Introduced in 1999, the euro has an interesting and unique history. Understanding the dynamics between each major currency can be helpful to an overall strategy, and the euro is no exception.

Introduction to the Euro (EUR)

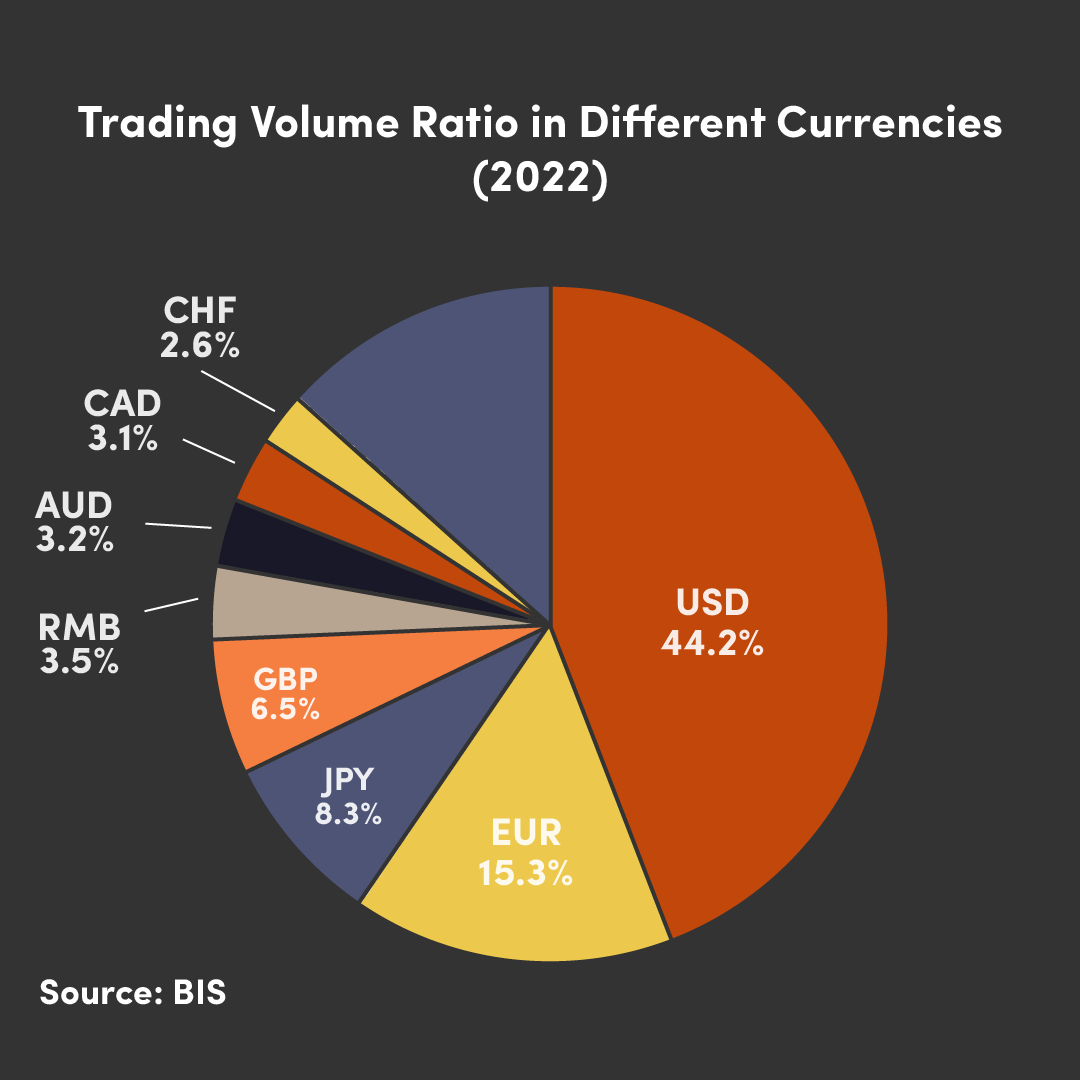

The Euro was introduced in 1999 and, as of January 2019, is the official currency of 19 countries, the most of any currency worldwide in modern times. The euro is also the second most traded currency in the world, following only the US dollar.

