The Dow Jones Industrial Average, or Dow Jones for short, has been used as a means to measure the performance of the US economy for the last 128 years. Discover more about the Dow Jones in this article.

What is the Dow Jones Industrial Average (DJIA)?

The Dow Jones Industrial Average, otherwise known as DJIA, or DJ for short, is a stock index created by Wall Street Journal founder Charles Dow to measure the development of the US stock market. At 138 years old, it is also one of the world's oldest stock indexes.

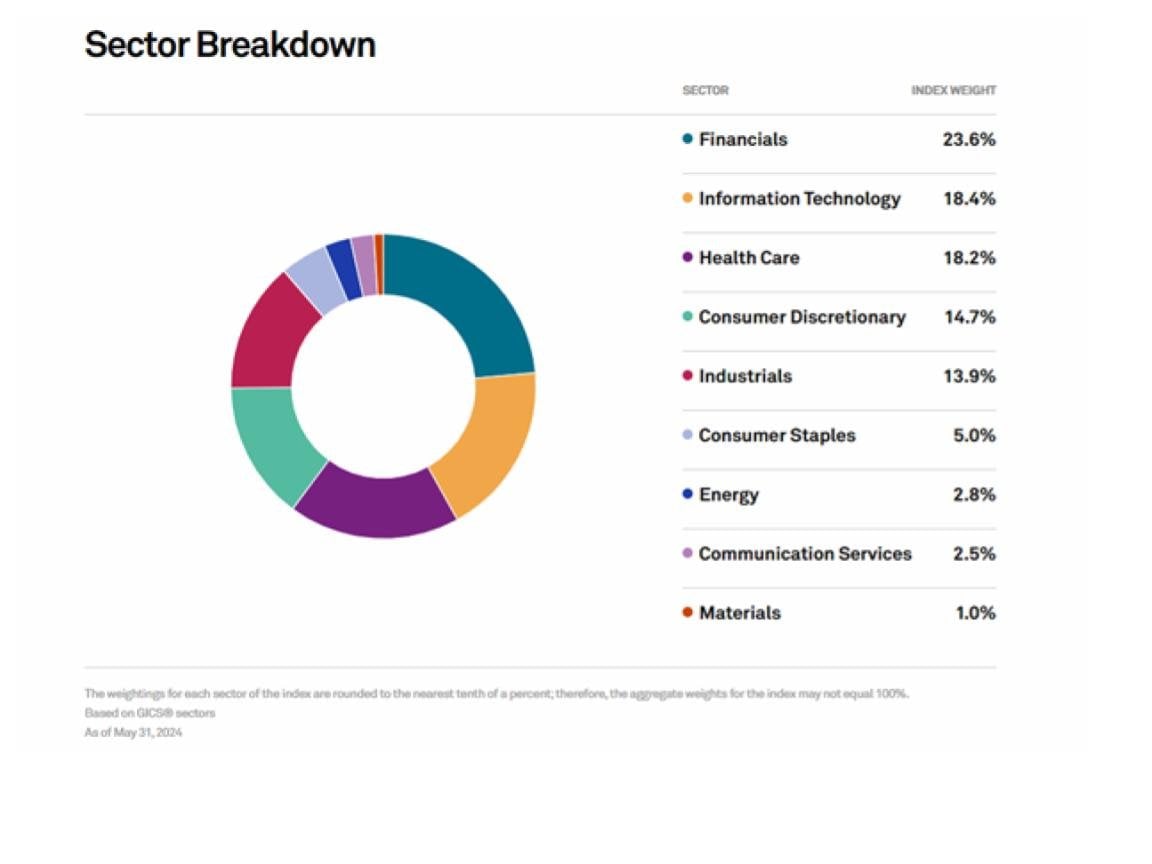

The Dow Jones consists of a total of 30 stocks, usually the largest or most well-known listed companies in the United States, covering a broad range of sectors, including industrial, financial, technology, retail, and insurance.

Due to the high correlation between its constituent stocks and the real economy, the performance of the Dow Jones is often considered a key metric in determining the health of the US economy.

How is the value of the Dow Jones calculated?

The Dow Jones is 'price-weighted', meaning the higher an individual constituent stock's price, the more influence it will have on the overall value of the index.

This method of calculation is different from that of the S&P 500 or Nasdaq-100, both of these examples being 'capitalization-weighted' instead.

Quick Summary:

- The DJIA was launched on the 16th of February 1885

- It has 30 constituent stocks, typical examples being UnitedHealth, Goldman Sachs, Home Depot, Microsoft, Salesforce, McDonald's

- Its value is determined by ‘price-weighted’ calculations

How are stocks selected for the DJ30?

