An introduction to the US Dollar: what you should know about the USD before trading it. What drives its value, key indicators, and its relationship to US bonds and gold.

Introduction to USD (the US Dollar)

This article describes the characteristics of the USD, the world's most popular currency. It also describes the relationship between the USD and financial products such as bond yields and gold.

The biggest currency by trading volume

With the world's most significant trading volume, the USD is often also bought as a safe haven asset.

As the currency of the United States, the world's largest economic and military power, the US Dollar enjoys a unique "world currency" status and global acceptance across financial markets. In addition to being the most widely used currency for international trade and financial transactions worldwide, the dollar also serves as the primary reserve currency for the central banks of numerous nations, making it central to the global economy.

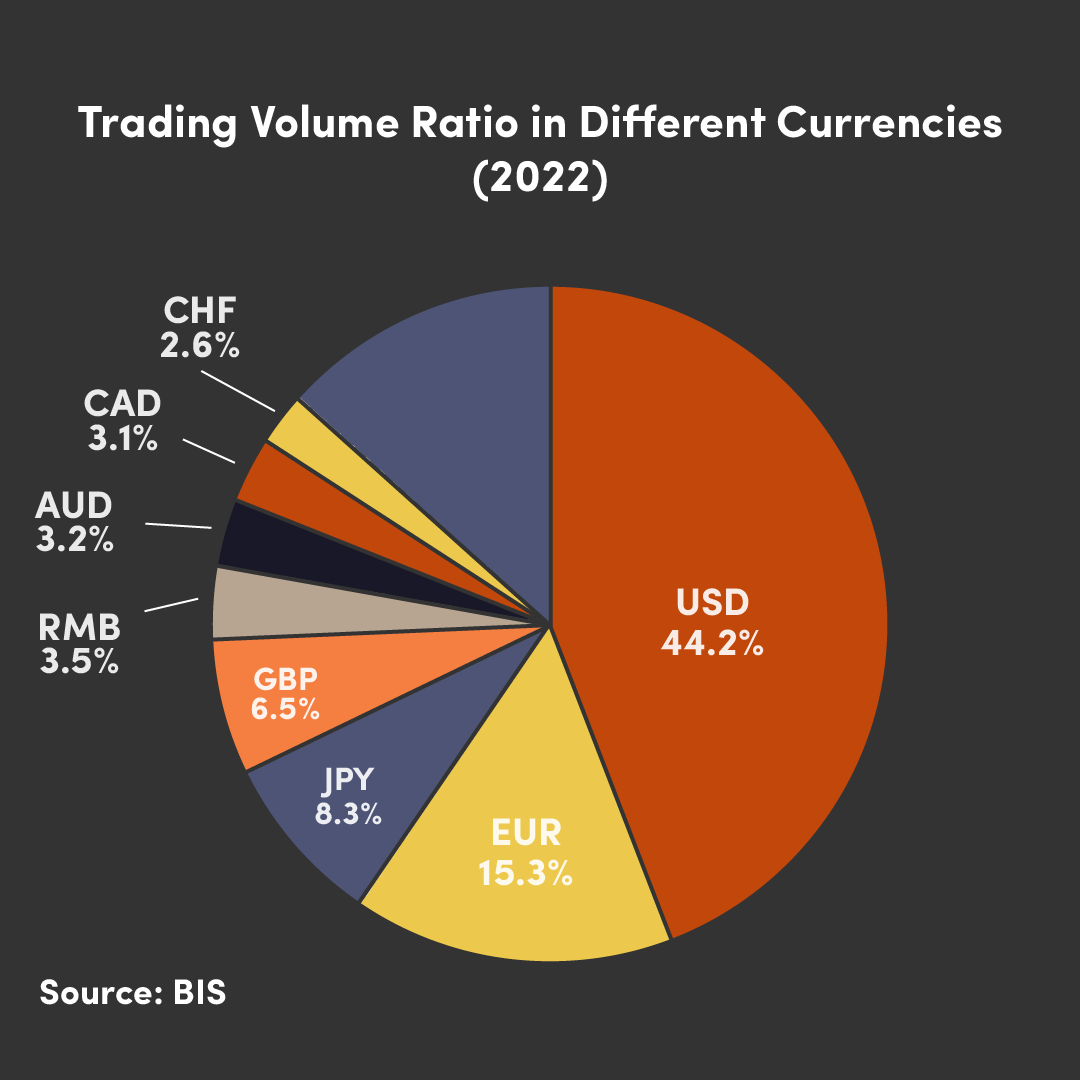

According to data released by the Bank of International Settlement (BIS), over 90% of forex trade in 2022 was in USD. Since the USD is traded worldwide and has high liquidity, it is considered a safe-haven currency with both JPY and CHF.

