An introduction to the Pound Sterling. What you should know about the GBP before trading it. What drives its value, key indicators, and its relationship to oil and the FTSE.

An Introduction to the British Pound (GBP)

The British Pound (GBP) or Pound Sterling is the national currency of the United Kingdom, and its code in the FX market is GBP. It is the fourth largest circulating currency in the world, after the US Dollar, the Euro, and the Japanese Yen.

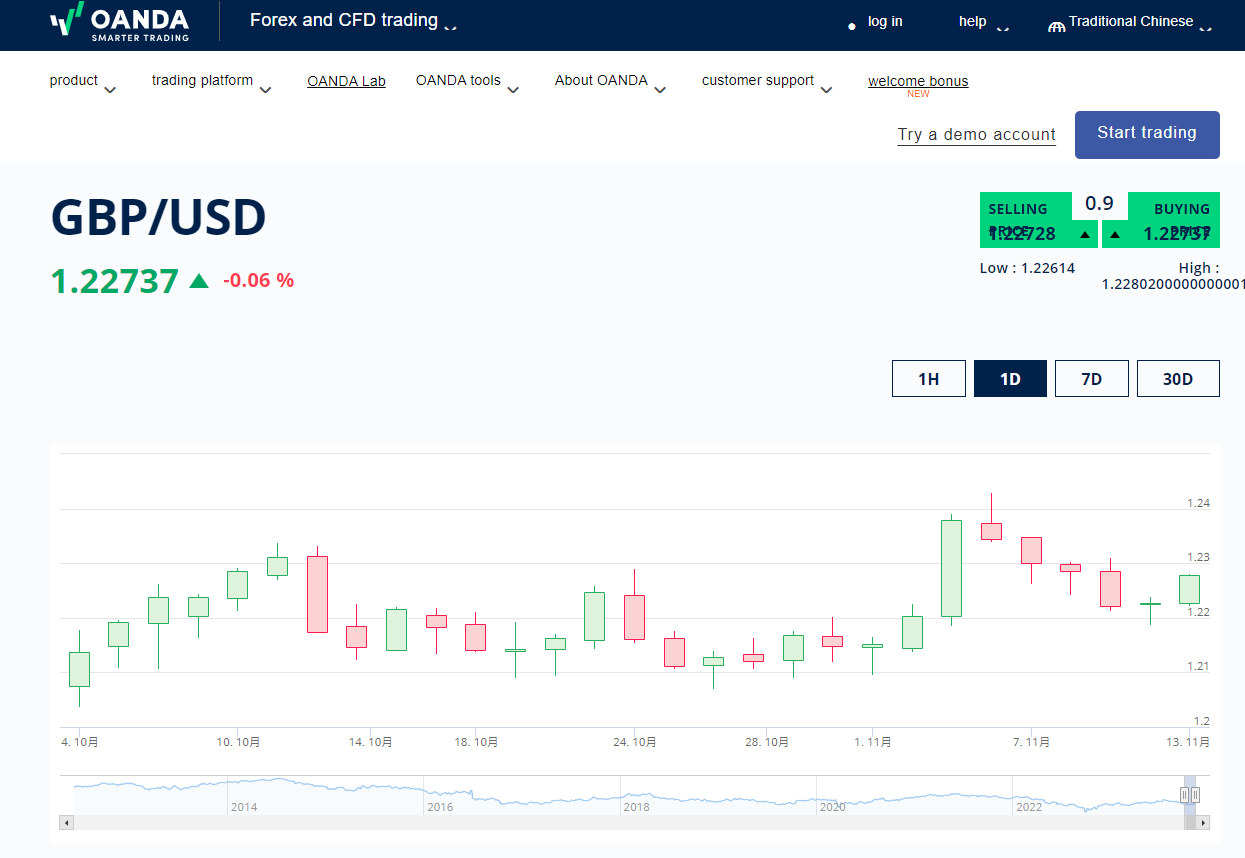

In the global FX markets, the GBPUSD is also one of the top currency pairs, with considerable market liquidity. The pair comprises the official currencies of the world's largest economies, the British Pound and the US Dollar.

- British Pound (GBP):

The GBP is the fourth-most traded currency in the world, according to the Bank of International Settlement (“BIS”) data . It is the official currency of the United Kingdom, the world’s fifth-largest economy. The Bank of England issues it with the symbol '£’.

