and potential losses.

- Two-way trading:

- Long Position: If a trader expects the FTSE 100 to rise, they can open a long CFD position. This means they will profit if the index's price increases.

- Short Position: Conversely, if a trader expects the FTSE 100 to fall, they can open a short CFD position. This means they will profit if the index's price decreases.

Benefits of Using CFDs to Trade the FTSE 100

- Access to Leverage: Leverage allows traders to maximize their exposure to the FTSE 100 with a relatively small initial investment. This can enhance returns but also increases the risk of losses.

- Ability to Go Long or Short: CFDs provide flexibility in trading. Traders can benefit from both rising and falling markets, which is not possible with traditional investing where profits are typically made only when the price of an asset increases.

- No Ownership of the Underlying Asset: Since CFDs are derivatives, traders do not need to own the actual stocks in the FTSE 100. This means there are no costs associated with owning the physical shares, such as custody fees or stamp duty in the UK.

- Hedging: Investors who hold long-term positions in the FTSE 100 or specific stocks within the index can use CFDs to hedge their portfolios against short-term market volatility. For example, if an investor holds a substantial amount of FTSE 100 stocks but expects a temporary downturn, they can open a short CFD position to offset potential losses.

Risks of Using CFDs

- Leverage Risk: While leverage can amplify gains, it also amplifies losses. Leverage trading is high risk and traders can lose more than their initial deposits if the market moves against their position.

- Margin Calls: If the market moves unfavorably, traders may be required to deposit additional funds to maintain their positions. Failure to do so can result in the CFD provider closing the position, potentially at a loss to the trader.

- Counterparty Risk: CFD trading involves entering into an agreement with a broker or CFD provider. If the provider faces financial difficulties or insolvency, the trader might face risks related to the counterparty's ability to fulfill its obligations.

- Market Volatility: The value of CFDs can be affected by market volatility. Sudden price movements can lead to substantial gains or losses in a short period of time.

- Funding charges: Also known as ‘overnight interest,’ it is paid if a position is held from one day to the next. In the case of holding long positions, the accumulated funding charges may result in lower returns.

With over 25 years of history, OANDA is the world's leading CFD broker and offers CFD trading on the Russell 2000

OANDA holds six regulatory licenses worldwide and is proud to be one of the most secure Forex brokers in the world:

- UK Financial Conduct Authority

- US Commodity Futures Trading Commission

- Canadian Investment Industry Regulatory Organization

- Australian Securities and Investments Commission

- Japan Financial Services Agency

- Monetary Authority of Singapore

Why should you trade with OANDA?

OANDA offers CFDs on most of the world’s key indices, including the top three US stock indices, the UK’s FTSE 100, the German DAX 40, and the French CAC 40.

Here are the reasons why you should trade with OANDA:

OANDA offers unique indicators and Expert Advisors (EAs)

OANDA offers dozens of unique technical indicators and EAs for beginners and professional traders.

OANDA offers over 60 CFDs

OANDA offers quotes for CFDs on indices, currency pairs, commodities, and precious metals. We offer competitive spreads on many different products, including the S&P 500, Nasdaq and Dow Jones.

Trade at home and on the go

You can trade with the OANDA Trade browser-based platform or MetaTrader 4 (MT4) desktop when you are at home or the OANDA Trade mobile and tablet app or MT4 mobile app on your phone or tablet devices when you are on the go.

OANDA has also partnered with TradingView which allows our clients to use an OANDA account on TradingView’s platform to combine TradingView’s community features, powerful charts and analytical tools with OANDA’s transparent pricing, fully-automated risk management systems and market data.