As a currency, the euro is managed by the European Central Bank (ECB). As the economic situation of each country can differ greatly, the ECB is tasked with the challenge of developing a monetary policy strategy that can be implemented universally across all economies that have adopted the euro.

Membership in the European Union is often tied to the use of the euro, although some member states, like Romania, have not adopted the euro as their official currency.

The world's #2 international currency

In addition to being the number two international currency in the world, the euro also maintains the title of the second-most held reserve currency of central banks globally, following the US Dollar.

As a result, this often means that when the outlook is bearish on the US dollar, the market will buy euros and sell the US dollar simultaneously in order to make a profit. This relationship between the two currencies is one of the major factors contributing to EUR/USD being the most traded currency pair worldwide.

Again, owing to this connection between the two currencies and similarly to the dollar, the performance of the euro can be correlated to other assets, such as oil and gold.

The graph below shows both the price action of oil, EUR/USD and EUR/JPY respectively. Although not exactly the same, it can be said that the relationship between the price of each asset is not unrelated.

A way to view the economy of the Eurozone

The economy of the eurozone is unique in how each country contributes to overall gross domestic product (GDP).

Germany alone accounts for the highest proportion of eurozone GDP, at around 30%, while France comes in second, with the two nations together responsible for almost half of the total GDP of the eurozone economy. If Italy and Spain are added to this list, this figure will increase to three-quarters of total GDP.

On account of this, it is often helpful to study key data releases from Germany, France, Italy, and Spain respectively, to better understand the performance and overall direction of the eurozone in general.

| Country | GDP % |

|---|---|

| Germany | 24.29% |

| France | 16.52% |

| Italy | 12.29% |

| Spain | 8.62% |

| Netherlands | 6.1% |

| Poland | 4.41% |

| Belgium | 3.43% |

| Sweden | 3.23% |

| Ireland | 2.97% |

| Austria | 2.81% |

| Denmark | 2.2% |

| Roamnia | 1.91% |

| Czechia | 1.8% |

| Finland | 1.64% |

| Portugal | 1.57% |

| Greece | 1.3% |

| Source | Statista |

How does the gap between American & German 10-year bond yields affect the euro price?

The gap between US and German bond yields can sometimes influence the direction of the EUR/USD.

Here's how it generally works:

- Interest Rate Differentials: The gap between bond yields reflects the interest rate differentials between the two countries. If American bond yields are higher than German bond yields, it suggests that US assets offer a higher return compared to German assets. This can attract capital flows into the US and lead to an appreciation of the U.S. dollar relative to the euro.

- Risk Perception: The gap in bond yields can also reflect differences in perceived risk between the two countries. If the yield on American bonds is significantly higher than that on German bonds, it may indicate that investors perceive the US as a riskier investment compared to Germany. In this case, capital flows may move out of the U.S. and into Germany, leading to an appreciation of the euro against the US dollar.

- Market Sentiment: Market sentiment and expectations about future economic conditions can also influence the relationship between bond yields and currency prices. For example, if investors believe that the US economy will outperform the German economy, they may be more inclined to invest in U.S. assets, leading to a stronger dollar.

It's important to note that the relationship between bond yields and currency prices is just one of many factors that can influence exchange rates. Economic data, geopolitical events, central bank policies, and market sentiment all play a role in determining the value of a currency. Traders and investors often consider a wide range of factors when making trading decisions in the forex market.

How does euro volatility change at market open?

The Euro, as an asset, can experience different levels of volatility across the different market sessions.

Typically, the euro undergoes less volatile changes in price during the Asian session, but naturally, during the European session, volatility can be significantly higher. During the European session, many traders will focus on trading EUR/USD.

That said, there can be some exceptions. EUR/JPY can experience some volatility during the Asian session, but often traders will choose to trade USD/JPY instead, often boasting higher volatility than its European counterpart.

Understanding where the most market liquidity can be found can be very important to determining the probability of your trade being successful.