- US Dollar (USD):

The USD is the most traded currency in the world, as per BIS. It is the official currency of the world's largest economy, the United States. The Federal Reserve issues it with the symbol ‘$’.

The symbols GBPUSD or GBP/USD are used when trading FX quotes in the FX market or CFDs.

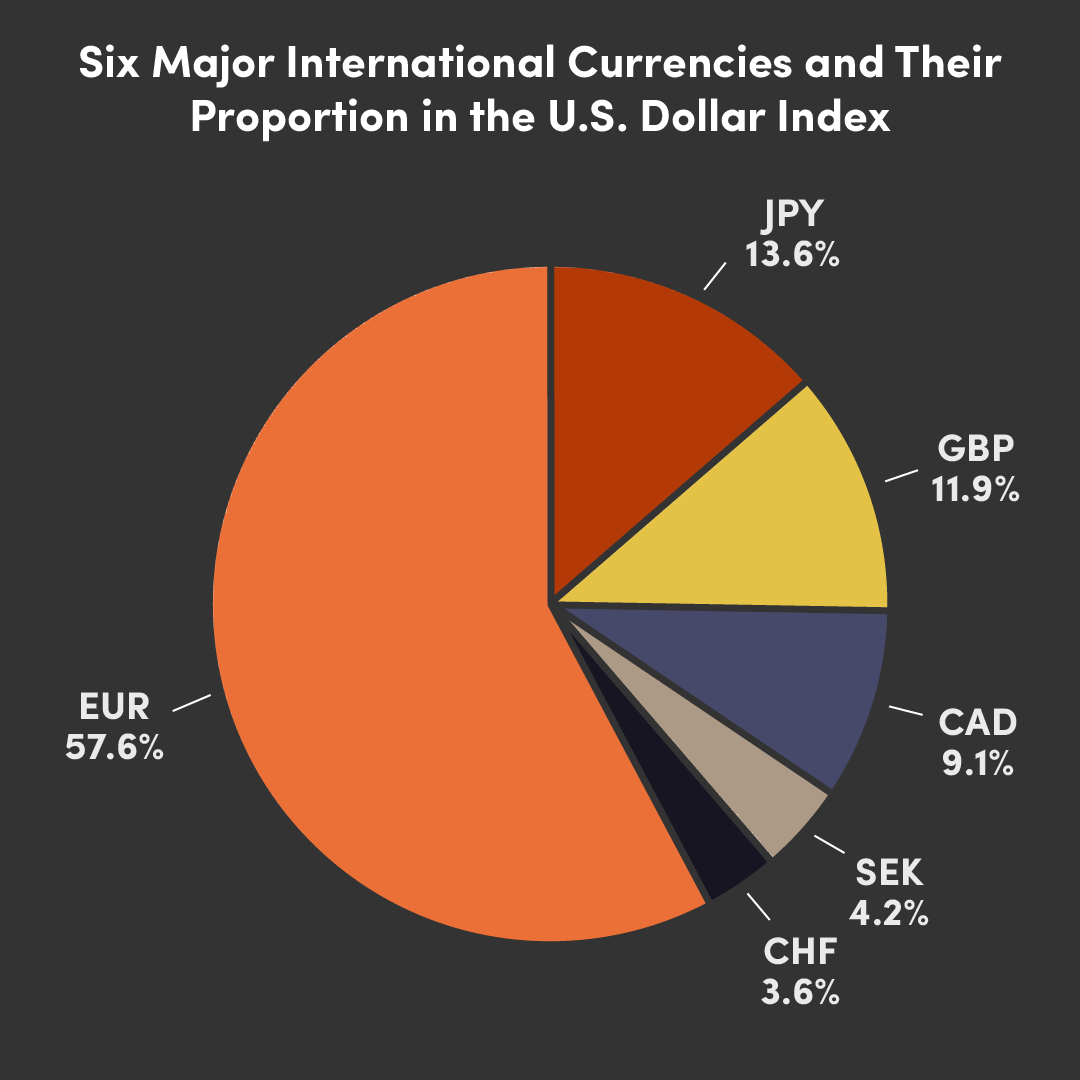

What is the position of the GBP in the US Dollar Index?

The US Dollar Index (DXY), trading on the Intercontinental Exchange (ICE), is a comprehensive measure of the US Dollar's exchange rate in the international FX market. It reflects global capital outflows and inflows into the US dollar.

