When an instrument has margin tiers, it generally means that the larger the position you hold over a certain size, the higher the applicable margin rate.

Different margin rates may apply depending on the size of your position, as your position size increases, so does the incremental margin rate on a tiered basis.

For example, on USD/JPY the margin rates are:

| Tier | Net Open Position (USD) | Margin |

|---|---|---|

| 1 | < 2 M | 0.50% |

| 2 | 2-5M | 1.00% |

| 3 | 5-50M | 5.00% |

| 4 | > 50M | 20.00% |

A position size of 3.5m USD/JPY would have a margin requirement of USD 25,000.

This is calculated as: (units in tier 1 x tier 1 margin rate) + (units in tier 2 x tier 2 margin rate) + (units in tier 3 x tier 3 margin rate).

| Tier | Net Open Position (USD) | Margin rate | Margin total (units x margin rate) |

|---|---|---|---|

| 1 | 2,000,000 | 0.50% | 2,000,000 x 0.5% = $10,000 |

| 2 | 1,500,000 | 1.00% | 1,500,000 x 1.00% = $15,000 |

| 3 | 0 | 5.00% | N/A |

| 4 | 0 | 20.00% | N/A |

| Total | 3,500,000 | $10,000 + $15,000 = $25,000 |

Different margin rates may apply depending on the size of your position, as your position size increases, so does the incremental margin rate on a tiered basis.

At certain times and in certain market conditions, our spreads could be wider than usual. This includes:

We offer clients the ability to trade with leverage. This means that you can enter into trades larger than your account balance and trade without depositing the full value of the trade that you wish to open. One of the benefits of trading with leverage is that you could potentially generate large profits relative to the amount invested. On the other hand, trading with leverage could also result in significant, rapid losses to your capital. Your losses can exceed the amount of your deposits.

We take a form of security (or deposit) against any losses you may incur when you trade

This collateral is typically referred to as margin

The margin needed to open each trade is derived from the leverage limit associated with the size of the position and the instrument you wish to trade

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Price volatility and changes in global market liquidity can result in large spread increases around market openings and closings, following news announcements and during times of uncertainty. At such times, our spreads usually widen to reflect market conditions. However, there may be occasions during which we opt to implement a fixed spread rather than allowing a spread to continue to widen.

If you leave trades open during the weekend or before markets close, or in the event that a particular market is suspended, you cannot close them until the markets reopen. Note that prices may change significantly or ‘gap’ when trading resumes. If prices move against you, a margin closeout may be triggered when trading resumes if you have insufficient funds in your account to support your trading.

Spreads (the difference between the bid price and the ask price) typically widen just prior to closure of the markets and when they open, to reflect decreased liquidity in the global markets. These widened spreads could trigger stop-loss orders or margin closeouts when a position is open at this time.

In order to keep a position open, you are required to maintain a minimum amount of equity in your trading account. This is known as margin requirement. This equity is your cash balance, plus any trading credits and the sum of your unrealised P/L.

The MetaTrader margin level % is defined as: (equity / margin used) x 100

If the margin level of your trading account falls below 100%, we will send you an email to inform you. If this happens, you will be unable to open any new positions. You might also want to consider adding more funds to your account or closing some positions to reduce the amount of margin you are using.

Should your margin level then drop to 50%, you are no longer meeting your margin requirement and we shall trigger margin closeout, whereby we automatically close out one or more of your positions, starting with the position with the largest loss on an open market.

Note: In fast-moving markets, there may be little or no time at all to warn you.

You are responsible for monitoring your trading account to prevent margin closeouts.

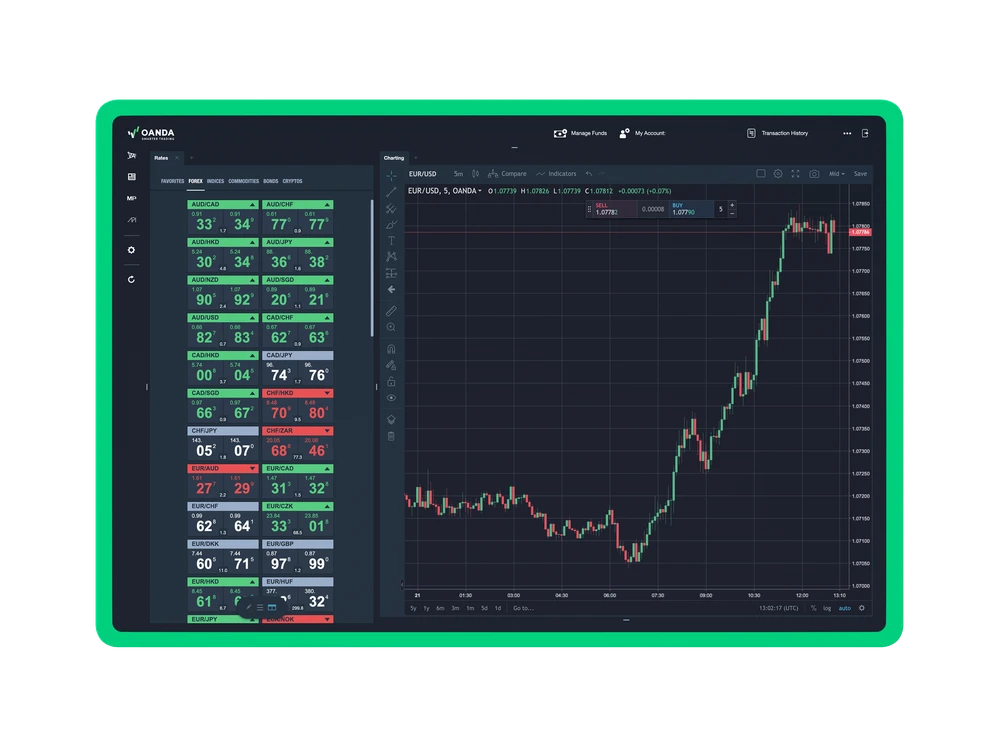

With over 25 years of experience, the OANDA Group offers leading tools, powerful platforms and transparent pricing.

Transparent trading costs

We are upfront about our fees, so you know how much you are paying when you trade with us.

Calculating financing costs

Financing costs can affect your cost of trading, so it's important to understand how financing works.

Accounts for every type of trader

Choose the account that’s right for you. A spread-only account or a spread-and-commission account.