The US Dollar is frequently regarded as a "safe haven" currency during times of market instability or geopolitical risk, and there is a strong tendency for investors to buy USD during these periods in order to diversify and de-risk their portfolios. However, since the terrorist attacks of September 11, 2001, there has been a growing trend towards selling the dollar. Selling USD can therefore become viable, particularly when there is risk in the US, so it's important to determine where the risk lies and take the appropriate measures depending on the circumstances.

What factors can affect the US Dollar?

Since the USD is the currency of the United States, the policies of the Federal Reserve, the US central bank, and core US economic indicators all significantly impact the value of the US Dollar.

The Federal Reserve's monetary policy

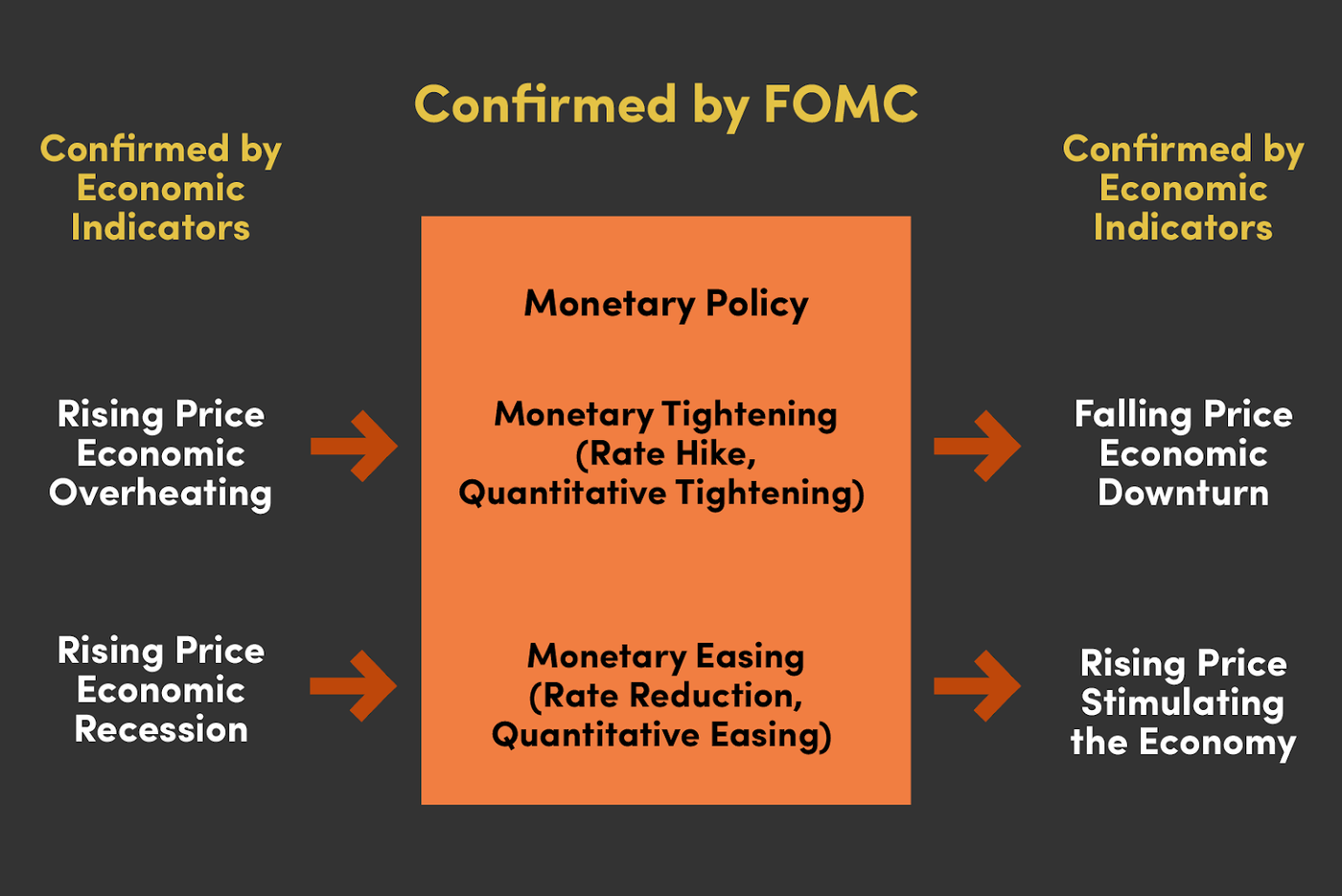

The monetary policy of the United States is determined at eight meetings held annually by the Federal Open Market Committee (FOMC).

The market closely follows these meetings, with the focus being on the decisions, policy statements, chairman's press conferences, and FOMC minutes, causing the US Dollar to sometimes overreact based on the direction of the monetary policy.

Generally, when the FOMC tightens monetary policy, the market tends to buy the US dollar. Conversely, when it loosens its policy, the market tends to sell the US dollar.

When the US economy is booming, the Federal Reserve tends to tighten monetary policy to prevent the economy from overheating and prices from excessively rising.Specifically, it raises interest rates in order to maintain economic stability.

On the other hand, expansionary monetary policies are also implemented to stimulate the economy when it slows down and the inflation rate falls. When interest rates are cut and bonds become attractive, money flows into the market, stimulating the economy and driving price increases.

Generally speaking, monetary policies that tighten the economy will increase the currency's value, making it a factor in buying USD. Monetary policies that loosen the economy will reduce the currency's value, making it a factor in selling USD.

Explaining this a bit more in details, central banks use interest rates as a tool to control the money supply and, consequently, economic activity. When a central bank raises interest rates, it makes borrowing more expensive, which can slow down economic growth but also attract foreign investors seeking higher returns on investments denominated in that currency. This increased demand for the currency can lead to an appreciation in its value. Conversely, when a central bank lowers interest rates, it can stimulate economic activity by making borrowing cheaper. However, lower interest rates can also lead to a decrease in the value of the currency as investors seek higher returns elsewhere.

However, suppose prices remain relatively high compared to other countries in the medium to long term. In that case, the currency's value will fall according to the Law of One Price, which states that the price of the same asset will have the same price globally when certain factors are taken into consideration, so it can also be a factor for selling.

What is the relationship between the US Dollar and Bond Yields?