The weight of the six major international currencies and their proportion in the US Dollar Index is the Euro (57.6%), the Japanese Yen (13.6%), the British Pound (11.9%), the Canadian Dollar (9.1%), the Swedish Krona (4.2%), and the Swiss Franc (3.6%). Therefore, the Pound Sterling accounts for the fourth place, and it can potentially affect the US Dollar exchange rate in case it experiences severe fluctuations.

What factors can affect the GBP exchange rate?

The most important factors influencing the exchange rate of the British Pound are the policies of the Bank of England (BoE) and the Monetary Policy Committee.

In addition, it also includes the GBP interest rates, government bonds, and the FTSE 100 index, among others.

- BoE monetary policy

Since 1997, the Bank of England has had an independent role in developing monetary policy. However, this monetary policy still needs to comply with the inflation standards set by the government.

- Interest Rate

The interest rate is the minimum lending rate (the base rate) set by the central bank; changes in the interest rate can have a substantial impact on the value of Pound.

- The Monetary Policy Committee (MPC)

The Bank of England’s Monetary Policy Committee (“MPC”) is responsible for making decisions about bank rate, which is the interest rate at which the Bank of England lends to commercial banks.. If most members of the MPC support an increase, rates will likely rise at the MPC meeting. If not, rates may decrease, or rates might be held stable. The Monetary Policy Committee (MPC) is made up of nine members: the Governor, the three Deputy Governors for Monetary Policy, Financial Stability, Markets, and Banking, our Chief Economist, and four external members appointed directly by the Chancellor. The MPC meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom (the Bank of England Base Rate).

Therefore, there is likely to be a significant impact on the movement of the Pound.

- Economic data

The crucial economic data of the UK generally include GDP, unemployment, industrial production index, average income, UK Consumer Price Index (CPI), Manufacturing Purchasing Managers Index (PMI), money supply, etc.

- UK Bonds

UK 10-year bond yields also have an impact on the movement of the Pound.

When bond yields rise, they generally indicate higher interest rates, which can attract foreign investors seeking better returns on their investments. This increased demand for British assets leads can lead to a stronger Pound. Conversely, falling bond yields suggest lower interest rates, making UK investments less attractive and potentially weakening the Pound. Thus, bond yields serve as a key indicator of investor confidence and economic expectations, influencing the currency's performance in global markets.

- The FTSE 100 index

The FTSE 100 is the leading equity index in the United Kingdom. It is a market-capitalization-weighted index of UK-listed blue-chip companies. The index is part of the FTSE UK Series and is designed to measure the performance of the 100 largest companies traded on the London Stock Exchange that pass screening for size and liquidity. Compared to its peers in the United States and Japan, it affects local currency movements to a lesser extent, but it still has some influence, especially on market sentiment overall.

The Dynamics of the GBP

Correlation with the Euro

The Pound is geographically close to the Eurozone and has a deep political and economic relationship with the region. Therefore, it is one of the currencies positively correlated with the Euro.

The following chart shows the daily cycles of GBP/USD, GBP/JPY, EUR/USD, and EUR/JPY. The chart indicates several occurrences where the movements of these pairs exhibit a consistent pattern. This suggests the existence of trends or regularities that traders or analysts can identify and potentially leverage for decision-making in the foreign exchange market.

