The currency of choice for the third-largest world economy, USD/JPY is the second-most traded currency pair globally. In this article, we discuss key features of the yen and how they can be applied to your trading.

USD/JPY is the second-most traded currency pair in the FX Market

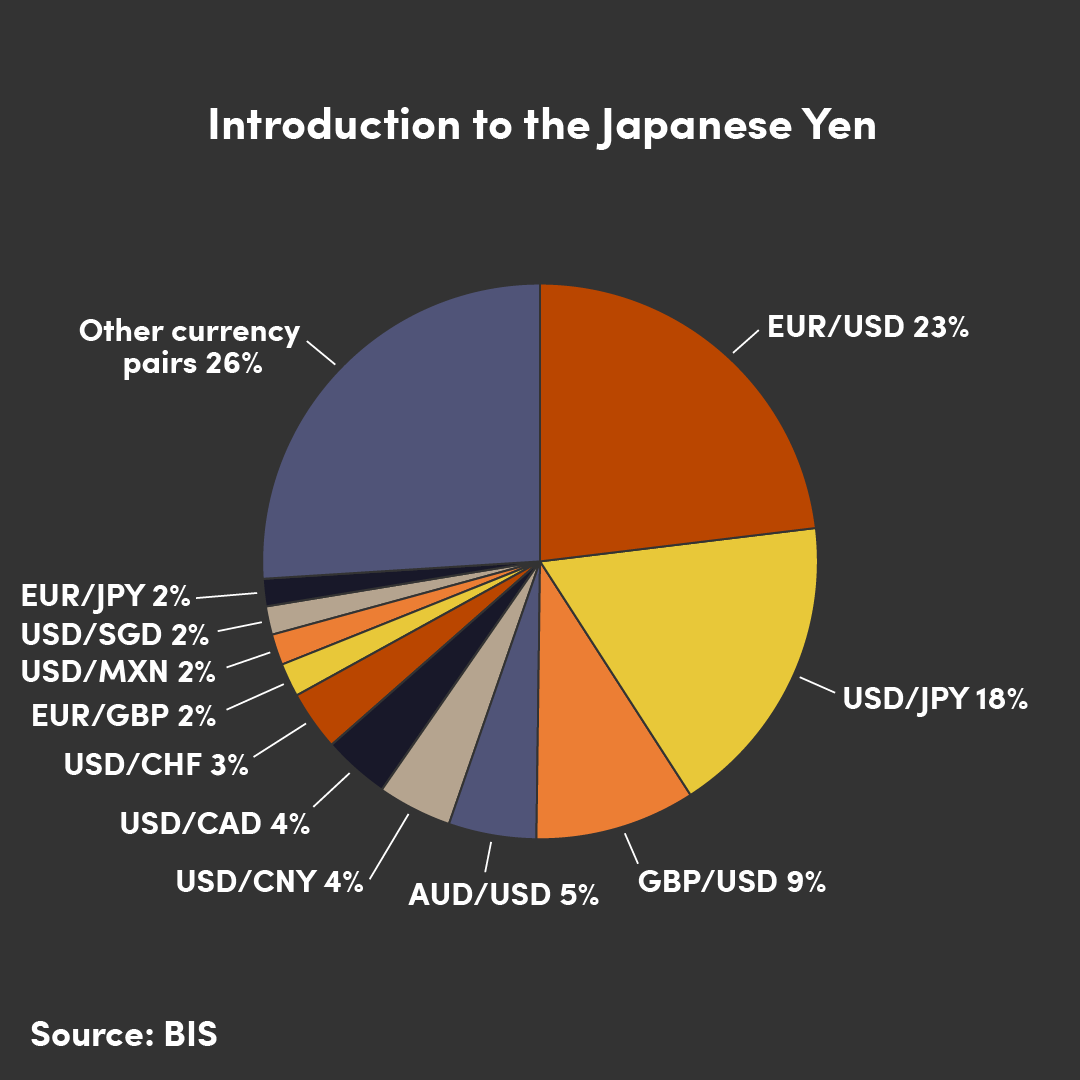

One of the seven major currency pairs, USD/JPY has many interesting attributes. Not only is USD/JPY the second-most traded currency pair globally, at 18% of FX market volume, USD/JPY is renowned for its high level of market liquidity, meaning that movements in price can be more consistent and stable when compared to other currency pairs.