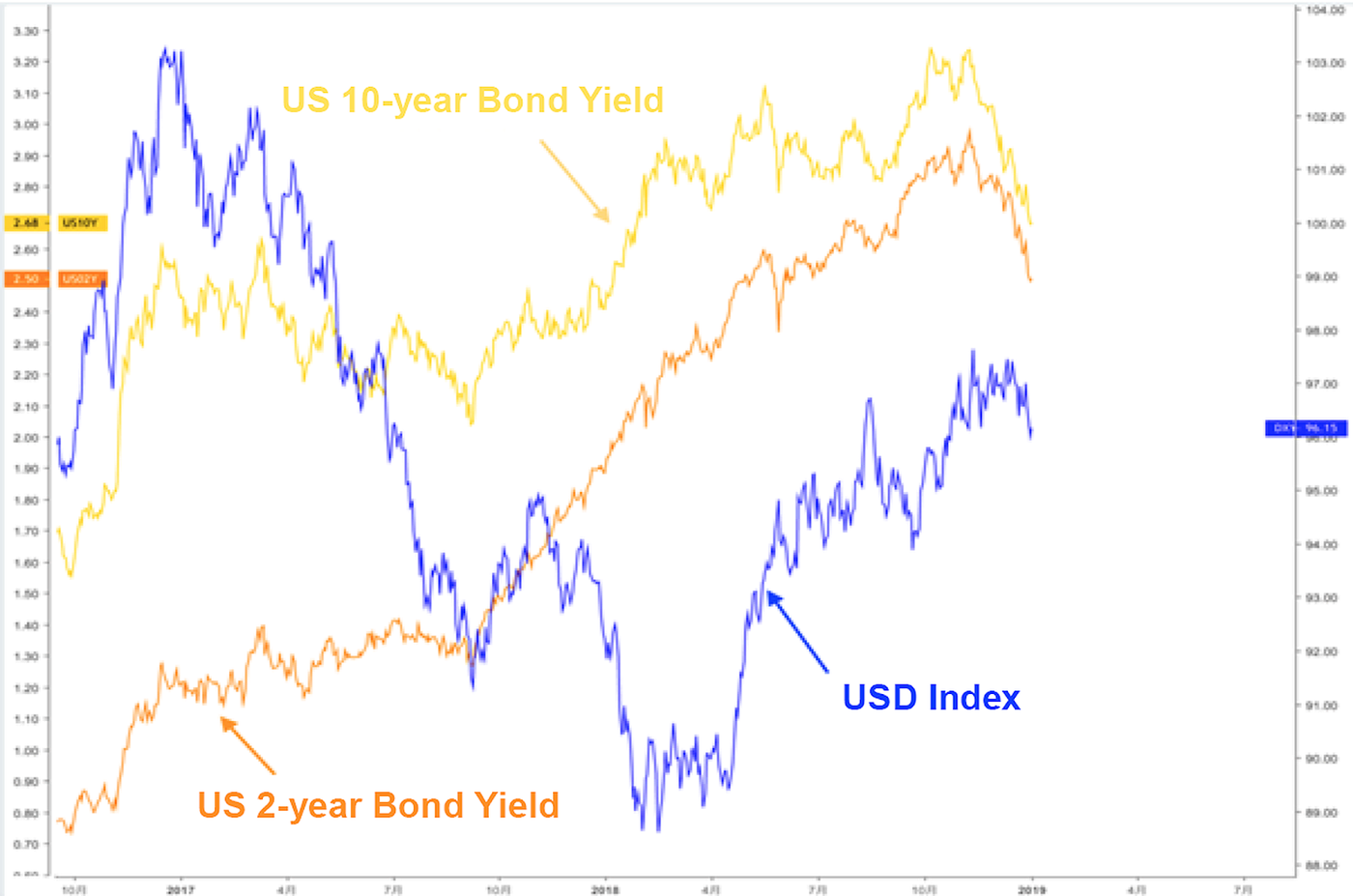

Bond yields are a great indicator of the strength of a country's stock market, which increases demand for the country's currency. Any increases in US bond yields will likely increase demand and, therefore, the price of the US dollar. While the relationship is generally fairly linear, the correlation is not strong.

When bond yields rise, it often suggests that investors are demanding higher returns to compensate for the perceived increase in risk. This increased risk appetite can be driven by various factors, such as a positive economic outlook, expectations of higher inflation, or improved market sentiment. However, it's important to note that the relationship between bond yields and risk tolerance is not always straightforward. Sometimes, higher bond yields can also be a sign of concerns about inflation or expectations of future interest rate hikes by central banks, which may not necessarily indicate a broad expansion in risk appetite. As with any market indicator, it's essential to consider the broader economic and market context when interpreting the significance of higher bond yields.

Below is a chart comparing the US dollar index to US 10-year and 2-year bond yields. As can be seen, the correlation is not always present.

