What is a pip in trading?

What are pips in leverage trading? Our article explains the basics of pips and ticks and how to use them when trading with OANDA

What are pips in leverage trading? Our article explains the basics of pips and ticks and how to use them when trading with OANDA

What is a pip?

In this article you will learn:

- What a pip is and what it represents

- How to calculate gains and losses based on pips

- What is a pipette and why it was introduced

What does “pip” mean?

Pip stands for ‘percentage in point’. A pip in forex trading is the smallest standardised move by which a currency pair quote can change, based on market convention. As it defines the change in price (for instance between two currencies), traders calculate the spread between the bid and ask prices of the traded instrument, and refer to the profit or loss that their position has made in terms of pips.

How does a pip work?

As mentioned above, each one pip move in your favour translates into a profit and every one pip move that goes against you translates into a loss. The size of that move determines how big the profit or loss is. Let’s focus on some real-life examples on how that translates to trading the markets.

How a pip works in currencies

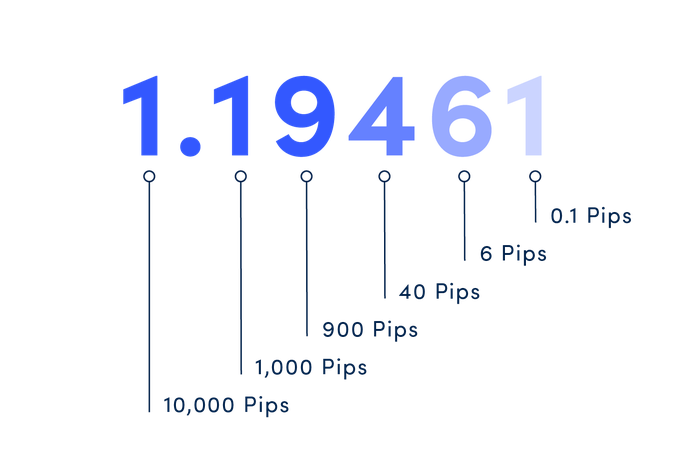

Most currency pairs are priced out to four decimal places and the pip change is the last (fourth) decimal point. One pip, therefore, is equivalent to 1/100 of 1% or one basis point.

The Japanese yen is a notable exception, as these currency pairs are quoted to only two decimal places. To calculate a change in pips in forex trading for, say USD/JPY, you have to look at the second digit after the decimal point.

With a yen currency pair such as USD/JPY, a move of 154.01 to 154.02 would be a single-pip movement. This means that if you decided to enter a long position on the pair at 154.01 and closed your trade as the price reached 154.51, you would make a 50-pip profit (154.51 - 154.01 = 0.50).

Let’s take a look at some examples. Let’s say you’re trading the EUR/USD currency pair. If the market were to move from 1.1600 to 1.1605, that 0.0005 increase would be a 5-pip move.

If you had entered a long position (clicking on buy), and the market moved from 1.1600 to 1.1650, and at that point you closed your trade, you would have made a profit of 50 pips (1.1600 - 1.1650 = 0.0050). Conversely, let’s say you had placed a stop loss at 1.1550 and the market moved against you, dropping from 1.1600 to 1.1550. Assuming there was no slippage, your stop-loss order would be hit and you would have made a loss of 50 pips (1.1600 - 1.1550 = 0.0050).

How pips work in other asset classes

Although the ‘pip’ is a forex naming convention, at OANDA we are not limiting the use of this term to currencies only. The decimal position between instruments in other asset classes varies though, just like it does for the Japanese yen. The reason for this is similar and depends on how many decimal places there are on the price of the instrument that is being quoted by convention. For currency, pips are used, for other asset classes value is refined in points.

