Donald Trump’s forthcoming presidency is poised to redefine global financial and trade dynamics. Even before his official inauguration, markets have been reacting to policy proposals outlined during his campaign trail, a phenomenon dubbed “Trumponomics 2.0.” This blog delves into these developments, their impact on key markets, and what lies ahead for investors navigating the Trump Trade.

Intermarket Analysis – Impact of Trump 2.0 on China cross-assets class

Even before the inauguration of US President-elect Trump to White House , the financial markets have already been greatly impacted. Market participants are reacting to his campaign trail policies, including corporate tax cuts and trade tariffs, signaling shifts in US fiscal and monetary landscapes. This early influence underscores the global anticipation of Trump’s economic strategies, which have the potential to reshape international trade and financial markets.

Trump’s proposed deep cut on the corporation tax rate from 21% to 15% will likely further increase the US budget deficit. In addition, the proposed higher trade tariffs of 60% on Chinese and the rest of the world’s imports ranging from 10% to 20% may also revive inflationary pressure in the US economy.

The net effect of Trump’s campaign trail proposed policies is higher longer-term US Treasury yields, which the bond vigilantes have responded to in the past four weeks.

The start of the current US Federal Reserve interest rate cut cycle on 18 September 2024 saw a jumbo 50 basis points (bps) cut on the Fed funds rate. In contrast, the longer-term 10-year US Treasury yield traded higher and rallied by 88 bps from its 17 September 2024 low of 3.60% to print a recent high of 4.47% on US presidential election day, 5 November 2024.

Part of the Trump Trade narrative is a stronger US dollar which is apparent in the movement of the US Dollar Index that added to its gains since the ongoing medium-term uptrend that has taken form since late September this year. It rallied by another 2.4% from the day of the US presidential election, 5 November 2024 to 12 November 2024.

Also read: Understanding the United States Dollar

Incoming hawkish relations toward China

According to various media reports, Trump is poised to pick two personnel with track records of harshly criticizing China for key positions in his administration, indicating that the current frosty state of US-China relations may deteriorate further.

Senator Macro Rubio, who is being sanctioned by China, is likely to be appointed as Secretary of State. House Representative Mike Waltz, who has declared that the US was in a “Cold War with the Chinese Communist Party” in 2021 is set to become National Security Adviser.

Hence, it is likely that Trump, who is surrounded by hawkish advisers on trade relations, will implement the higher tariffs on Chinese goods headed for the US that he suggested while on the campaign trail.

Also read: A comprehensive guide to the S&P 500 and its CFD trading

A weaker yuan is a headwind to Hong Kong stocks and AUD/USD

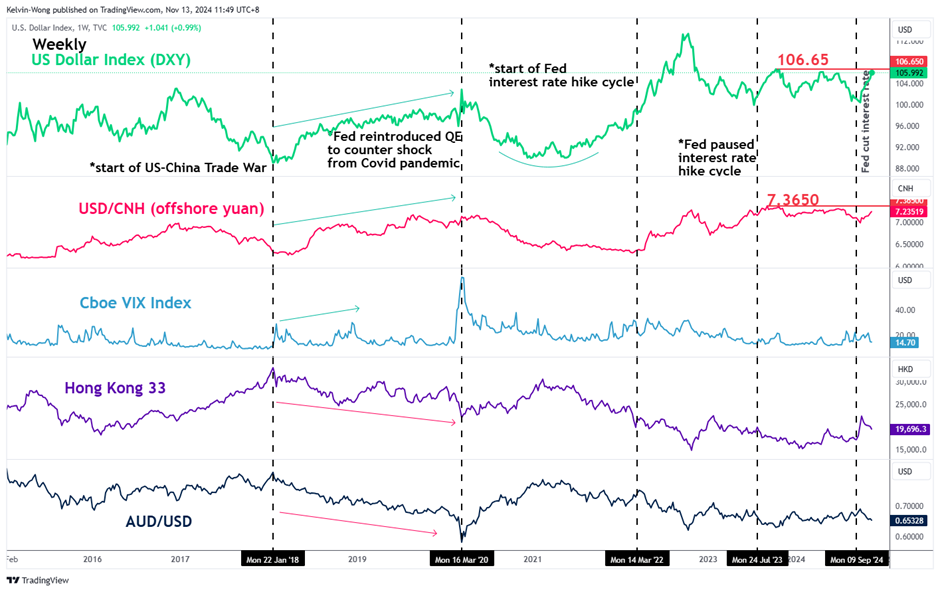

Trump kickstarted the US-China Trade War during his first administration. Since January 2018, he started imposing tariffs and other trade barriers on China, which in turn retaliated by imposing tariffs on US agricultural imports and a deliberate weakening of the yuan against the US dollar.

It was the yuan weakness that triggered a significant negative feedback loop into the Hong Kong stock market and the Aussie dollar.

From the start of the US-China Trade War 1.0 in January 2018 to March 2020, the Hong Kong 33 CFD Index tumbled by 33% in line with a 12% rally seen in the US dollar against the offshore yuan (USD/CNH) over the same period (see Fig 1).

The high beta Aussie dollar (AUD/USD) is also dependent on the economic growth prospect of China due to Australia being a major exporter of industrial commodities such as iron ore to China, which torpedoed downwards by 27% over the same period.

In recent weeks the fear of such a negative feedback loop may resurface due to a potential US-China Trade War 2.0 and market participants have started to react accordingly.

Watch the major resistances of 106.65 on the US Dollar Index and 7.3650 on the USD/CNH. A clear breakout above these resistances may suggest a profound negative sentiment towards the Hong Kong 33 CFD Index and AUD/USD.