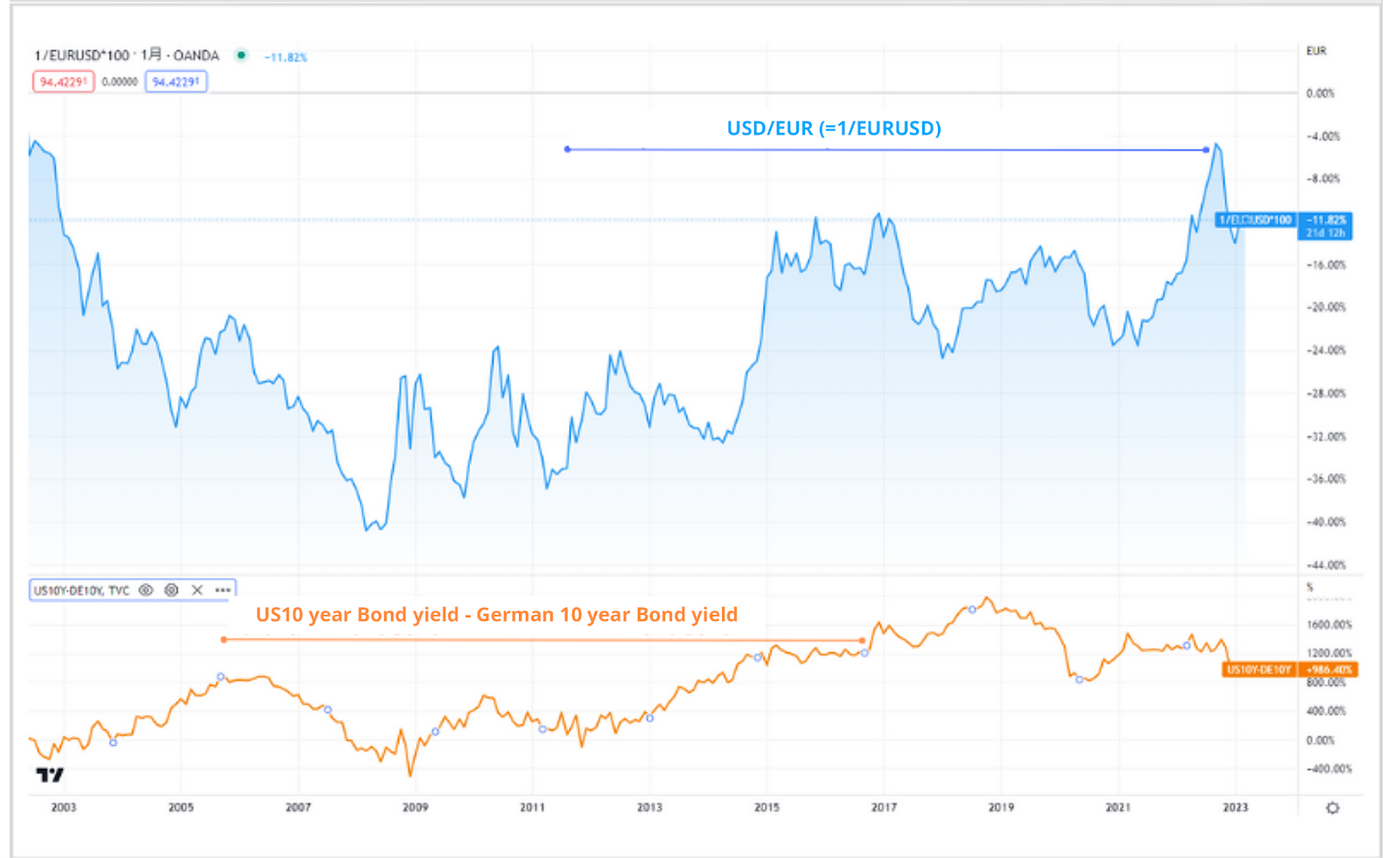

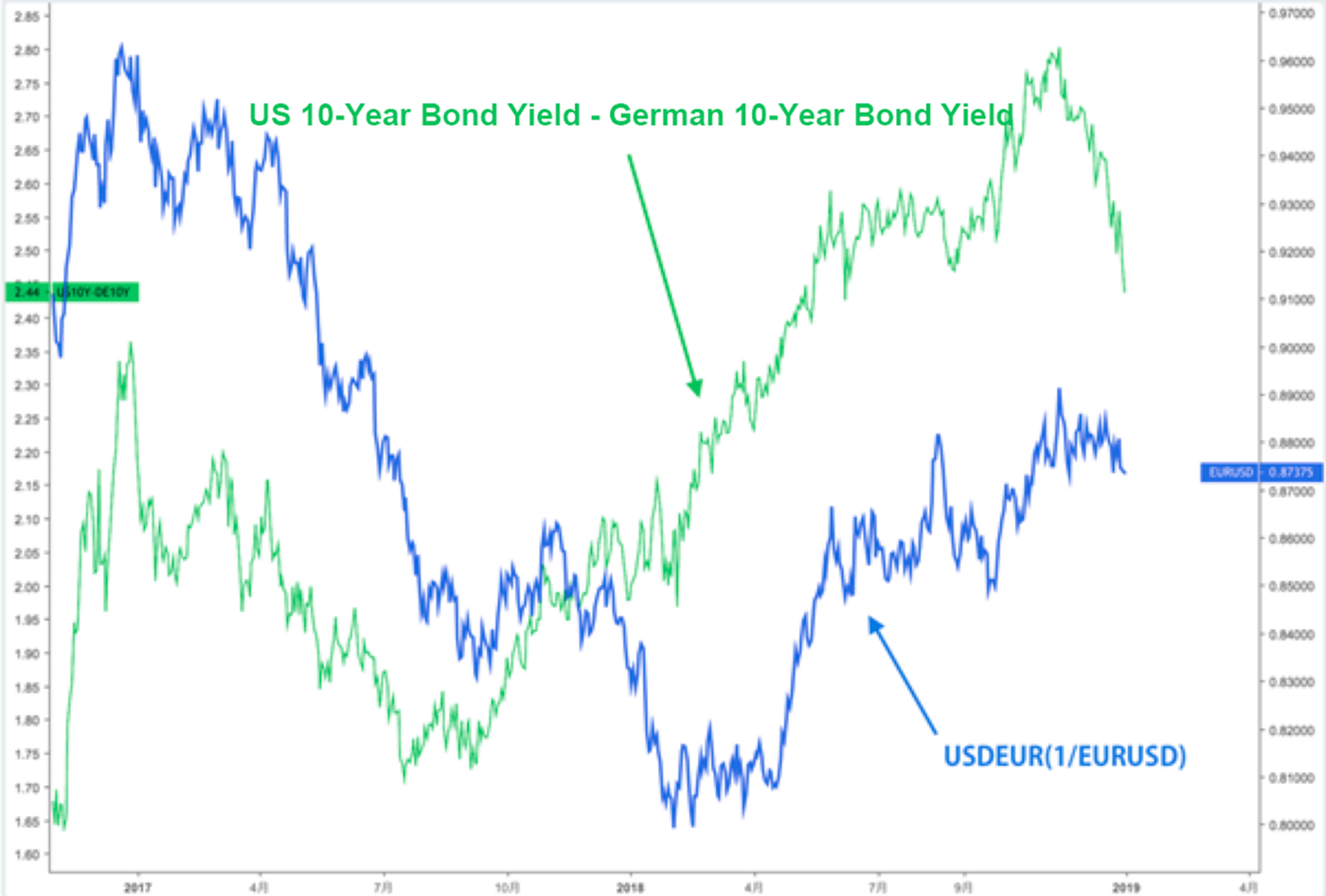

For example, the chart below compares the USDEUR yield (1÷EUR/USD) and the US 10-year bond yield minus the German 10-year bond yield. The two data points are often moving in the same direction, so it may be easier to understand the direction of the general trend by comparing them in this way.

In the case of USD/JPY, the difference in yield between US bonds and Japanese bonds tends to be correlated, while in the case of GBP/USD, the difference in yield between US bonds and UK bonds tends to be related.

Let’s explain this further with an example of USD/ JPY

- When the yield on US bonds increases compared to Japanese bonds (i.e., the yield spread widens), the USD tends to strengthen against the JPY.

- Conversely, when the yield on Japanese bonds increases compared to US bonds (i.e., the yield spread narrows), the JPY tends to strengthen against the USD.

- The correlation implies a direct relationship where changes in bond yields in the US and Japan influence the USD/JPY exchange rate.

Similarly, the difference in yield between UK bonds and US bonds often tends to be related to the GBP/USD exchange rate.

How does the price of gold correlate with the United States dollar?

There is often a negative correlation between the US Dollar and gold.

That is, when the dollar rises, the price of gold falls, and when the dollar falls, the price of gold rises.

We find the same relationship when the value of money decreases and the price of goods rises and when the value of money increases and the price of goods falls.

Because crude oil is priced in US dollars, this inverse relationship is also present in the oil market, meaning that when the value of the US dollar falls, crude oil prices tend to rise, and vice versa. However, there are other fluctuations in the oil market due to a range of factors, such as supply and demand or geopolitical events. Gold is the most prone to exhibit a negative correlation with the US Dollar.