As an example, currency pairs like EUR/JPY and GBP/JPY have a much lower level of market liquidity, so price action is likely to be more erratic, which may be less suitable for traders with less experience.

The Japanese Yen: A popular safe haven asset

In modern times, the Japanese yen is typically seen as a 'safe haven' asset.

Consistently maintaining both a current account surplus and a low inflation rate, the Japanese financial system is said to be relatively stable compared to other global economies, which helps the yen maintain its 'safe haven' status.

In periods of economic uncertainty, the yen is likely to increase in value; those looking to avoid risk will buy the yen and sell other 'riskier' currencies.

By contrast, when the market is stable and risk tolerance increases, safe haven currencies, including the yen, are likely to be sold as the market looks to buy-and-hold currencies with a higher interest rate.

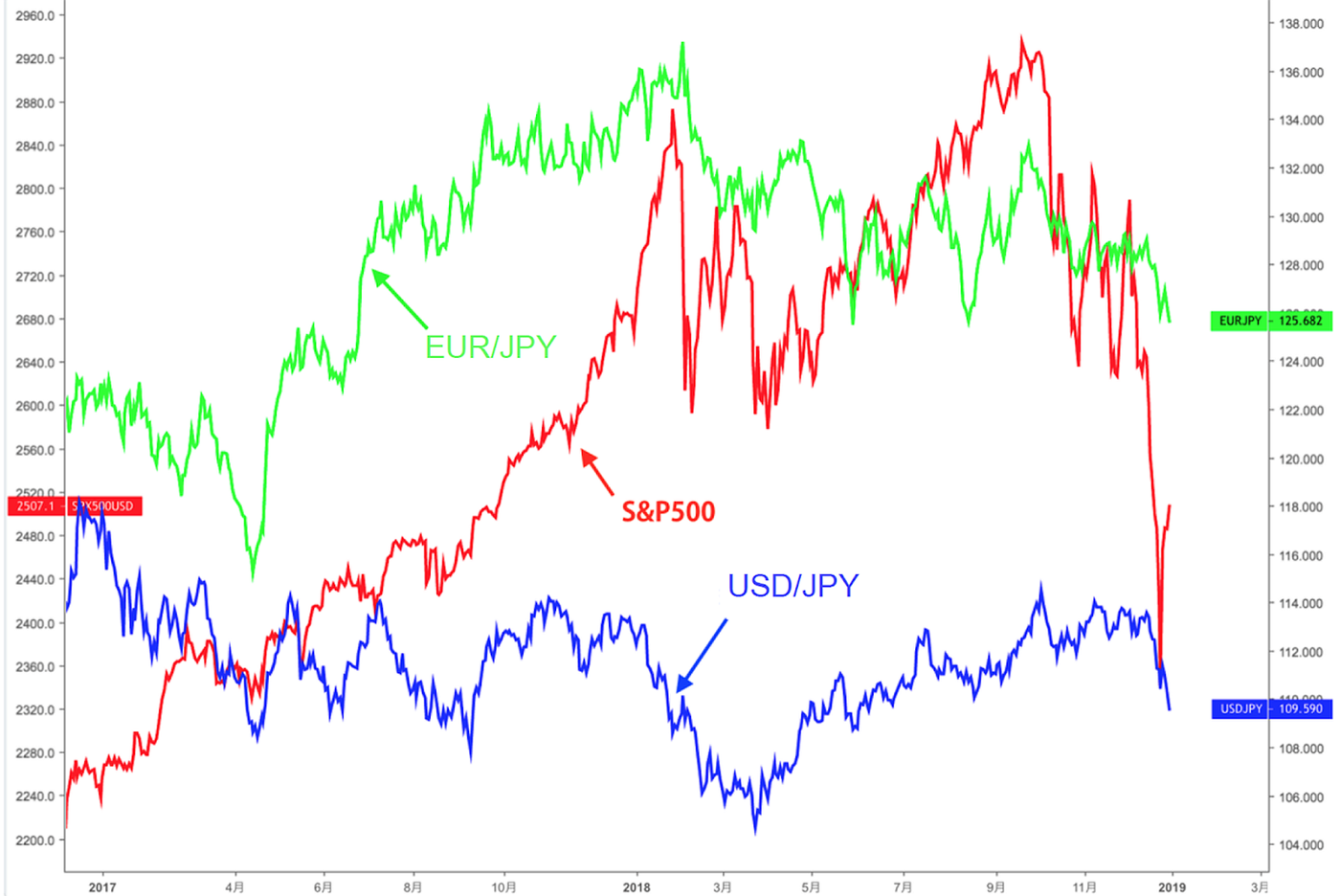

The chart below compares the price action of the S&P 500 to both USD/JPY and EUR/JPY respectively. When the S&P 500 decreases in value, the value of the yen rises as the market reduces risk exposure.

US and Japanese Bond Prices: How do they affect USD/JPY?

The difference between US and Japanese bond prices can sometimes influence the performance of USD/JPY. Let’s explain this a bit in details through the lens of interest rates and investor behavior. Here's a breakdown of how this works:

- Bond Prices and Interest Rates

- Inverse Relationship: Bond prices and interest rates have an inverse relationship. When bond prices go up, interest rates (yields) go down, and vice versa.

- Country-Specific Bonds: US bonds (like Treasuries) and Japanese bonds (like JGBs) reflect the interest rates set by the respective central banks (the Federal Reserve in the US and the Bank of Japan).

- Influence on USD/JPY

- Interest Rate Differential: The difference in interest rates between the US and Japan is a key factor influencing USD/JPY. Higher interest rates in one country attract more investors, seeking better returns.

- Capital Flows: If US bond yields rise relative to Japanese bond yields, US bonds become more attractive to investors. This can lead to capital flowing into the US, increasing demand for the US dollar and causing USD/JPY to rise (dollar appreciation against the yen).

- Conversely: If Japanese bond yields rise relative to US yields, Japanese bonds become more attractive. Capital might flow into Japan, increasing demand for the yen and causing USD/JPY to fall (yen appreciation against the dollar).