| Asset class | Instrument example | 1 Pip/Point Position (decimal place) | Traded in |

|---|---|---|---|

| Currencies | AUD/USD | (0.0001) | unit |

| USD/JPY | (0.01) | unit | |

| Commodities | Gold | (0.01) | $/oz |

|

Silver Copper |

(0.0001) |

$/oz $/Lbs |

|

|

Corn Soybeans Wheat |

(0.01) | $/oz | |

|

West Texas Oil Brent Crude Natural gas |

(0.01) |

$/barrel $/MMBtu |

|

| Indices | US SPX | (1.0) | Index points |

| Cryptos |

Bitcoin Cash Binance Coin BiCoin Ether Kusama Solana |

(0.1) | $/unit (coin) |

|

Avalanche Chainlink Litecoin Uniswap |

(0.01) | $/unit (coin) | |

|

Cardano Pokadot EOS Moonbeam Matic Tezos |

(0.001) | $/unit (coin) | |

|

Dogecoin Stellar |

(0.0001) | $/unit (coin) | |

| Share CFD’s - US | 3M CO | (0.1) | USD /unit (share) |

| Share CFD's-UK | 3I GROUP PLC | (0.1) | GBP /unit (share) |

| Share CFD's-DK | AMBU A/S | (0.1) | DKK /unit (share) |

| Share CFD's-SE | AAK AB | (0.1) | SEK /unit (share) |

|

Share CFD's-BE Share CFD's-DE Share CFD's-ES Share CFD's-FI Share CFD's-FR Share CFD's-NL Share CFD's-PT |

AB INBEV 1&1 AG ACERINOX SA CARGOTEC OYJ AB SCIENCE AALBERTS NOS SGPS SA |

(0.01) | EUR /unit (share) |

Gains and losses in pips

Example 1:

Let’s say you buy at 1.0598 to open a 100,000 unit trade on USD/CAD when it’s trading at 1.0597/1.0598.

When the value of USD/CAD rises to 1.0618/1.0619, you close the trade by selling at 1.0618. Given that one pip is a movement of 0.0001, you have made a profit of 20 pips (1.0618 – 1.0598 = 0.0020).

Example 2:

Let’s say you open an order to buy a 10,000 unit trade on USD/CAD when it’s trading at 1.0669/1.0670.

The value of USD/CAD falls to 1.0640/1.0641 and hits your stop loss, closing the trade for a 30-pip loss (1.0670 – 1.0640 = 0.0030) .

Example 3:

For the next example, let’s say you’re trading gold. The smallest contract size you can trade on our standard platforms is normally one ounce.

Let’s assume you bought 26 ounces of gold at $1750 using an account in dollars, and you have your take profit set at US$1751.23. This means you’re expecting a gain of 123 pips or $1.23 per ounce.

Now you should multiply this by the number of ounces you have bought: 123 pips x 26 ounces = 3198 pips (or $1.23 x 26 ounces = $31.98 profit). This is your expected profit on 26 ounces of gold if your take profit target is reached.

What is a pipette?

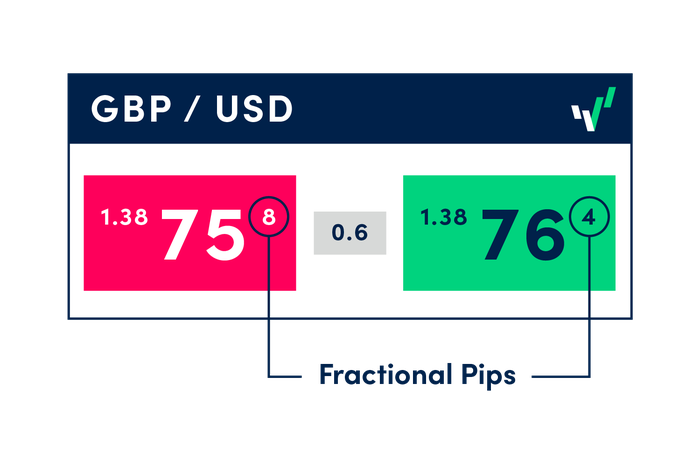

Fractional pips are known as "pipettes". A fractional pip is equivalent to 1/10 of a pip, giving you the EUR/USD currency pair with five decimal points, while yen pairs now extend to three decimal points. Pipettes are displayed in superscript format in the quote panel.

You can further build your knowledge of leverage trading by exploring our education content. Besides the introduction to leverage trading articles, we cover topics such as fundamental and technical analysis and the basics of risk management.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more