The selection of stocks for the DJ30 is managed by a committee composed of representatives from S&P Dow Jones Indices and The Wall Street Journal. The key criteria and process for selecting stocks for the DJ30 are as follows:

- Industry Representation: The committee aims to represent a wide range of industries within the U.S. economy. The goal is to provide a snapshot of the overall economic landscape.

- Company Size and Reputation: Companies considered for inclusion are typically large, reputable firms with a strong financial performance. Market capitalization is an important factor, but it is not the sole criterion.

- Trading Volume: Stocks with high trading volumes and liquidity are preferred, as they are more stable and easier for the index to manage.

- Corporate and Economic Relevance: The companies selected are usually those that are considered leaders in their respective industries and that significantly impact the U.S. economy.

- Sector Balance: While the Dow does not include every sector of the economy, the committee ensures a balanced representation across major sectors to provide a comprehensive view of the market.

- No Fixed Rules: Unlike some indices that have strict rules-based criteria, the DJ30 selection process involves a degree of subjectivity. The committee periodically reviews the index and makes changes as necessary, but there are no predefined rules for inclusion.

- Price-Weighted Index: The DJ30 is a price-weighted index, meaning that stocks with higher prices have more influence on the index's movement than those with lower prices. This factor is considered when selecting stocks to ensure the index remains balanced.

The committee does not follow a specific schedule for making changes to the index, and adjustments are made as needed to reflect the evolving market and economy.

What’s so industrial about the Dow Jones?

Despite its full name being the 'Dow Jones Industrial Average', the index no longer focuses on stocks purely of an 'industrial' classification.

In the modern day, the Dow Jones has expanded to include sectors such as technology, finance, and retail, to name some examples.

In any case, the word 'industrial' only has historical significance today.

| # | Company | Symbol | Weight |

|---|---|---|---|

| 1 | Unitedhealth Group Inc | UNH | 8.56418 |

| 2 | Goldman Sachs Group Inc | GS | 7.713844 |

| 3 | Microsoft Corp | MSFT | 7.049196 |

| 4 | Home Depot Inc | HD | 5.56149 |

| 5 | Caterpillar Inc | CAT | 5.5498 |

| 6 | Amgen Inc | AMGN | 5.207565 |

| 7 | Visa Inc Class A Shares | V | 4.61543 |

| 8 | Mcdonald S Corp | MCD | 4.45109 |

| 9 | American Express Co | AXP | 4.019568 |

| 10 | Salesforce Inc | CRM | 3.979076 |

| 11 | Travelers Cos Inc | TRV | 3.551791 |

| 12 | Honeywell International Inc | HON | 3.51096 |

| 13 | Jpmorgan Chase & Co | JPM | 3.374235 |

| 14 | Apple Inc | AAPL | 3.292742 |

| 15 | Boeing Co | BA | 3.195663 |

| 16 | Amazon.com Inc | AMZN | 3.038438 |

| 17 | Procter & Gamble Co | PG | 2.829539 |

| 18 | Intl Business Machines Corp | IBM | 2.809208 |

| 19 | Chevron Corp | CVX | 2.645206 |

| 20 | Johnson & Johnson | JNJ | 2.504077 |

| 21 | Merck & Co. Inc. | MRK | 2.180648 |

| 22 | Walt Disney Co | DIS | 1.750651 |

| 23 | 3m Co | MMM | 1.670683 |

| 24 | Nike Inc Cl B | NKE | 1.605117 |

| 25 | Walmart Inc | WMT | 1.128359 |

| 26 | Coca Cola Co | KO | 1.083293 |

| 27 | Dow Inc | DOW | 0.93437 |

| 28 | Cisco Systems Inc | CSCO | 0.803405 |

| 29 | Verizon Communications Inc | VZ | 0.704123 |

| 30 | Intel Corp | INTC | 0.508778 |

| None | Source: | Dow Jones Index | None |

What are some disadvantages of the Dow Jones?

1. It's method of value calculation means that stocks of a higher price may disproportionately affect index value

Owing to the 'price-weighted' algorithms by which the value of the Dow Jones is determined, companies with the same market capitalization but trading at different stock prices will have varying levels of influence on the overall value of the index. As price alone is not an accurate indication of true market value, this can mean the performance of the Dow Jones is not fully representative of real market conditions.

2. There are too few stocks within the Dow Jones

When compared to other major US stock indexes, like the S&P 500, the Dow Jones includes far fewer stocks. By virtue of this, it can be argued that the DJIA is not as representative of real market conditions as other indexes.