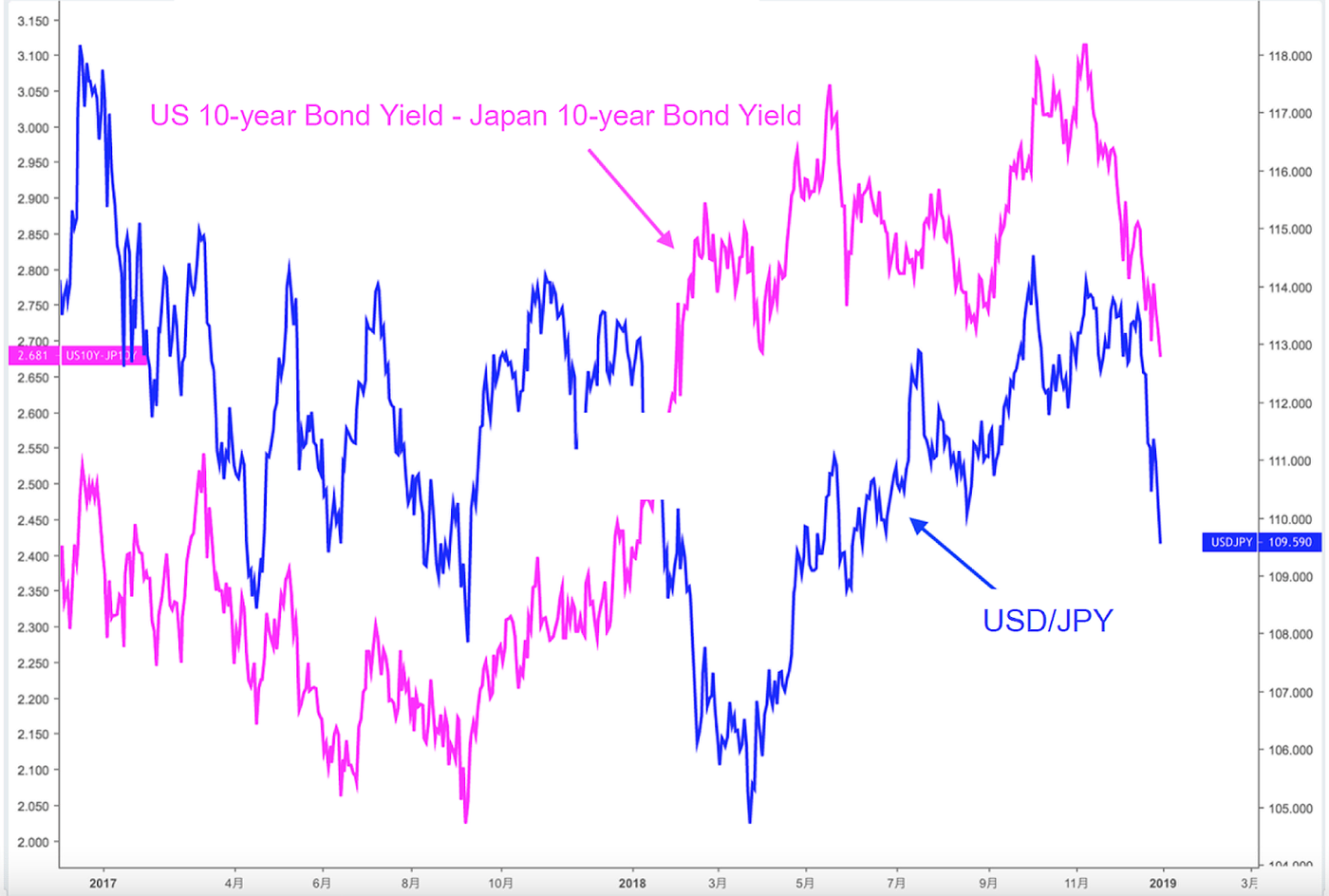

In the following chart, as an example, you can see that when the US 10-year bond yield is subtracted from the Japanese, price action correlates somewhat versus that of USD/JPY.

How can BoJ monetary policy affect USD/JPY?

In regards to monetary policy, the choices of the Bank of Japan (BoJ) significantly influence both the market outlook and the performance of the Japanese yen.

Generally, any decision deemed to be 'tightening' of monetary policy is likely to increase the value of the Japanese yen; when monetary policy is tightened, stock markets are expected to endure some selling pressure, contributing to higher demand for the yen as a means of risk aversion. Let’s analyse this slightly -

When the Bank of Japan decides to tighten its monetary policy, it typically means they are making efforts to reduce the money supply, often by raising interest rates. This can lead to an increase in the value of the Japanese yen for a couple of reasons:

- Higher Interest Rates: Tighter monetary policy usually involves higher interest rates. Higher interest rates make Japanese financial assets more attractive to investors because they offer better returns. As a result, more investors want to buy yen to invest in these assets, increasing the demand and value of the yen.