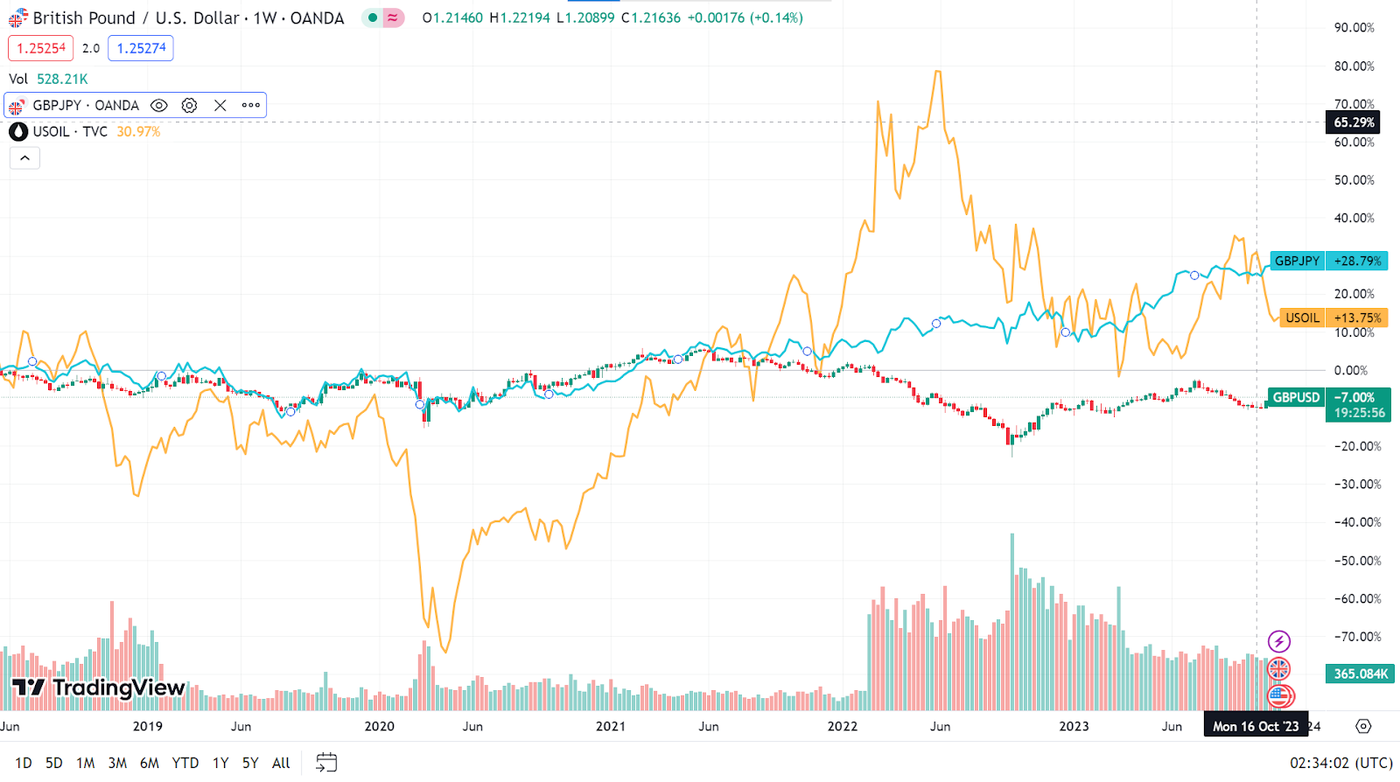

Correlation with the oil market

The United Kingdom, with its North Sea oil fields, is also vulnerable to oil prices. The chart below shows the oil price on the daily cycle chart of GBP/USD and GBP/JPY.

Although the movement may not be completely consistent, we can see that they often move in the same direction. The direction in which oil prices impacts GBP depends on whether the country is a net importer or exporter of oil and the how the rising or falling prices of oil influence the trade deficits and surpluses of UK

Volatility increases significantly when the European market opens

Like the Euro, the British Pound has little volatility in the early Asian market, and trading will increase significantly after the European market opens. This is largely because the majority of economic activities and news that impact the GBP occur during the European and US sessions.

How do GBP spread in the FX markets work?

There are two common ways to obtain a GBP spread in the FX market by investing in GBP:

- Carry Trade

- FX Trading

Carry Trade (overnight interest)

Carry trade refers to currency spread trading, which involves borrowing a low-interest-rate currency and converting it into a high-interest-rate currency to earn the interest difference between both.

The trading logic of carry trading is to borrow low-interest currencies and hedge against high-interest currencies. Therefore, in carry trade, the Japanese Yen is usually borrowed to hedge against high-interest currencies such as the Australian Dollar, New Zealand Dollar, and South African Rand. By virtue of the same trading logic described above, there are examples where GBP/JPY is used as a carry-trade currency pair, but not GBP/USD.

However, carry trading requires a comprehensive risk management strategy, as exchange rate swings can amplify potential gains or losses.

FX Trading

FX trading involves trading the price difference between two currencies and making the difference between the price of these two currencies.

For example, when the exchange rate between the British Pound and the US Dollar is 1:1.30, $1,300 is exchanged for £1,000.

If the Pound appreciates and the exchange rate between the Pound and the US dollar rises to 1:1.40, you exchange 1,000 pounds for US Dollars and ultimately get $1,400 back, making a $100 profit.

There will be losses if the Pound depreciates (or the Dollar appreciates).

Channels of investing in GBP in the FX market

There are three ways to invest in Pound Sterling in the FX market.