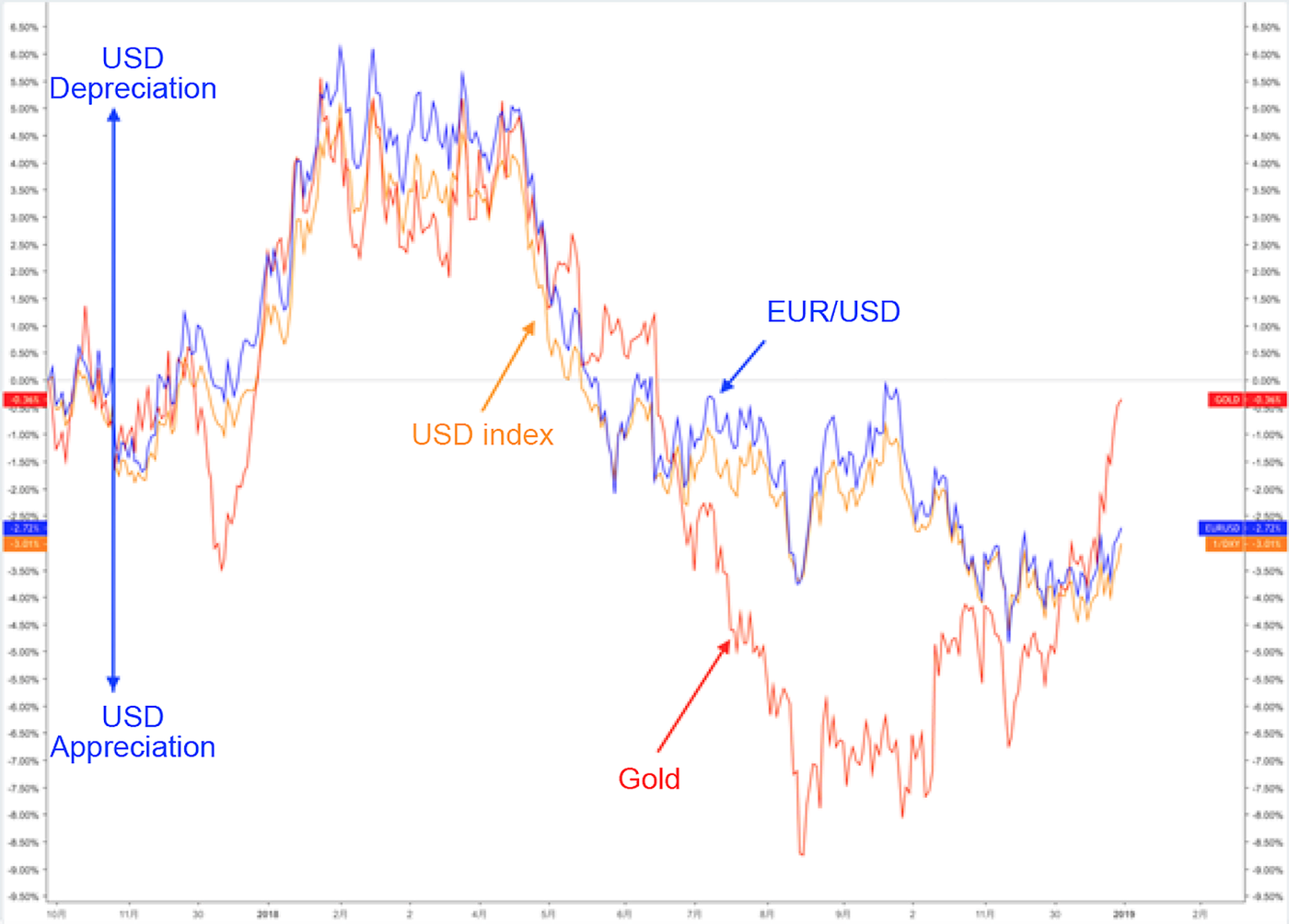

The chart below compares EUR/USD, Dollar Index expressed by USD strength and gold price. As can be seen, the correlation is strong.

If you divide 1 by the USD index, the above chart will be displayed upside down.