- Stock Market Impact: Tightening monetary policy can also lead to selling pressure in the stock market. Investors might sell stocks because higher interest rates can make borrowing more expensive and reduce corporate profits. When investors sell stocks, they often move their money into safer investments, such as cash or government bonds, which increases demand for the yen.

Overall, these factors contribute to a stronger yen as investors seek to avoid risk and take advantage of higher returns on yen-denominated assets.

On the other hand, the 'easing' of monetary policy can be expected to have the opposite effect on the yen price. In this scenario, the priority of the BoJ is usually reducing inflation to a target of 2%.

That said, the same monetary policy decision may cause the market to react in a range of different ways, depending on the current stage within the economic cycle.

When trying to analyse the yen fundamentally, understanding the latest policy information from the Bank of Japan can prove invaluable.

Trading Yen-related Financial Products in OANDA

- US Dollar/Japanese Yen (USD/JPY) price movement chart, instant exchange rate

- Euro/Japanese Yen (EUR/JPY) price movement chart, instant exchange rate

- British Pound/Japanese Yen (GBP/JPY) price movement chart, instant exchange rate

- Australian Dollar/Japanese Yen (AUD/JPY) price movement chart, instant exchange rate

- Singapore Dollar/Japanese Yen (SGD/JPY) price movement chart, instant exchange rate