Download our award-winning* apps for Android and iOS**. You’ll have access to our full range of instruments, get the same functionality as our web platform and have more control of your trades when you’re on the move.

Platform technology lies at the core of what we do. Intuitive and award-winning*, our browser-based platform has a range of powerful features to help you identify opportunities and trade smarter.

*Voted Most Popular Broker three years in a row (TradingView Awards 2022, 2021, 2020). Named Best in Class for Research and Ease of Use (ForexBrokers.com 2023 Annual Awards).

Get the best of OANDA and TradingView. Thanks to our partnership, you can access powerful charts and tools, whilst enjoying transparent pricing and fully automated risk management systems.

No last look, with customizable layouts, a range of plug-ins, an intuitive interface and more. Take advantage of MT4 from your OANDA account wherever you are with the MT4 iOS and Android apps.

It's easy to fund your account using one of the following payment methods.

Our hours of operation coincide with the global financial markets. In the UK, trading is available from approximately 5 pm Sunday (ET). Please note: these times are subject to change during daylight saving time and during certain public holidays.

Margin trading allows you to trade without depositing the full value of the trade that you wish to open. One of the benefits of margin trading is that you could potentially generate large profits relative to the amount invested. On the other hand, margin trading could also result in significant, rapid losses to your capital. You cannot, however, lose more than the funds available on your account.

Below are the three most common reasons why your trade was not successful:

1) ‘Bid’ or ‘ask’ price did not reach your specified target

The most likely reason why your trade did not execute is because the applicable market price has not reached the price you specified. Depending on your chart settings, the chart you are viewing may not be showing the type of price applicable to your trade.

Many of the charts on our trading platform use the average price, meaning an average between the ‘bid’ and ‘ask’ prices, so they don’t take into consideration the spread. The spread is the difference between the actual buy and sell price of a financial product at any given time.

A long (buy) trade will open at the ‘ask’ and close at the ‘bid’ price. A short (sell) trade will open at the ‘bid’ and close at the ‘ask’ price. To verify the actual traded prices, you can add a ‘bid’ or ‘ask’ price overlay to the chart on our trading platform by clicking on ‘Add Study’ at the lower left of the chart and selecting the 'Price Overlay'. There you will be able to select either the high or low, ‘bid’ or ‘ask’ price overlay. This will show you the price that triggers a trade.

Note: the MT4 platform only shows the ‘bid’ price. To see the historical ‘low/high’, ‘ask/bid’, you will need to go to the OANDA trading platform and follow the steps mentioned above.

2) Insufficient funds

On your trade ticket (new order window), you can type in the size of the trade you wish to open so that you can see the margin needed to open that trade. If you are placing a market order, our platform will tell you right away if you do not have sufficient margin (available funds) to place the trade.

If you are trying to place an entry order, our platform will not stop you from placing the order if you do not have the current margin (available funds) necessary, but the order will fail to execute if you have not increased the available funds on your account when the pre-specified entry price is reached.

3) Take profit or stop loss was set too close to your order price

The third reason your order likely did not trigger is because your take-profit or stop-loss order was set too close to your order price. A valid take-profit and stop-loss order must be placed further away than the current spread on the financial instrument that you are trading.

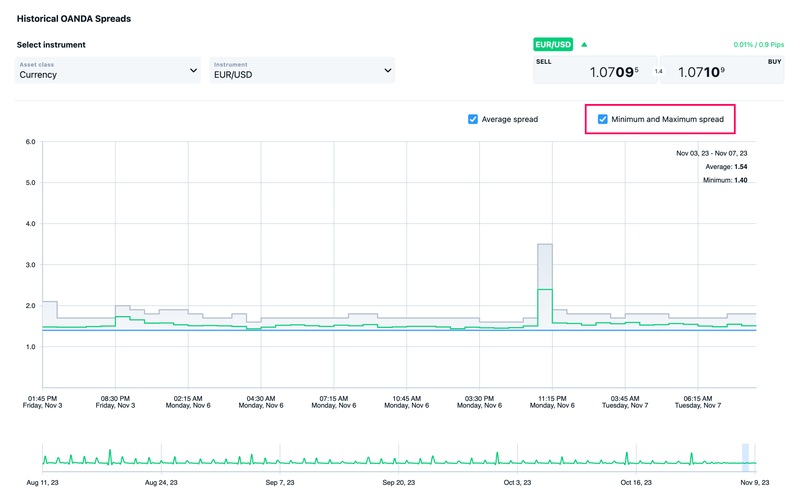

As the spread can increase during news events or when the market is volatile, we recommend your take-profit and stop-loss orders are set at a point further away than the maximum spread for the instrument that you are trading.

Review our recent OANDA spreads to determine your take-profit and stop-loss order levels. Click on 'Maximum', located towards the right hand side of the spread chart shown below, to review recent spreads on your nominated instrument.

Whenever you have questions about your trades and/or orders, we are happy to assist. Below is information that will help you with this process.

Please submit all the relevant information about your trades and/ or orders, so that we can investigate and provide you with a detailed analysis. You can do this by clicking on and filling out the Trade enquiries form. Once it is downloaded and filled out, you can then email it back to us.

Please submit the form using the following format:

- Email the form to frontdesk@oanda.com

- In the subject line include: "Trade investigation" followed by the instrument involved, for example: EUR/USD, BCO/USD, UK100/GBP or XAU/USD

- Attach the corresponding form

To ensure accurate and speedy processing, please provide as much information as possible about your trades or orders such as those listed below:

- Your username and account ID number (for example, 001-001-1234567-001 or MT4 account ID 7654321)

- The trading platform used at the time such as OANDA Mobile or MT4. Also, which medium you used to access the platforms such as desktop, mobile, web or any third-party system.

- The ticket number or transaction ID of the trades or orders involved

- The instrument(s) involved

- The time and date of the transaction

- Please describe the issue with your trades or orders

- Screenshots of your platform regarding the trades or order

- The remediation or assistance you would like us to provide

As trade inquiries vary in their complexity, so too does the time it takes to respond to these inquiries. However, you should receive a response in two to five business days.

With over 25 years of experience, the OANDA Group offers leading tools, powerful platforms and transparent pricing.

CFD trading

We offer a wide range of global CFD instruments, including indices, forex, commodities, metals and bonds.

Platform tools

Identify potential trading opportunities using the range of powerful analysis tools that are available on our trading platform.

Trade smarter with OANDA and TradingView

Get the best of both platforms. Access powerful charts and tools, enjoy transparent pricing and take advantage of fully automated risk management systems.