How can you trade the Dow Jones?

As the Dow Jones Index is only a statistical number, trading must be based on its derivative products. One method to trade the Dow Jones index is by using contracts for difference, or CFDs, which, through the use of leverage, allow investors to trade with a small amount of funding. CFDs are contracts that allow traders to trade in the price movement of an underlying asset, in this case an index such as the Dow Jones Index.

If price is expected to rise, traders can take a long CFD position and a short CFD position if price is expected to fall, making CFDs a good option for both long and short trading.

Steps to Trade Dow Jones CFDs:

- Choose a CFD Broker: Select a reliable CFD broker that offers trading on the Dow Jones Index. Ensure the broker is regulated and provides a robust trading platform.

- Open and Fund Your Account: Register for an account with your chosen broker and deposit funds. Many brokers offer demo accounts to practice before trading with real money.

- Analyse the Market: Use technical and fundamental analysis to understand market trends and make informed decisions. Tools like chart patterns, economic indicators, and news updates are essential.

- Place a Trade: Decide whether you believe the Dow Jones will increase (go long) or decrease (go short). Enter the trade by specifying the amount you want to invest and setting stop-loss and take-profit levels to manage risk.

- Monitor and Adjust: Continuously monitor your trade and the broader market. Be prepared to adjust your positions based on market movements and new information.

- Close the Trade: Close the trade to realize profits or cut losses.

When trading CFDs, selecting the right CFD broker is essential.

Benefits of Using CFDs to Trade the Dow Jones

- Access to Leverage: Leverage allows traders to maximize their exposure to the Dow Jones Industrial Average with a relatively small initial investment. This can enhance returns but also increases the risk of losses.

- Ability to Go Long or Short: CFDs provide flexibility in trading. Traders can benefit from both rising and falling markets, which is not possible with traditional investing where profits are typically made only when the price of an asset increases.

- No Ownership of the Underlying Asset: Since CFDs are derivatives, traders do not need to own the actual stocks in the Dow Jones Industrial Average. This means there are no costs associated with owning the physical shares, such as custody fees or stamp duty in the US.

- Hedging: Investors who hold long-term positions in the Dow Jones Industrial Average or specific stocks within the index can use CFDs to hedge their portfolios against short-term market volatility. For example, if an investor holds a substantial amount of Dow Jones Industrial Average stocks but expects a temporary downturn, they can open a short CFD position to offset potential losses.

Risks of Using CFDs to Trade the Dow Jones

- Leverage Risk: While leverage can amplify gains, it also amplifies losses. Leverage trading is high risk and traders can lose more than their initial deposits if the market moves against their position.

- Margin Calls: If the market moves unfavorably, traders may be required to deposit additional funds to maintain their positions. Failure to do so can result in the CFD provider closing the position, potentially at a loss to the trader.

- Counterparty Risk: CFD trading involves entering into an agreement with a broker or CFD provider. If the provider faces financial difficulties or insolvency, the trader might face risks related to the counterparty's ability to fulfill its obligations.

- Market Volatility: The value of CFDs can be affected by market volatility. Sudden price movements can lead to substantial gains or losses in a short period of time.

- Funding charges: Also known as ‘overnight interest,’ it is paid if a position is held from one day to the next. In the case of holding long positions, the accumulated funding charges may result in lower returns.

With over 25 years of history, OANDA is the world's leading CFD broker and offers CFD trading on the Dow Jones

OANDA holds six regulatory licenses worldwide:

- UK Financial Conduct Authority

- US Commodity Futures Trading Commission

- Canadian Investment Industry Regulatory Organization

- Australian Securities and Investments Commission

- Japan Financial Services Agency

- Monetary Authority of Singapore

What are the advantages to opening an account with OANDA?

OANDA offers unique indicators and Expert Advisors (EAs)

OANDA offers dozens of unique technical indicators and EAs for beginners and professional traders.

OANDA offers over 60 CFDs

OANDA offers quotes for CFDs on indices, currency pairs, commodities, and precious metals. We offer competitive spreads on many different products, including the S&P 500, Nasdaq and Dow Jones.

Trade at home and on the go

You can trade with the OANDA Trade browser-based platform or MetaTrader 4 (MT4) desktop when you are at home or the OANDA Trade mobile and tablet app or MT4 mobile app on your phone or tablet devices when you are on the go.

OANDA has also partnered with TradingView which allows our clients to use an OANDA account on TradingView’s platform to combine TradingView’s community features, powerful charts and analytical tools with OANDA’s transparent pricing, fully-automated risk management systems and market data.