- Spot Trading: The full notional amount is required for the trade. It involves immediate exchange of currencies at the current market rate

- Futures Trading: Here, margin trading is allowed, typically around 2% on platforms like CME (Chicago Mercantile Exchange). Contracts specify future exchange rates for a predetermined date.

- Contracts for Difference (CFD): This allows trading on margin. Investors can can gain exposure toprice movements without owning the underlying asset. However, it is worth always keeping in mind that CFD leverage trading is high risk, losses can exceed deposits.CFD leverage trading is high risk, losses can exceed deposits.

All three channels entail exchange rate risk, where the value of the Pound Sterling against the US Dollar (GBPUSD) can fluctuate, influencing the profitability of the investment.

Spot trading

Investors in the FX market do not use spot trading to trade the GBP/USD because this trading model will be affected by the exchange difference and requires a full upfront capital commitment, significantly tying up funds compared to margin methods. This characteristic, coupled with exposure to immediate exchange rate risk, where adverse movements in GBP/USD can impact profits, contributes to the possible inefficiency of spot trading. Additionally, the limited leverage offered in spot trading, in contrast to futures and CFDs, might pose a drawback for traders seeking higher leverage. Concerns about potentially less favorable transaction costs, such as bid-ask spreads, further contribute to the considerations when choosing between trading methods.

Therefore, spot trading is sometimes considered the least ideal trading method in the FX market.

Futures trading

A foreign exchange future of GBP/USD is a forward contract transaction with a leverage and margin system, so investors can operate the GBP/USD if they have enough margin. Still, usually, the margin threshold is relatively high and this results in lesser leverage effect and relatively lower risk. So this may not be appropriate for traders with a low volume of funds.

Contracts for Difference (Forex margin)

Investing in the British Pound (GBP) can be done through Contracts for Difference (CFDs). CFDs allow investors to enter the market with a smaller upfront capital due to the use of leverage, which amplifies both potential profits and losses. Leverage enables investors to gain significant market exposure by paying only a small portion of the trade's total value as margin. This means that investors can potentially achieve higher returns with less initial capital, but it also increases the risk of substantial losses.

CFDs offer the flexibility to profit from both rising and falling markets through long and short positions. This versatility is not always available in spot and futures markets, making CFDs an attractive option for certain investors. Additionally, margin trading with CFDs can enhance capital efficiency.

However, it's crucial to be aware of the risks involved. The use of leverage can lead to significant losses, often exceeding the initial investment. Therefore, careful risk management and a thorough understanding of how leverage works are essential. Selecting the right CFD broker is also important to ensure favorable trading conditions and reliable support.

In summary, while CFDs provide an accessible and flexible way to trade the GBP, the high leverage involved requires careful consideration of the potential risks and choosing a reputable broker to mitigate these risks.

The flexibility of CFDs versus spot and futures market can be captured by the below points:

Spot Market:

- Immediate Settlement: Involves the immediate purchase and sale of assets at the current market price, typically for physical delivery, which limits short selling flexibility.

- No Leverage: Transactions are usually not leveraged, requiring the full amount upfront, which restricts the ability to control larger positions with less capital.

Futures Market:

- Contract Expiry: Futures have specific expiration dates, necessitating position management around these dates and potentially incurring rollover costs.

- Margin Requirements: Requires maintaining both initial and maintenance margins, with the risk of margin calls if the market moves unfavorably.

- Regulatory Constraints: Often more regulated, with stringent margin, reporting, and settlement requirements, limiting flexibility.

Advantages of CFDs:

- Leverage: Allows traders to control larger positions with smaller capital, amplifying potential profits but also increasing risk.

- No Expiry: Positions can be held indefinitely as long as the margin is maintained.

- Ease of Short Selling: Simplifies short selling without the need for borrowing assets.

Risks of CFDs:

- High Risk: Leverage can lead to significant losses, potentially exceeding the initial investment.

- Counterparty Risk: Being over-the-counter products, CFDs depend on the financial stability of the broker, introducing counterparty risk.

CFDs offer unique benefits such as higher leverage and the ease of short selling, making them a flexible trading option. However, these advantages come with increased risks, requiring careful management.

Three considerations for selecting a broker

The broker should be a reputable dealer to reduce possible disputes.

- They should be supervised by major global regulators to protect investors.

- They should offer fund protection, convenient access to funds, and guaranteed withdrawal services.

OANDA is the world's leading Forex and CFD broker, offering CFD trading on GBP pairs. It enjoys a history of more than 25 years and a total of six regulatory licenses worldwide:

- The UK Financial Conduct Authority (FCA)

- The US Commodity Futures Trading Commission (CFTC)

- Canadian Investment Industry Regulatory Organization (CIRO)

- Australian Securities and Investments Commission (ASIC)

- Japan Financial Services Agency (FSA)

- Monetary Authority of Singapore (MAS)

In addition, there are several advantages to choosing OANDA to trade GBP.

Advantages of Choosing OANDA for GBP Trading

Advantage # 1: OANDA offers two Forex trading platforms

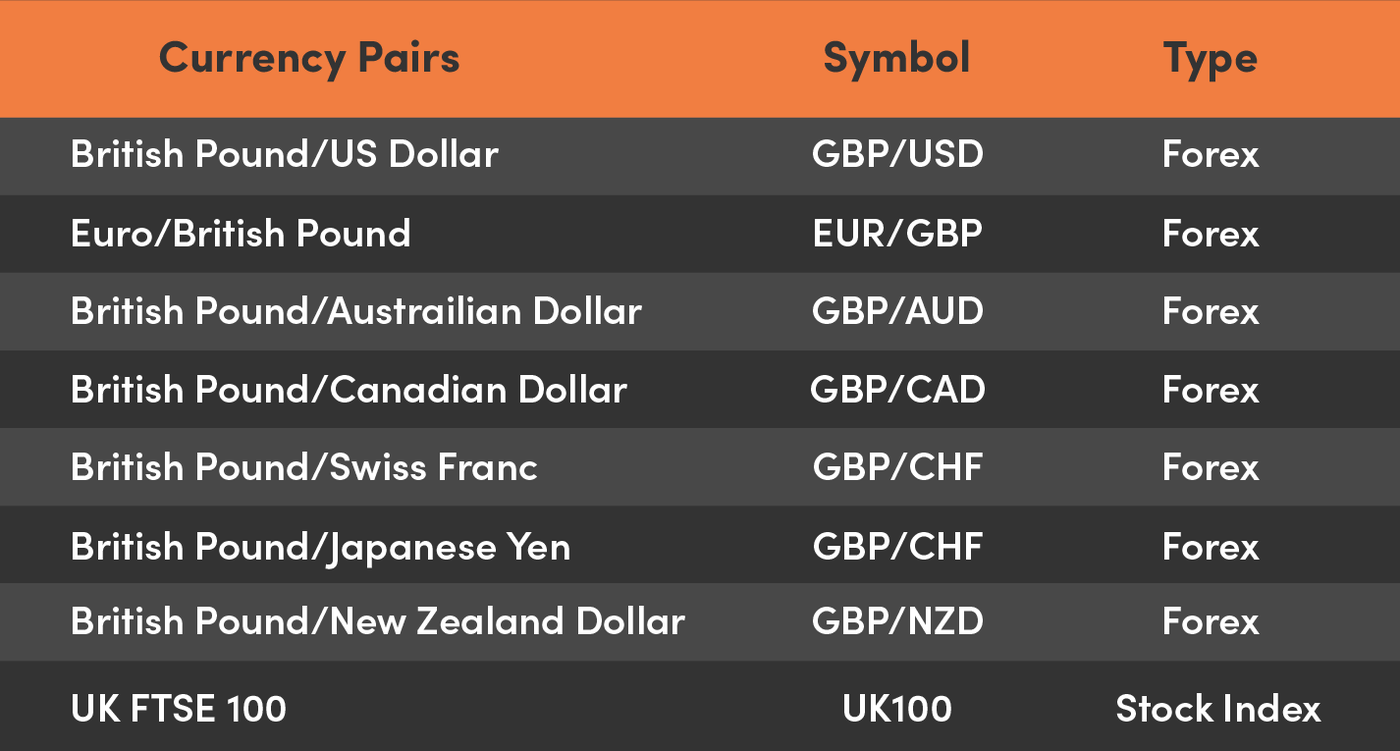

OANDA offers both MT4 and MT5 trading platforms to trade GBP pairs. In addition to the desktop version, it is available on iOS, Android, and web platforms. You can also trade the FTSE 100 index, the Euro Stoxx 50 index, and other commodities on the platform.

Advantage # 2: There are many GBP pairs

In addition to the primary pairs, such as GBP/USD and EUR/GBP, other pairs, such as GBP/NZD, are also available. See the list below for details.